- Hong Kong

- /

- Construction

- /

- SEHK:1183

MECOM Power and Construction's (HKG:1183) Dividend Will Be Increased To HK$0.028

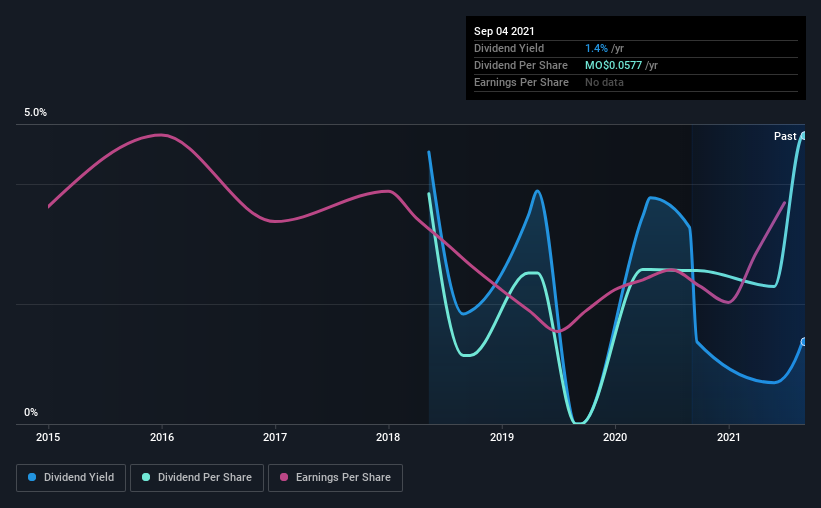

MECOM Power and Construction Limited (HKG:1183) will increase its dividend on the 29th of September to HK$0.028. This takes the annual payment to 1.4% of the current stock price, which unfortunately is below what the industry is paying.

View our latest analysis for MECOM Power and Construction

MECOM Power and Construction Is Paying Out More Than It Is Earning

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Prior to this announcement, the company was paying out 96% of what it was earning. Without profits and cash flows increasing, it would be difficult for the company to continue paying the dividend at this level.

EPS is set to fall by 5.2% over the next 12 months if recent trends continue. If the dividend continues along recent trends, we estimate the payout ratio could reach 110%, which could put the dividend in jeopardy if the company's earnings don't improve.

MECOM Power and Construction's Dividend Has Lacked Consistency

The track record isn't the longest, but we are already seeing a bit of instability in the payments. The dividend has gone from MO$0.046 in 2018 to the most recent annual payment of MO$0.058. This implies that the company grew its distributions at a yearly rate of about 7.8% over that duration. We have seen cuts in the past, so while the growth looks promising we would be a little bit cautious about its track record.

Dividend Growth May Be Hard To Come By

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. MECOM Power and Construction has seen earnings per share falling at 5.2% per year over the last five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

We're Not Big Fans Of MECOM Power and Construction's Dividend

Overall, while the dividend being raised can be good, there are some concerns about its long term sustainability. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in MECOM Power and Construction stock. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1183

MECOM Power and Construction

Offers construction services in Macau, Hong Kong, Cyprus, and the People’s Republic of China.

Adequate balance sheet with low risk.

Market Insights

Community Narratives