Dividend and Bond Plan Might Change The Case For Investing In Postal Savings Bank of China (SEHK:1658)

Reviewed by Sasha Jovanovic

- Postal Savings Bank of China Co., Ltd. has approved a reshuffle of its board committees, declared an interim dividend of RMB 1.23 per 10 shares for the first half of 2025, and scheduled an extraordinary general meeting for December 19, 2025, to vote on profit distribution, remuneration, board authorization changes and a financial bond issuance plan.

- Together, the dividend announcement and governance adjustments highlight the bank’s focus on capital management, regulatory alignment and ongoing returns to shareholders.

- We will now examine how the interim dividend and planned financial bond issuance shape Postal Savings Bank of China’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Postal Savings Bank of China's Investment Narrative?

To own Postal Savings Bank of China, you have to believe in a large, state-linked retail bank delivering steady, if unspectacular, earnings from its vast deposit base, even as returns on equity sit in the single digits and dividend patterns have been uneven. The newly approved committee reshuffle and the interim dividend of RMB 1.23 per 10 shares mostly reinforce that story rather than rewrite it: they signal continued attention to risk oversight, regulatory expectations and cash returns, but do not obviously alter near term earnings drivers such as net interest income pressure or modest profit growth forecasts. The planned financial bond issuance, if approved at the December EGM, could matter more for the investment case, shaping how the bank funds growth and manages capital in a business already trading below many fair value estimates.

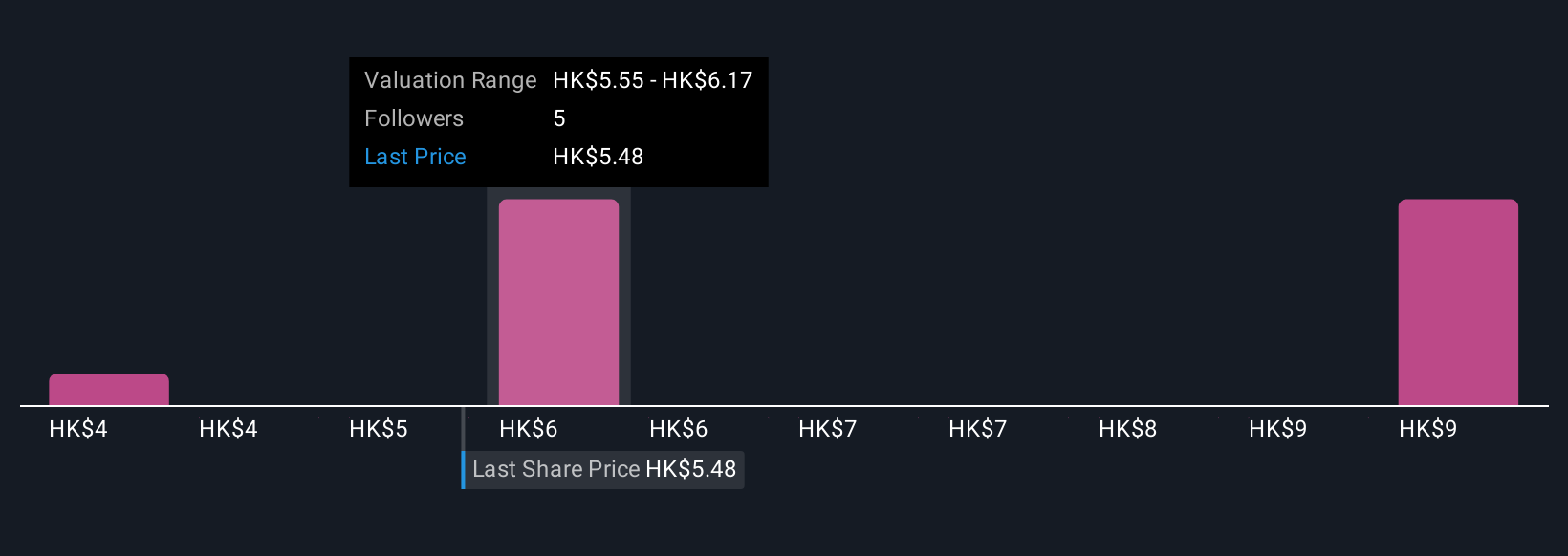

However, one area that investors should not overlook is how board turnover and evolving governance could affect future decision making. Despite retreating, Postal Savings Bank of China's shares might still be trading 45% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Postal Savings Bank of China - why the stock might be worth just HK$6.12!

Build Your Own Postal Savings Bank of China Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Postal Savings Bank of China research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Postal Savings Bank of China research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Postal Savings Bank of China's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1658

Postal Savings Bank of China

Provides various banking products and services for retail and corporate customers in the People’s Republic of China.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026