Bank of Communications (SEHK:3328): Assessing Valuation and Market Sentiment for Investors

Reviewed by Kshitija Bhandaru

Bank of Communications (SEHK:3328) shares have seen some changes recently, which has caught the attention of investors looking at Hong Kong’s banking sector. Let’s take a closer look at how the stock is performing.

See our latest analysis for Bank of Communications.

Over the past year, Bank of Communications has delivered a modest 0.13% total shareholder return, with more muted price momentum in recent months as the stock hovers near HK$6.53. While the short-term share price has been relatively steady, this performance hints at cautious optimism among investors and a market that is waiting for clearer signals on growth or risk ahead.

If you’re keeping an eye on trends in banking but want to broaden your horizons, it could be the ideal moment to discover fast growing stocks with high insider ownership

With shares trading at a slight discount to analyst targets and steady financial growth, the question now is whether Bank of Communications is undervalued or if the market has already anticipated its next move, leaving little room for upside.

Price-to-Earnings of 6x: Is it justified?

Bank of Communications is currently trading at a Price-to-Earnings (P/E) ratio of 6x, making it appear attractively valued compared to both its estimated fair P/E ratio of 6.3x and the peer average of 7x. With a closing price of HK$6.53, investors may see signs of undervaluation when benchmarked against its industry rivals and historical averages.

The P/E ratio measures how much investors are willing to pay for each HK dollar of earnings. It is a widely used indicator of value in the banking sector. For a bank like Bank of Communications, this ratio is crucial because it reflects market expectations around earnings growth and risk. When the P/E is below peer averages, it may signal cautious sentiment despite the company's solid financial track record.

Compared with the Hong Kong Banks industry average of 5.6x, the company's current multiple is slightly higher. This indicates the market assigns a bit of a premium. However, the fair value estimate, based on regression analysis, suggests that the stock's valuation could move closer to the fair P/E of 6.3x if growth and earnings projections are met.

Explore the SWS fair ratio for Bank of Communications

Result: Price-to-Earnings of 6x (UNDERVALUED)

However, slower revenue and net income growth, along with recent price declines, could signal lingering concerns weighing on Bank of Communications' near-term outlook.

Find out about the key risks to this Bank of Communications narrative.

Another View: What Does the SWS DCF Model Say?

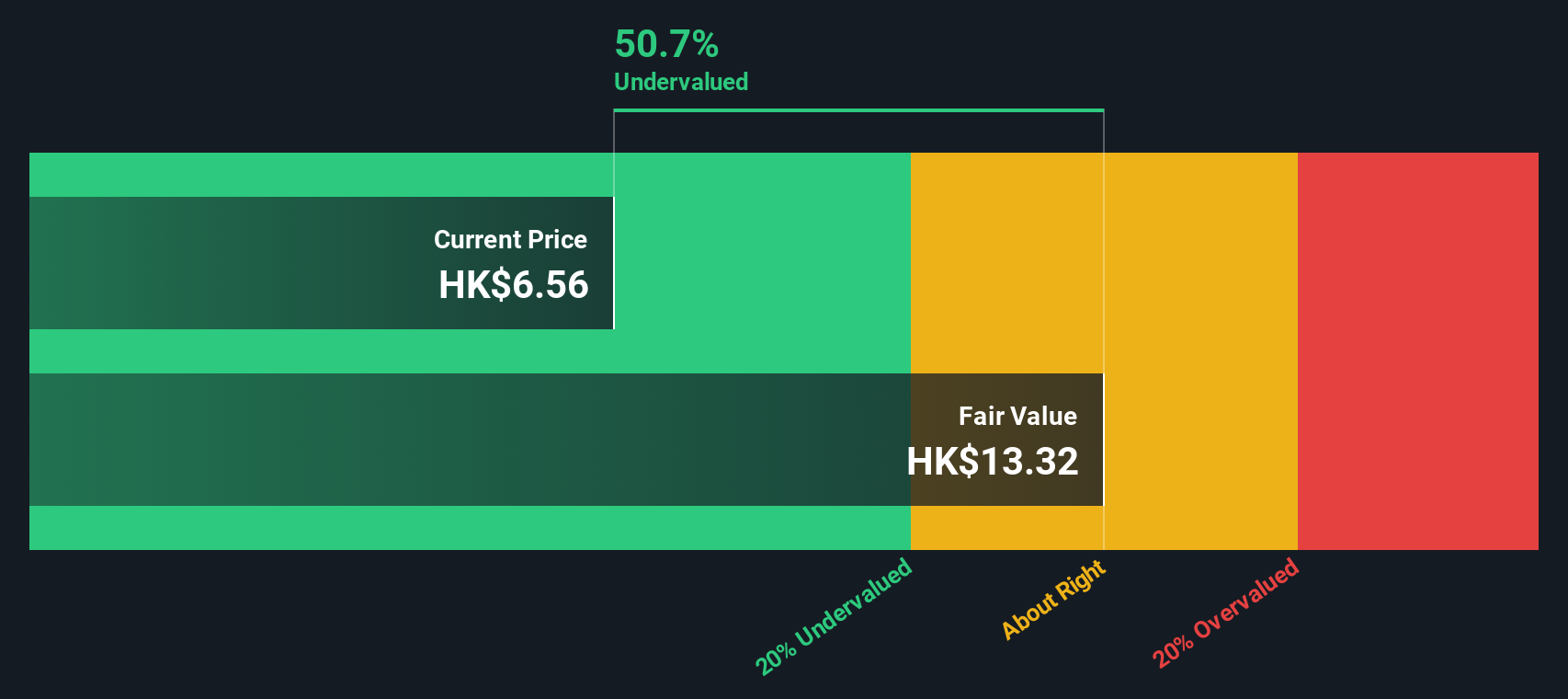

Taking a different approach, our DCF model suggests an even larger undervaluation for Bank of Communications. It estimates fair value at HK$13.34, which is well above the current share price. This method factors in expected future cash flows. However, does it provide a more reliable picture than using simple earnings multiples?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of Communications for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of Communications Narrative

If you want to dig into the details yourself or have a different take, you can easily craft your own perspective in just a few minutes, Do it your way

A great starting point for your Bank of Communications research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart moves don’t happen by chance. Use the right tools to spot unique growth potential or untapped opportunities across the market before others catch on.

- Unleash your portfolio’s AI edge by tapping into the momentum behind these 24 AI penny stocks, where emerging companies are redefining entire industries with intelligent technologies.

- Supercharge your returns by targeting income potential with these 19 dividend stocks with yields > 3%, filtering for stocks offering solid yields above 3% for consistent payouts.

- Stay ahead of market trends by zeroing in on deep value opportunities via these 900 undervalued stocks based on cash flows, tailored to highlight companies trading below their intrinsic cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3328

Bank of Communications

Provides commercial banking products and services in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives