- Hong Kong

- /

- Construction

- /

- SEHK:1220

The Market Lifts Zhidao International (Holdings) Limited (HKG:1220) Shares 29% But It Can Do More

Zhidao International (Holdings) Limited (HKG:1220) shares have had a really impressive month, gaining 29% after a shaky period beforehand. The annual gain comes to 130% following the latest surge, making investors sit up and take notice.

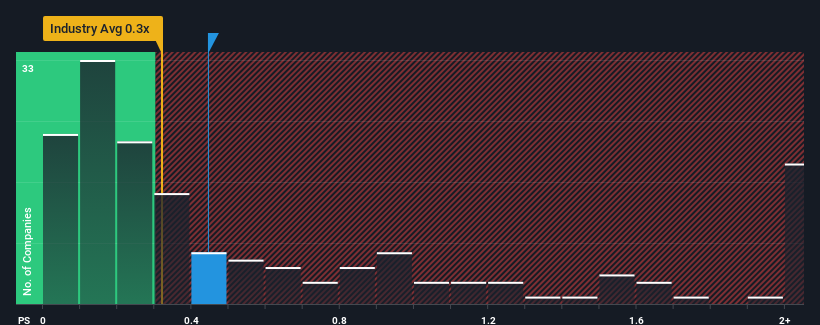

Although its price has surged higher, you could still be forgiven for feeling indifferent about Zhidao International (Holdings)'s P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Construction industry in Hong Kong is also close to 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Zhidao International (Holdings)

How Has Zhidao International (Holdings) Performed Recently?

With revenue growth that's exceedingly strong of late, Zhidao International (Holdings) has been doing very well. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Zhidao International (Holdings) will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhidao International (Holdings)'s earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Zhidao International (Holdings)?

Zhidao International (Holdings)'s P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 206% last year. Pleasingly, revenue has also lifted 300% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 13% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Zhidao International (Holdings)'s P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Zhidao International (Holdings)'s P/S?

Its shares have lifted substantially and now Zhidao International (Holdings)'s P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision Zhidao International (Holdings)'s P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Zhidao International (Holdings) (2 shouldn't be ignored!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Zhidao International (Holdings), explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhidao International (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1220

Zhidao International (Holdings)

An investment holding company, provides construction and engineering services in Hong Kong and Macau.

Flawless balance sheet slight.