- Hong Kong

- /

- Industrials

- /

- SEHK:1

Assessing CK Hutchison Holdings (SEHK:1) Valuation After New Telecom Subsidiary Update Spurs Investor Interest

Reviewed by Simply Wall St

CK Hutchison Holdings (SEHK:1) has published a quarterly trading update for its telecom subsidiary, featuring unaudited financial results for the quarter ended September 30, 2025. The company urged investors to treat this data with caution.

See our latest analysis for CK Hutchison Holdings.

Following the telecom update, CK Hutchison Holdings’ shares have surged, with a 34.6% share price return year to date and a 44.9% total shareholder return over the past year. With momentum building on these recent gains, investors are taking a closer look at its broader value and growth story.

If these developments have you curious about what else is gaining traction in the market, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With such a strong rally behind it, the key question for investors now is whether CK Hutchison Holdings still trades at an attractive valuation or if the recent gains mean the market has already priced in further growth.

Most Popular Narrative: 9.6% Undervalued

CK Hutchison Holdings' consensus fair value estimate is HK$61.1, sitting around 10% above the last close price of HK$55.25. This sets the stage for a valuation thesis driven by ambitious long-term growth levers rather than short-term market euphoria.

Sustained investment and efficiency-driven growth in the Ports division, including expanded facilities in key geographies and increased storage income, position the company to benefit from global trade resilience and supply chain optimization, supporting higher revenue and stable cash flows. Strategic expansion and modernization of the group's retail arm (notably A.S. Watson's store portfolio and loyalty program development, plus omni-channel/dark store initiatives), are anticipated to drive same-store sales growth and operational leverage, contributing to higher revenue and sustainable bottom-line growth.

Wonder about the bold projections that underpin this optimistic outlook? The narrative leans on multifaceted growth, margin expansion, and ambitious profit targets that could reshape expectations. There is more at play here than meets the eye. Find out what key financial forces are driving this potential upside.

Result: Fair Value of $61.1 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in Mainland China retail and heavy reliance on non-recurring gains could challenge the company's ability to sustain earnings growth in the future.

Find out about the key risks to this CK Hutchison Holdings narrative.

Another View: Market Ratios Suggest Lofty Pricing

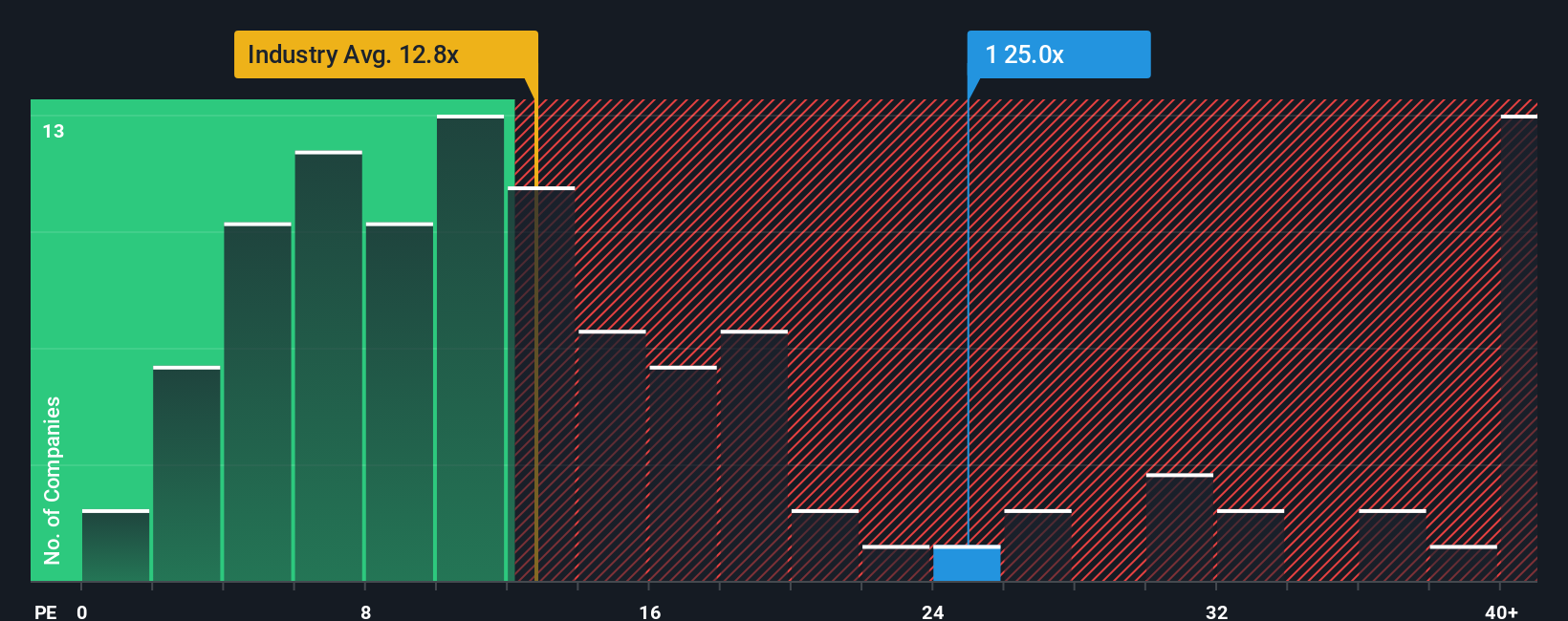

While the consensus sees upside, market valuation ratios paint a more cautious picture. CK Hutchison Holdings trades on a price-to-earnings ratio of 27.4x, which is far above both the peer average of 26.4x and the Asian Industrials industry’s 12.4x. Its fair ratio, estimated at 18.6x, is also much lower than today's level. This gap suggests investors may be exposed to valuation risk if market expectations shift.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CK Hutchison Holdings Narrative

If you see things differently or want to dig deeper for yourself, you're welcome to build your own view in just a few minutes. Do it your way

A great starting point for your CK Hutchison Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stick to just one opportunity? Tap into powerful tools designed to uncover tomorrow’s leaders and unlock more ways to advance your financial goals today.

- Tap into rapid innovation by evaluating these 25 AI penny stocks, which are pushing the boundaries of artificial intelligence across industries and business models.

- Pursue income growth by selecting these 14 dividend stocks with yields > 3% that offer robust yields and a record of consistent shareholder returns in a low-rate environment.

- Stay ahead of disruptive trends by tracking these 82 cryptocurrency and blockchain stocks, which are at the forefront of blockchain and digital asset integration.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1

CK Hutchison Holdings

An investment holding company, primarily operates in ports and related services, retail, infrastructure, and telecommunications businesses in Hong Kong, Mainland China, Europe, Canada, Asia, Australia, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives