Impro Precision Industries Limited (HKG:1286) Shares Fly 26% But Investors Aren't Buying For Growth

Impro Precision Industries Limited (HKG:1286) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 98% in the last year.

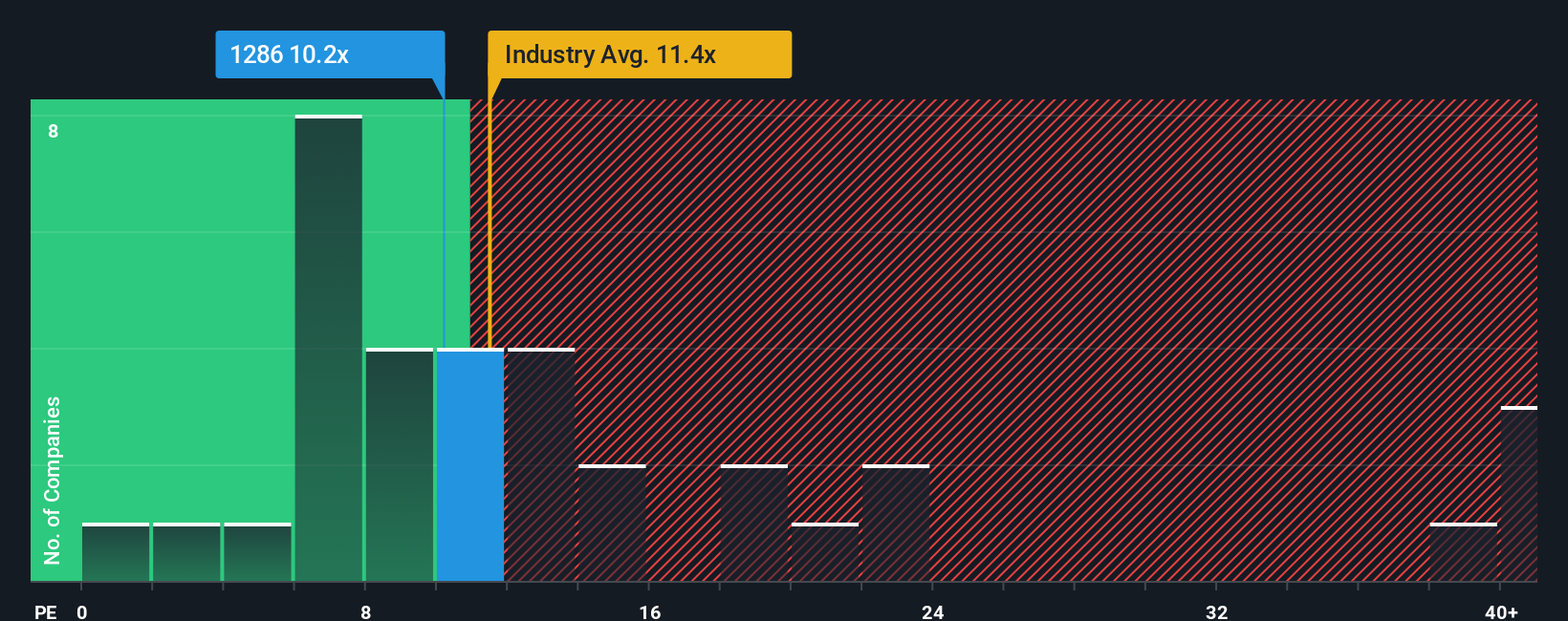

Although its price has surged higher, Impro Precision Industries may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10.2x, since almost half of all companies in Hong Kong have P/E ratios greater than 13x and even P/E's higher than 26x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for Impro Precision Industries recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for Impro Precision Industries

Is There Any Growth For Impro Precision Industries?

The only time you'd be truly comfortable seeing a P/E as low as Impro Precision Industries' is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 17% gain to the company's bottom line. The latest three year period has also seen an excellent 44% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Impro Precision Industries is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

The latest share price surge wasn't enough to lift Impro Precision Industries' P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Impro Precision Industries revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 1 warning sign for Impro Precision Industries you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1286

Impro Precision Industries

Provides casting products and precision machining parts in the Americas, Europe, and Asia.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives