- Hong Kong

- /

- Construction

- /

- SEHK:1220

What Zhidao International (Holdings) Limited's (HKG:1220) 57% Share Price Gain Is Not Telling You

Despite an already strong run, Zhidao International (Holdings) Limited (HKG:1220) shares have been powering on, with a gain of 57% in the last thirty days. The last 30 days were the cherry on top of the stock's 311% gain in the last year, which is nothing short of spectacular.

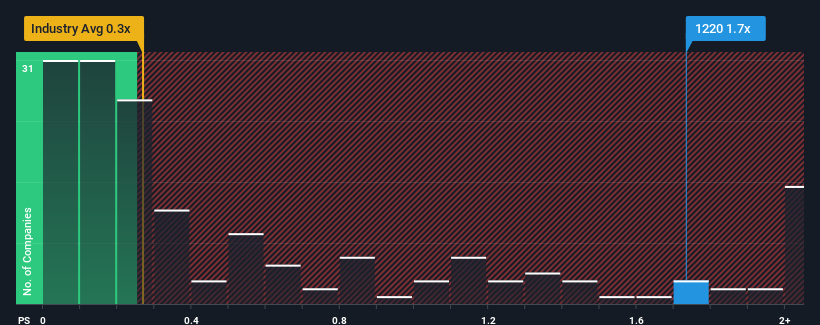

Following the firm bounce in price, you could be forgiven for thinking Zhidao International (Holdings) is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.7x, considering almost half the companies in Hong Kong's Construction industry have P/S ratios below 0.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Zhidao International (Holdings)

What Does Zhidao International (Holdings)'s P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Zhidao International (Holdings) over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhidao International (Holdings)'s earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Zhidao International (Holdings)?

In order to justify its P/S ratio, Zhidao International (Holdings) would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 65% decrease to the company's top line. As a result, revenue from three years ago have also fallen 16% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 10% shows it's an unpleasant look.

In light of this, it's alarming that Zhidao International (Holdings)'s P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Zhidao International (Holdings)'s P/S

Zhidao International (Holdings) shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Zhidao International (Holdings) revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Zhidao International (Holdings) (1 doesn't sit too well with us) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zhidao International (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1220

Zhidao International (Holdings)

An investment holding company, provides construction and engineering services in Hong Kong and Macau.

Flawless balance sheet slight.