Stock Analysis

- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2411

Exploring Dah Sing Banking Group And Two More Hidden Small Caps With Strong Financials

Reviewed by Simply Wall St

As global markets navigate through a landscape marked by shifting trade dynamics and a pronounced pivot towards small-cap and value stocks, the Hong Kong market presents unique opportunities for discerning investors. In this context, identifying small-cap companies like Dah Sing Banking Group with robust financials can offer potential growth avenues aligned with current market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| China Leon Inspection Holding | 17.06% | 24.06% | 27.08% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Sundart Holdings | 0.01% | -2.76% | -4.34% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Laopu Gold | 8.43% | 26.56% | 36.28% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Dah Sing Banking Group (SEHK:2356)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Banking Group Limited operates as an investment holding company, offering a range of banking and financial services across Hong Kong, Macau, and the People's Republic of China, with a market capitalization of approximately HK$8.73 billion.

Operations: Dah Sing Banking Group generates its revenue primarily through personal banking, corporate banking, and treasury and global markets, with significant contributions of HK$2.45 billion, HK$1.04 billion, and HK$1.13 billion respectively. The bank has consistently demonstrated a strong net income margin trend over the years, highlighting efficient operations despite varying market conditions.

Dah Sing Banking Group, a notable player in Hong Kong's financial sector, presents an intriguing investment profile. With total assets of HK$260.7B and a robust deposit base of HK$212.1B, the bank maintains a healthy loans portfolio at HK$144.6B and a commendable Net Interest Margin of 2%. Notably, its bad loans stand at only 1.9%, reflecting strong credit management. The company's earnings have surged by 15.6% over the past year, outpacing the industry's growth and are projected to grow by 5.77% annually, underscoring its potential as an undiscovered gem in the market.

- Delve into the full analysis health report here for a deeper understanding of Dah Sing Banking Group.

Gain insights into Dah Sing Banking Group's past trends and performance with our Past report.

Shenzhen Pagoda Industrial (Group) (SEHK:2411)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Pagoda Industrial (Group) Corporation Limited is a multinational fruit retailer with operations spanning China, Indonesia, Singapore, and Hong Kong, currently boasting a market capitalization of HK$2.99 billion.

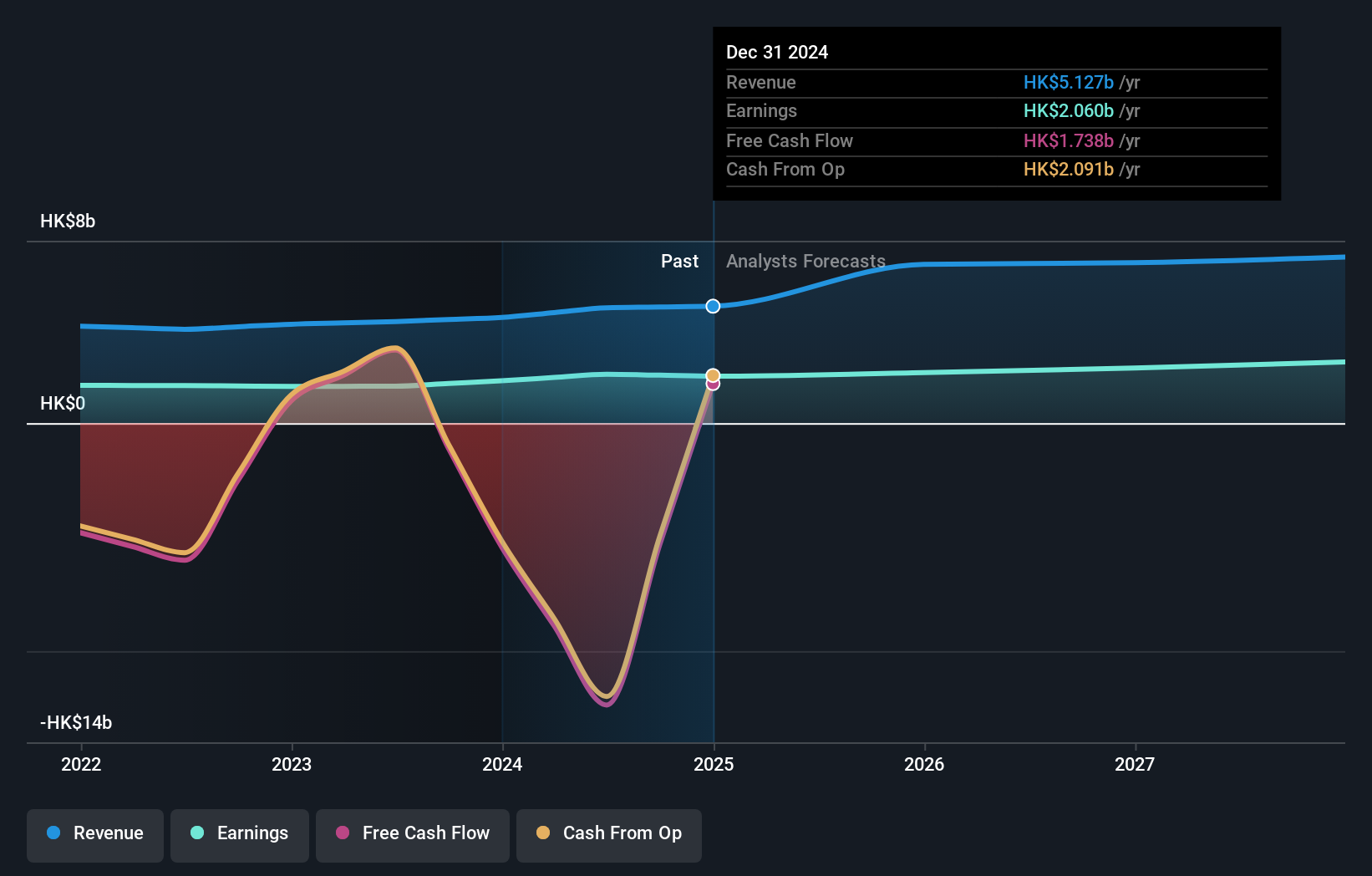

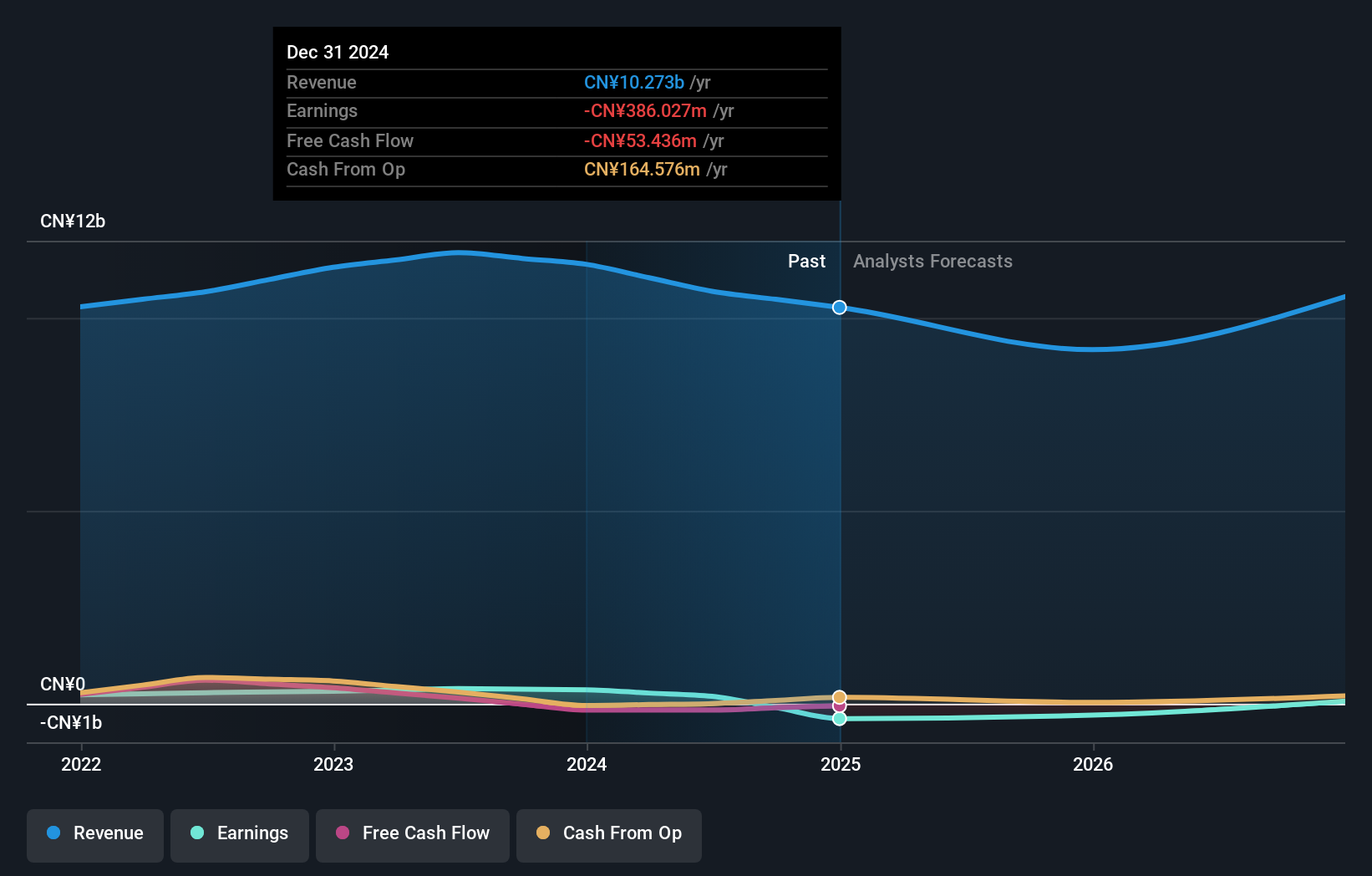

Operations: Shenzhen Pagoda Industrial (Group) primarily generates its revenue from franchising, contributing CN¥10.89 billion, with additional income from trading activities amounting to CN¥870.34 million. The company has seen a trend of increasing gross profit margin over the years, reaching 11.52% by the end of 2023, reflecting improved operational efficiency in managing the costs of goods sold which totaled CN¥10.08 billion in late 2023.

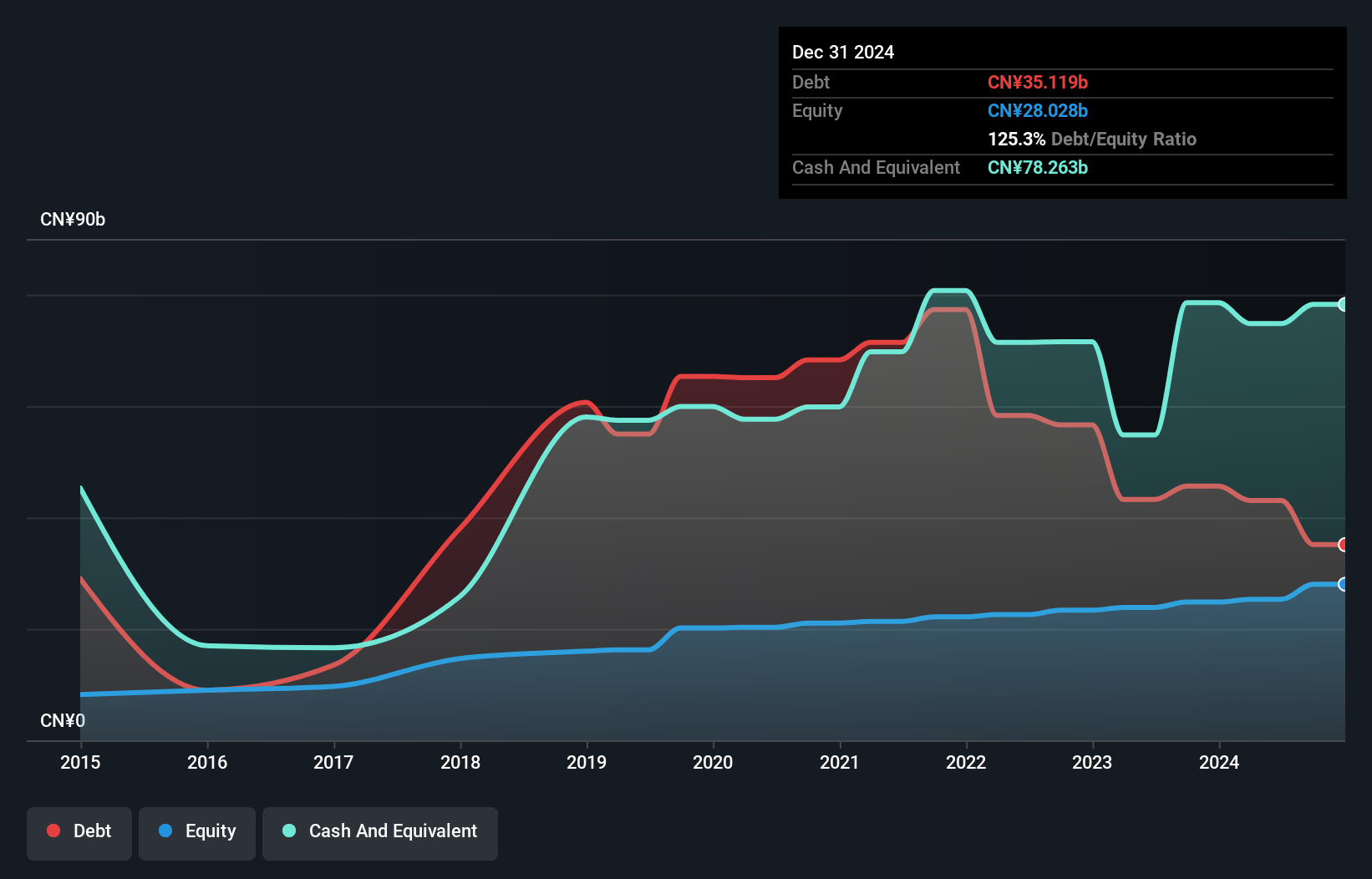

Shenzhen Pagoda Industrial (Group) showcases a robust financial profile with a Price-To-Earnings ratio of 7.7, well below Hong Kong's market average of 9.4, indicating potential undervaluation. The company's debt is comfortably exceeded by its cash reserves, and interest payments are securely covered 22.9 times by EBIT. Recent corporate activities include a dividend payout set for July 19, 2024, and the appointment of Mr. SUN Kai as non-executive director, reflecting ongoing governance enhancements that could intrigue investors looking for growth coupled with stability in lesser-explored markets.

Jinshang Bank (SEHK:2558)

Simply Wall St Value Rating: ★★★★★★

Overview: Jinshang Bank Co., Ltd. is a financial institution based in China, offering a diverse range of banking products and services, with a market capitalization of HK$7.59 billion.

Operations: The bank generates significant revenue from corporate banking, accounting for CN¥3.28 billion, supplemented by retail banking at CN¥1.05 billion and treasury operations at CN¥29.82 million. It consistently achieves a high gross profit margin of 100%, with net income margins showing an upward trend, reaching approximately 45.83% by the end of 2023.

Jinshang Bank, trading at a significant 65.7% below its estimated fair value, showcases robust health with CN¥361.3B in assets and a strong equity base of CN¥24.8B. With total deposits at CN¥281.1B against loans of CN¥184.7B, the bank maintains an appropriate bad loan ratio at 1.8%, reflecting prudent risk management. Notably, its earnings growth of 8.9% last year outpaced the industry’s 1.6%, underscoring potential as an undervalued entity in Hong Kong’s financial sector.

- Navigate through the intricacies of Jinshang Bank with our comprehensive health report here.

Explore historical data to track Jinshang Bank's performance over time in our Past section.

Seize The Opportunity

- Access the full spectrum of 180 SEHK Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Shenzhen Pagoda Industrial (Group) is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2411

Shenzhen Pagoda Industrial (Group)

Operates as a fruit retailer in China, Indonesia, Singapore, Hong Kong, and internationally.

Good value with adequate balance sheet.