Does China Construction Bank’s Stock Offer Value After Recent Price Dip and Regulatory Developments?

Reviewed by Bailey Pemberton

Wondering what to do with China Construction Bank stock? You are definitely not alone. Whether you have watched its price climb over 100% in the last three or five years, or you are noting the recent dip over the past month, the ride has been anything but dull. Year to date, shares are still up an impressive 20.7%, and over the past year, investors have enjoyed a hefty 26.1% return. Even with a slide of -5.0% in the last 30 days, long-term performance shows plenty of resilience and perhaps hints at both growth potential and shifting market sentiment.

Most analysts are paying close attention to market shifts affecting China’s state-owned lenders, with sentiment fluctuating as new financial regulations and economic reopening hopes ripple through the sector. For China Construction Bank specifically, its track record stands out, not just for price appreciation. Right now, the company scores a perfect 6 out of 6 on our valuation checklist, meaning it looks undervalued on every metric we track. That result deserves a closer look.

If you have been thinking about when or why to make your move, you will want to see how China Construction Bank stacks up using a range of valuation approaches. We will break down those methods in detail next. Later, I will share a more holistic way to think about value for long-term investors.

Approach 1: China Construction Bank Excess Returns Analysis

The Excess Returns valuation model estimates a company's value by measuring how much its return on invested capital exceeds the required cost of equity. In essence, this approach shows whether a business is generating enough earnings from its equity base, compared to what investors expect in return for their risk.

For China Construction Bank, the numbers stand out for their resilience and consistency. The bank reports a Book Value of HK$12.86 per share and a Stable Earnings Per Share (EPS) of HK$1.35, based on future return on equity estimates from 14 analysts. The average return on equity is strong at 9.48%, suggesting solid profitability. In comparison, the Cost of Equity is HK$1.21 per share, so the Excess Return, or the value earned above that required by shareholders, comes to HK$0.14 per share. Peer forecasts also indicate a stable Book Value projected at HK$14.21 per share, again driven by consensus among 11 analysts.

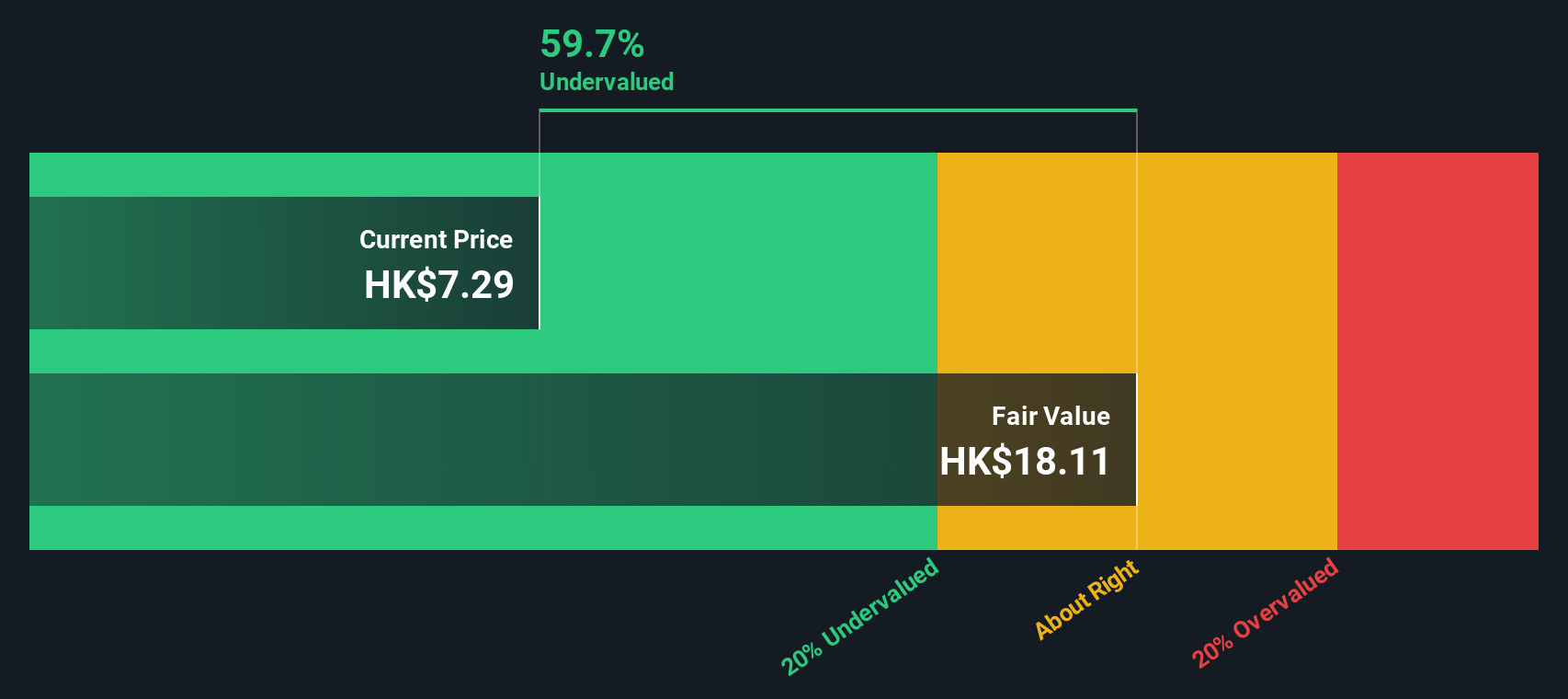

Given these estimates, the Excess Returns model places the intrinsic value of China Construction Bank stock at a significant discount to its current price. Specifically, the calculation indicates the shares are 59.7% undervalued according to this approach, pointing to notable upside for value-focused investors.

Result: UNDERVALUED

Our Excess Returns analysis suggests China Construction Bank is undervalued by 59.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: China Construction Bank Price vs Earnings

The price-to-earnings (PE) ratio is often the preferred valuation tool for profitable companies like China Construction Bank. It compares the current share price to per-share earnings. For investors, this multiple provides a snapshot of how much they are paying for each dollar of earnings, making it a quick and widely understood benchmark for gauging value among established banks.

A “normal” or fair PE ratio does not exist in a vacuum. Growth expectations play a significant role. Faster-growing companies often command higher PE ratios, while higher perceived risks (economic, regulatory, or sector-specific) tend to lower them. It is also important to examine how a company stacks up relative to industry and peer averages, providing context for whether it trades at a premium or discount.

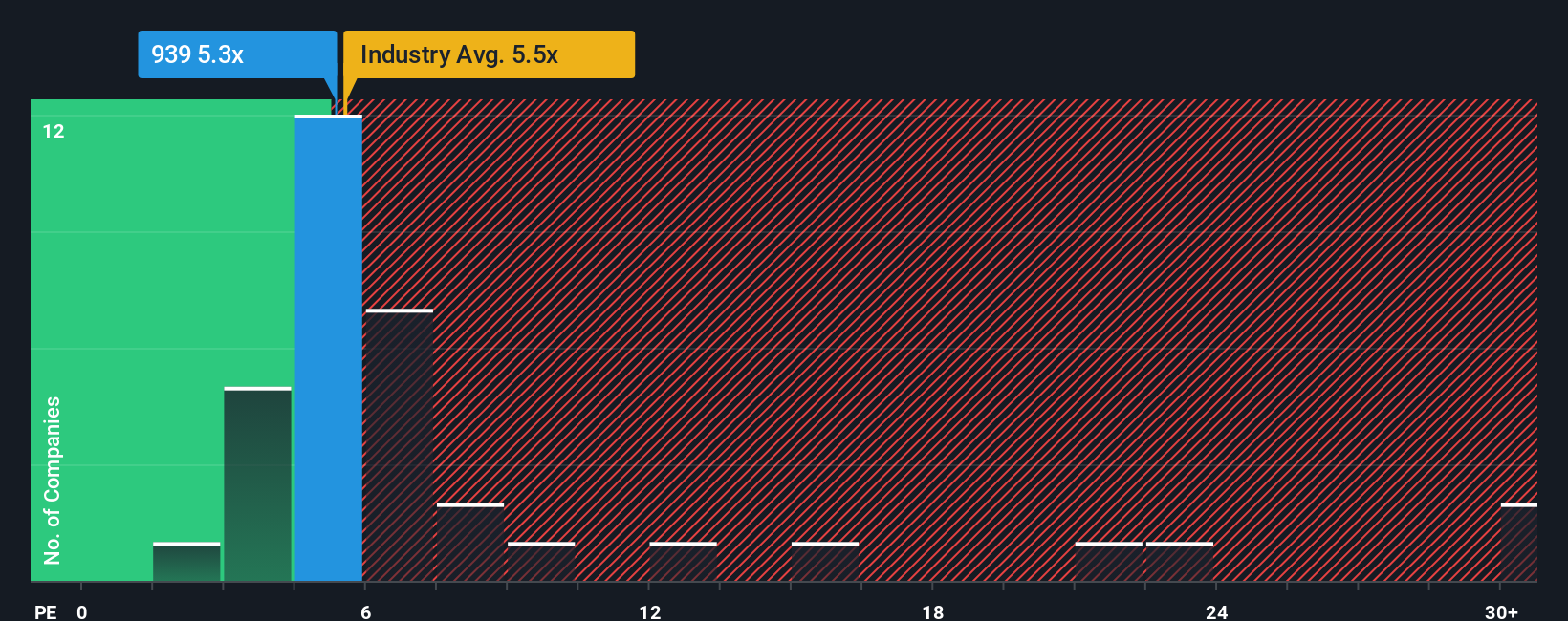

China Construction Bank currently trades at 5.35x earnings, which is below the Banks industry average of 5.57x and its peer group average of 6.11x. Simply Wall St's proprietary Fair Ratio, which incorporates earnings growth, risk profile, profit margins, industry dynamics, and company size, stands at 6.82x. This Fair Ratio gives a more tailored reflection of what investors should reasonably pay for the stock, rather than relying solely on basic comparisons with peers or industry averages.

Comparing the actual PE ratio to the Fair Ratio, there is a meaningful gap, indicating the stock is undervalued based on its fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your China Construction Bank Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your unique story and perspective about a company, connecting your view of its future to a specific financial forecast and, ultimately, a fair value for the stock. Rather than just relying on traditional ratios, Narratives let you express your logic behind assumed revenue growth, earnings, and margins, bringing the numbers to life with context. Think of it as linking the company’s journey, what you expect from its business, industry trends, and future direction, with your own valuation forecast.

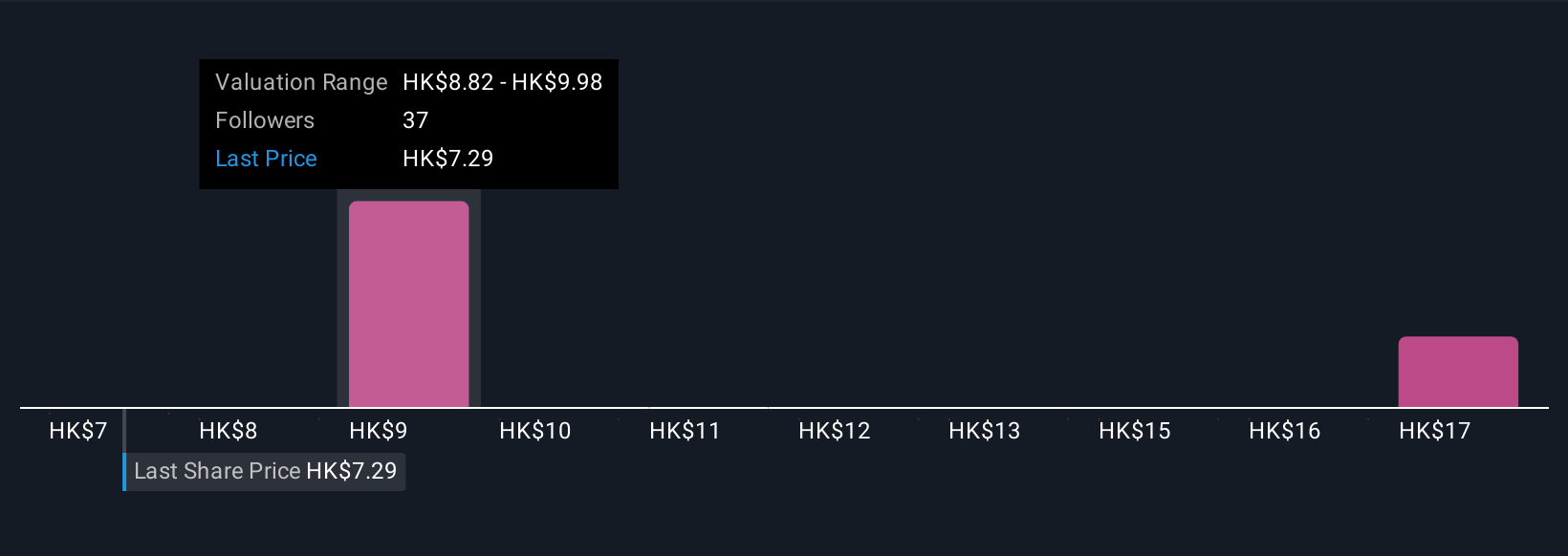

On Simply Wall St’s Community page, millions of investors use Narratives to easily build, update, and share their outlooks. Comparing your fair value to the current price helps guide smarter buy or sell decisions. As fresh news, earnings, and analysis emerge, Narratives are updated automatically, ensuring your view stays current. For example, some investors believe China Construction Bank is poised for a rally thanks to rising Chinese wealth and digital innovation, placing fair value as high as HK$11.71. Others focus on risks like real estate exposure and see fair value nearer to HK$6.21. Narratives make these perspectives and the reasoning behind them clear, dynamic, and accessible for every investor.

Do you think there's more to the story for China Construction Bank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:939

China Construction Bank

Engages in the provision of various banking and related financial services to individuals and corporate customers in the People's Republic of China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success