Chongqing Rural Commercial Bank (SEHK:3618) Margin Pressure Challenges Narrative of Sustained Profitability

Reviewed by Simply Wall St

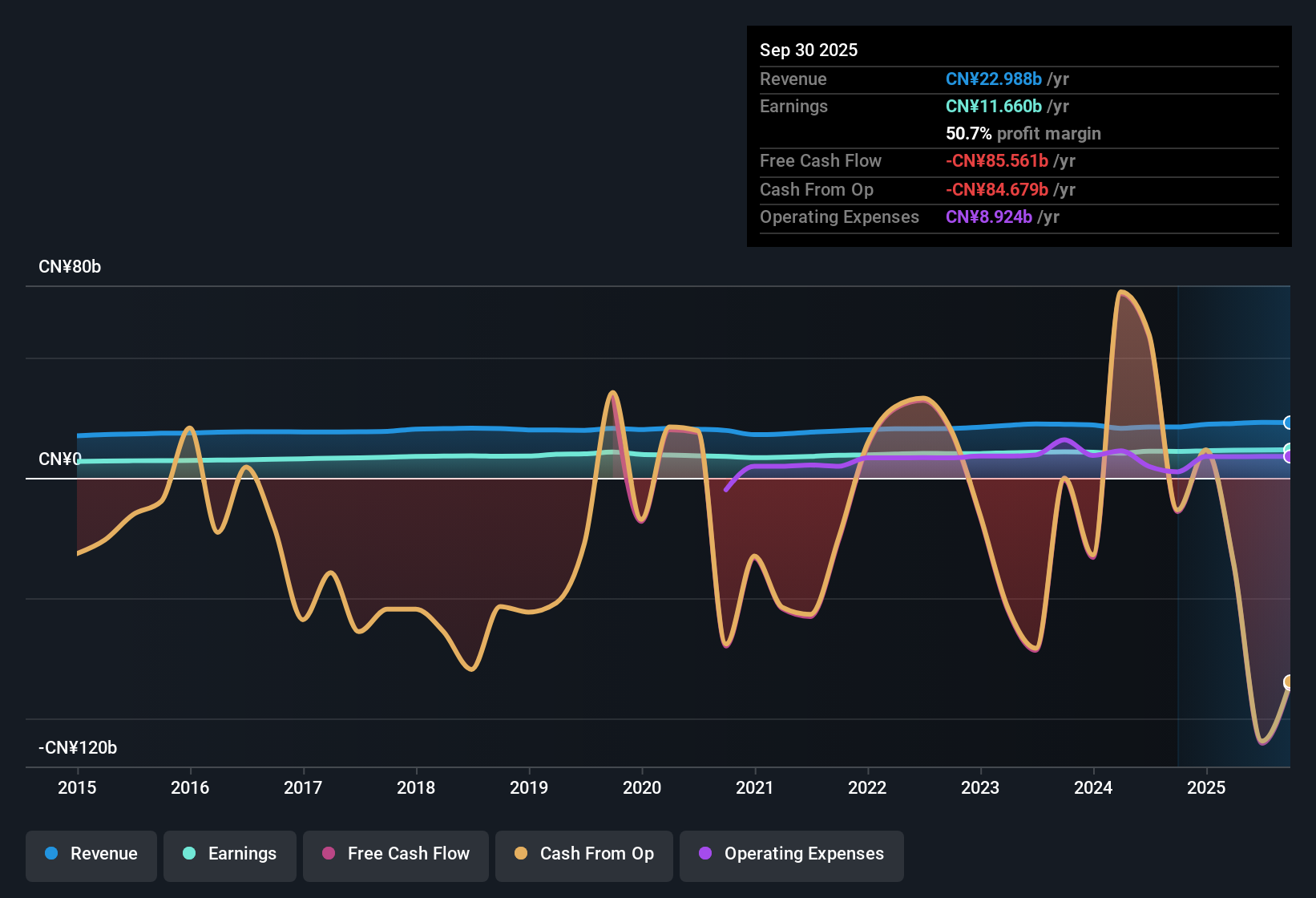

Chongqing Rural Commercial Bank (SEHK:3618) booked annual earnings growth of 5.8%, just below its five-year average of 6% per year. Revenue is expected to rise 11% annually, outpacing the broader Hong Kong market at 8.6%. Net profit margins eased to 50.5% from last year’s 52.3%. Despite the recent margin pressure, the bank’s share price (HK$6.45) remains well below the estimated fair value (HK$15.07), offering investors a potential value opportunity in the context of solid growth and sustained profitability.

See our full analysis for Chongqing Rural Commercial Bank.Next up, we’ll see how the latest figures compare against some of the widely watched narratives for Chongqing Rural Commercial Bank, highlighting where the results fit the prevailing story and where they might challenge expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Slip But Remain Strong

- Net profit margins eased to 50.5% this year from last year’s 52.3%, showing some recent pressure yet still staying high relative to most other Hong Kong banks.

- Stability in margins supports a steady outlook according to the prevailing market view,

- Analysts note that even as profitability faced recent compression, the bank continues to report robust operational results, outpacing many regional peers.

- Ongoing prudent risk management and digital transformation are often cited as factors that may help cushion against further downside in future profitability.

Growth Forecast Outpaces Broader Market

- Earnings are forecast to grow at 5.75% per year, with revenue expected to climb 11% annually. Both rates are faster than the broader Hong Kong market’s 8.6% revenue growth pace.

- Prevailing market view points to the bank’s operational stability and growth guidance as attractive for investors,

- Prudent controls combine with ongoing digital initiatives and local economic support to reinforce expectations of continued top-line expansion.

- Compared to other regional banks, the growth outlook gives Chongqing Rural Commercial Bank a perceived advantage among value and income-focused investors seeking steady gains.

Trading at a Discount to DCF Fair Value

- Shares trade at HK$6.45, well below the DCF fair value estimate of HK$15.07, and at a Price-To-Earnings Ratio of 5.7x, just under the industry average of 5.9x but above direct peers at 4.4x.

- Current valuation appears to support the case for positive long-term sentiment,

- Despite some margin pressure and questions about dividend sustainability, the large gap to DCF fair value and ongoing profit growth both heavily support the outlook for further upside.

- For investors who are comfortable balancing yield reliability with capital appreciation potential, the discount to fair value stands out as a compelling argument to revisit the stock’s long-term positioning.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Chongqing Rural Commercial Bank's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Recent margin compression and questions around dividend sustainability suggest Chongqing Rural Commercial Bank may face challenges delivering consistent shareholder returns in the future.

If steady income is your top priority, use our these 2016 dividend stocks with yields > 3% to focus on companies delivering strong, reliable yields backed by solid payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3618

Chongqing Rural Commercial Bank

Provides banking services in the People’s Republic of China.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives