Stock Analysis

- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1373

International Housewares Retail And Two More SEHK Dividend Stocks To Consider

Reviewed by Simply Wall St

In recent trading sessions, the Hang Seng Index has faced challenges, retreating by 4.79% amid broader concerns reflected in global markets about economic growth and trade tensions. Despite these headwinds, dividend stocks in Hong Kong continue to attract investors looking for potential steady income streams in a fluctuating market environment.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| China Construction Bank (SEHK:939) | 7.92% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 9.21% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.02% | ★★★★★☆ |

| China Overseas Grand Oceans Group (SEHK:81) | 9.21% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 9.09% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.42% | ★★★★★☆ |

| International Housewares Retail (SEHK:1373) | 9.03% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.32% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.00% | ★★★★★☆ |

| Tian An China Investments (SEHK:28) | 5.00% | ★★★★★☆ |

Click here to see the full list of 89 stocks from our Top SEHK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

International Housewares Retail (SEHK:1373)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: International Housewares Retail Company Limited operates as an investment holding company focused on the retail sale and trading of housewares products, with a market capitalization of approximately HK$0.89 billion.

Operations: International Housewares Retail Company Limited generates revenue primarily through its retail operations in Hong Kong and Macau, which contributed HK$2.44 billion, and in Singapore, which added HK$0.31 billion.

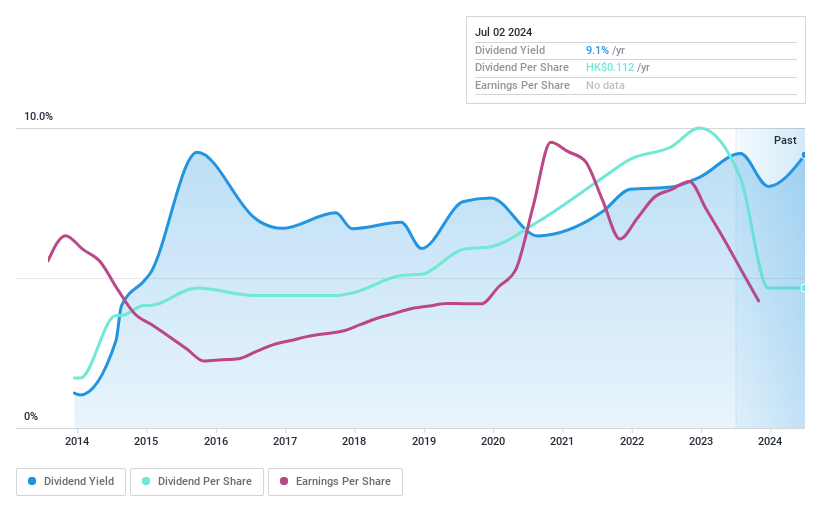

Dividend Yield: 9%

International Housewares Retail recently projected a significant profit decline of 32% to 38% for the year ended April 2024, primarily due to reduced demand post-pandemic and increased operating costs. Despite these challenges, the company has managed to increase its dividend payments over the past decade and maintains a high dividend yield at 9.03%, ranking in the top quartile within Hong Kong's market. However, its dividends have shown volatility over this period, with notable fluctuations exceeding 20% annually. The firm’s dividends are currently supported by both earnings and cash flows, with payout ratios of 80.2% and cash payout ratios at a more comfortable 22.3%, respectively.

- Delve into the full analysis dividend report here for a deeper understanding of International Housewares Retail.

- The valuation report we've compiled suggests that International Housewares Retail's current price could be quite moderate.

Precision Tsugami (China) (SEHK:1651)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Precision Tsugami (China) Corporation Limited is an investment holding company that specializes in manufacturing and selling computer numerical control machine tools, operating mainly in Mainland China and globally, with a market capitalization of approximately HK$3.55 billion.

Operations: Precision Tsugami (China) generates revenue primarily through the manufacture and sale of CNC high precision machine tools, totaling CN¥3.12 billion.

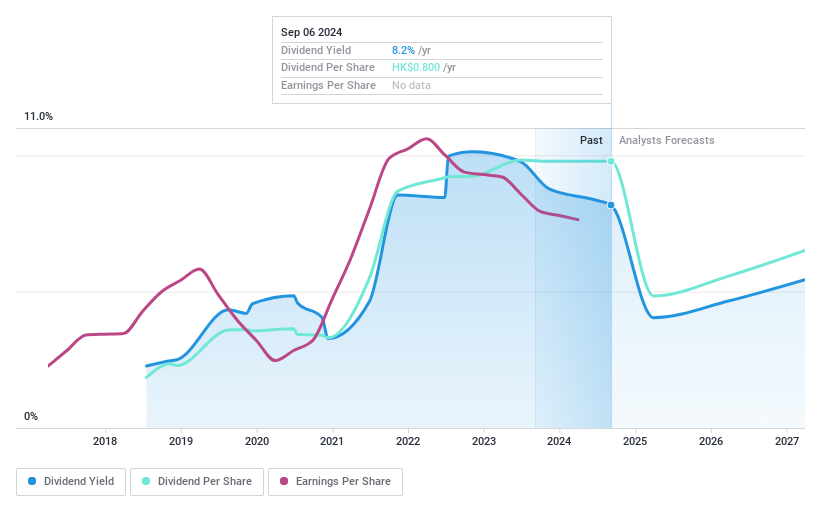

Dividend Yield: 8.5%

Precision Tsugami (China) Corporation Limited has been increasing its dividends, with a recent proposal of HK$0.4 per share, despite a short dividend history of six years. The company's dividends are well-supported by earnings and cash flows, with payout ratios at 58.5% and cash payout ratios at 67.7%, respectively. However, it faces challenges as earnings have declined year-over-year from CNY 579.19 million to CNY 479.97 million, impacting its financial stability and future growth prospects in dividend payments.

- Click here to discover the nuances of Precision Tsugami (China) with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Precision Tsugami (China) is trading behind its estimated value.

Xinhua Winshare Publishing and Media (SEHK:811)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinhua Winshare Publishing and Media Co., Ltd. operates in publishing and distribution across the People's Republic of China, with a market capitalization of approximately HK$15.81 billion.

Operations: Xinhua Winshare Publishing and Media Co., Ltd. generates its revenue primarily from publishing and distribution activities within the People's Republic of China.

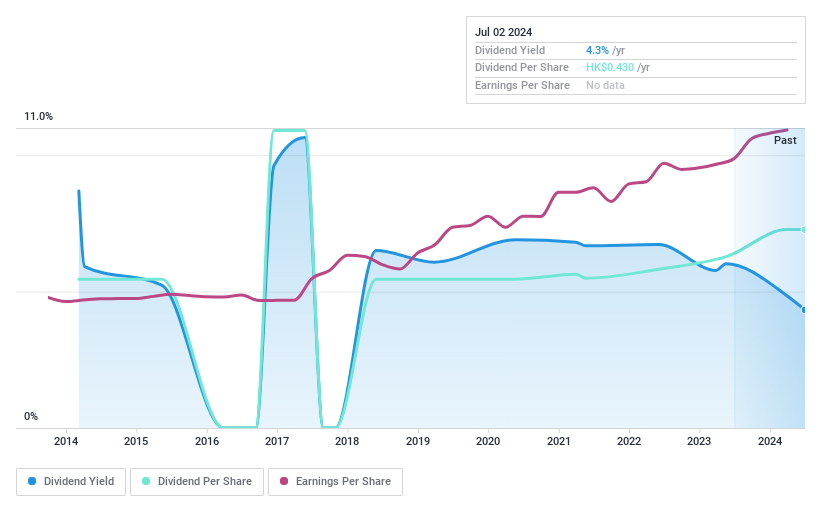

Dividend Yield: 4.5%

Xinhua Winshare Publishing and Media has approved a final dividend of RMB 0.40 per share for 2023, reflecting a commitment to shareholder returns despite its historically volatile dividend track record. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 30.9% and 23.1% respectively, suggesting sustainability from a financial perspective. However, the relatively low yield compared to top Hong Kong dividend payers indicates limited attractiveness for yield-focused investors. Recent management changes and auditor switch to KPMG may influence future governance and financial transparency.

- Click to explore a detailed breakdown of our findings in Xinhua Winshare Publishing and Media's dividend report.

- Our valuation report unveils the possibility Xinhua Winshare Publishing and Media's shares may be trading at a discount.

Where To Now?

- Dive into all 89 of the Top SEHK Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether International Housewares Retail is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1373

International Housewares Retail

An investment holding company, engages in the retail sale and trading of housewares products.

Flawless balance sheet established dividend payer.