- Hong Kong

- /

- Industrials

- /

- SEHK:1

Is There Still Upside for CK Hutchison After European Expansion and a 28.5% Price Jump?

Reviewed by Bailey Pemberton

Trying to decide whether to buy, hold, or sell CK Hutchison Holdings? You are not alone. Lately, this stock has been on a steady climb, and every investor watching it is wondering whether now is the right moment to act or to wait it out. Over the past week, shares are up 1.5%, and if you zoom out, you will see a tidy 2.9% rise over the last month. The real eye-opener is the longer-term picture, with shares up 24.6% year-to-date and a remarkable 28.5% for the year. Looking all the way back over three and five years, returns of 51.4% and 42% respectively could have created some serious winners for patient shareholders.

So, what is driving these movements? Recently, CK Hutchison Holdings has been in the news for expanding its presence in key European markets and locking in new strategic partnerships. These moves have gotten the attention of the broader investing community, boosting sentiment and perhaps leading to some of the recent positive price action. At the same time, global economic uncertainty means risks are still in play, but it is hard to ignore the company’s momentum.

With a value score of 2, CK Hutchison Holdings is undervalued in two out of six core metrics, which certainly sets up an intriguing case for a valuation deep-dive. Ready to compare the numbers behind the story? First, let us look at how valuation is typically approached for companies like CK Hutchison. Keep your eye out for an even smarter way to judge value that most investors miss, coming up at the end of the article.

CK Hutchison Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CK Hutchison Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its expected future cash flows and discounting them back to today’s value. For CK Hutchison Holdings, this analysis uses the 2 Stage Free Cash Flow to Equity method, leveraging analyst forecasts for the next five years and reasonable extrapolations beyond that period.

CK Hutchison Holdings currently generates around HK$37.7 billion in free cash flow each year. Analyst projections suggest steady growth, reaching HK$48.97 billion by 2035. These projections include specific analyst expectations through 2027 and modest estimated increases thereafter, providing a balanced long-term outlook. All numbers are in Hong Kong dollars, which matches the reporting currency for the business.

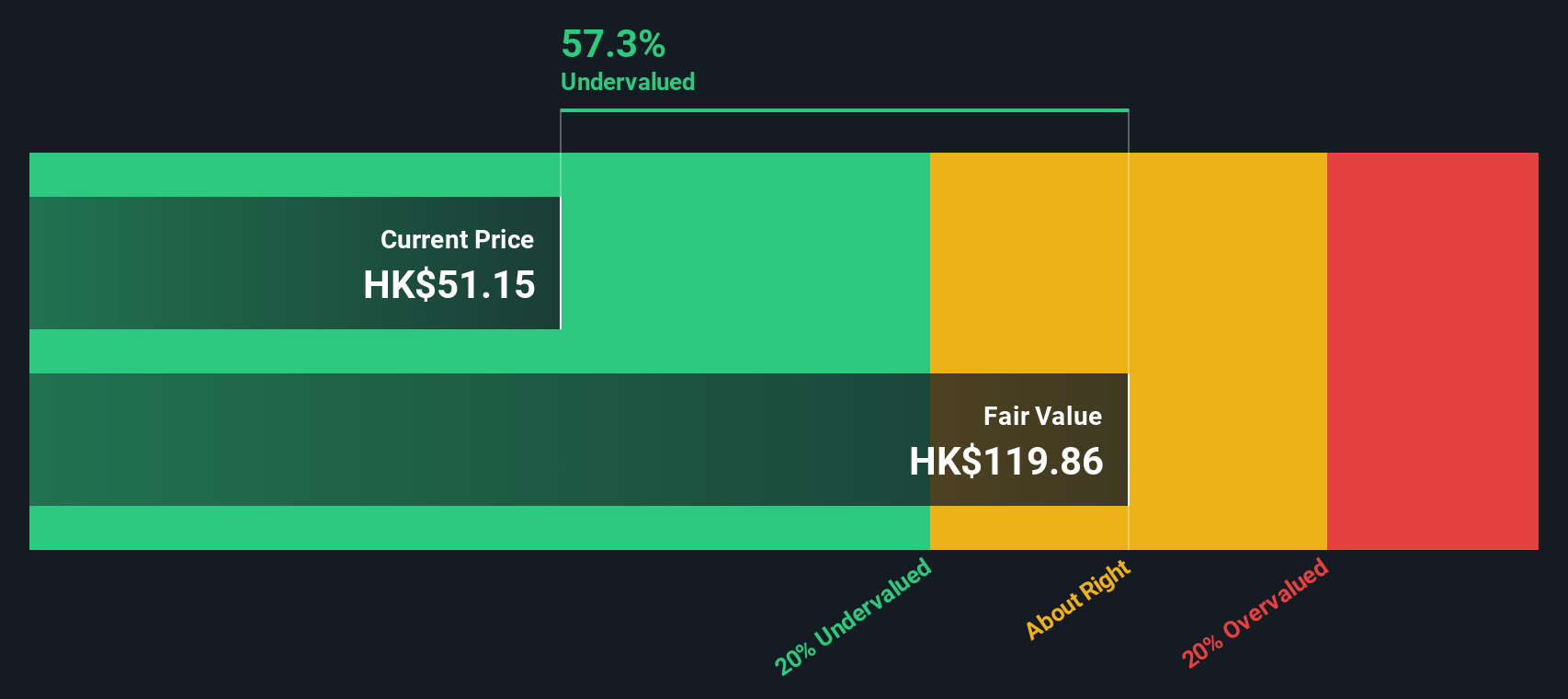

The DCF model calculates CK Hutchison Holdings' fair value at HK$119.86 per share. With the stock currently trading at a 57.3% discount to this value, the analysis indicates the shares are significantly undervalued at current levels. This considerable margin could present opportunities for patient investors if the underlying assumptions remain valid.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CK Hutchison Holdings is undervalued by 57.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CK Hutchison Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for profitable companies like CK Hutchison Holdings. It compares a company’s current share price to its per-share earnings, making it a useful benchmark for understanding how the market values its profitability. Growth prospects and risk profiles both play a significant role in what constitutes a “normal” or “fair” PE ratio. Higher growth and lower perceived risks often justify a higher multiple.

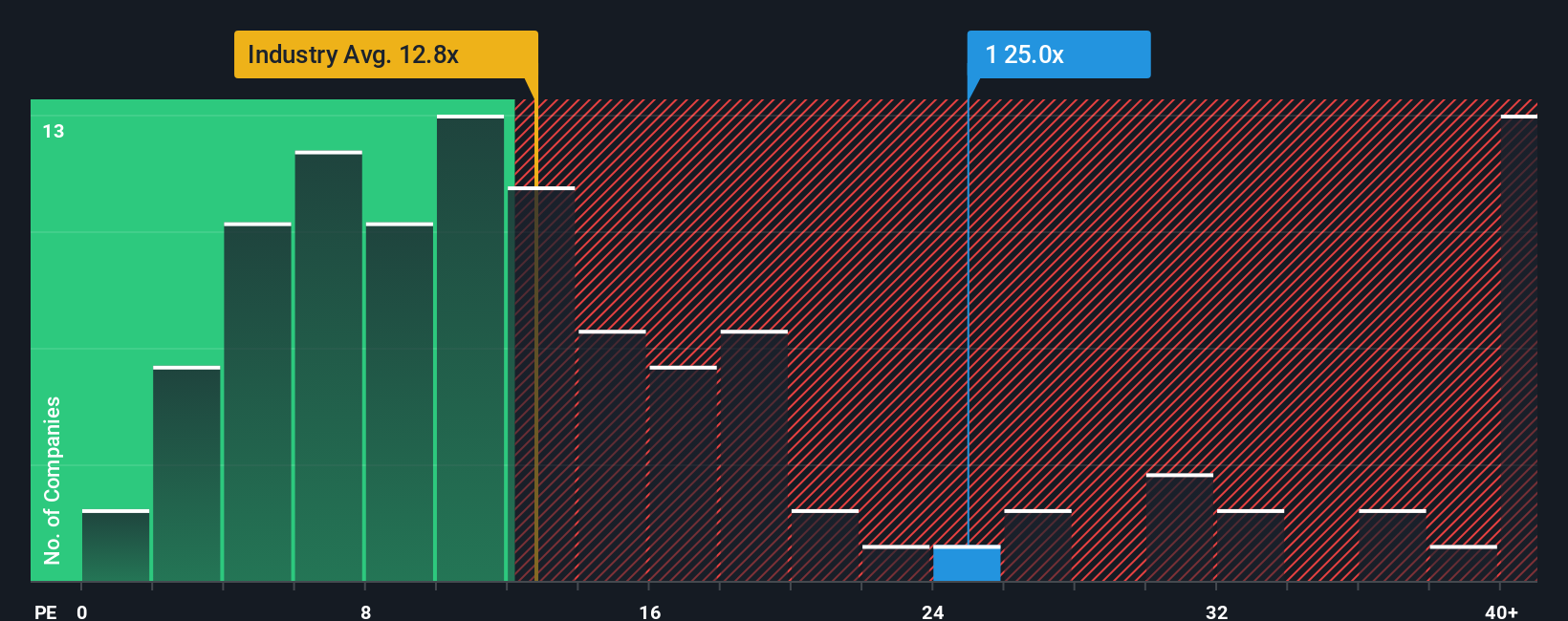

CK Hutchison Holdings presently trades at a PE ratio of 25.3x. This is slightly above the industry average of 12.8x for industrials and largely in line with the average PE of comparable peers, which sits at 25.1x. While industry and peer benchmarks provide quick reference points, they may not fully reflect the unique characteristics of a specific company.

This is where Simply Wall St’s proprietary “Fair Ratio” comes into play. The Fair Ratio is a more nuanced measure that factors in CK Hutchison Holdings’ earnings growth potential, profit margins, industry, market cap and specific risk profile. Unlike broad comparisons with sector averages, the Fair Ratio aims to present a fair valuation to investors based on the company’s particular strengths and vulnerabilities. For CK Hutchison Holdings, the Fair Ratio is 17.5x, noticeably below the current market multiple.

Based on this analysis, CK Hutchison Holdings appears overvalued relative to its Fair Ratio, suggesting the stock may be priced above what underlying fundamentals would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CK Hutchison Holdings Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story behind the numbers; it is how you tie together your own assumptions about CK Hutchison Holdings’ future growth, profit margins, and business outlook to reach a fair value unique to your perspective.

Rather than simply accepting analyst targets or industry multiples, Narratives help you connect what is happening in the company or the broader industry with financial forecasts to support your investment decisions. On Simply Wall St’s Community page, used by millions of investors, you can create your own Narrative in just a few clicks to see how your view compares to others.

Narratives make it easier to decide when to buy or sell by showing you how your fair value compares to the current market price. They update automatically when new news or results come in, ensuring your analysis stays fresh. For CK Hutchison Holdings, for example, some investors’ Narratives reflect bullish expectations for a price target of HK$75.0 based on strong telecom synergies and margin expansion, while others with more cautious outlooks set targets as low as HK$57.0, reflecting regulatory and profitability risks.

Do you think there's more to the story for CK Hutchison Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1

CK Hutchison Holdings

An investment holding company, primarily operates in ports and related services, retail, infrastructure, and telecommunications businesses in Hong Kong, Mainland China, Europe, Canada, Asia, Australia, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives