Stock Analysis

Amid a backdrop of fluctuating global markets, the Hong Kong stock market presents unique opportunities for investors looking to diversify their portfolios. As small-cap stocks show resilience and potential growth in uncertain times, exploring lesser-known companies in this vibrant market could uncover valuable prospects. In such an environment, a good stock often combines robust fundamentals with the potential to benefit from current economic conditions or sectoral trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| China Leon Inspection Holding | 17.06% | 24.06% | 27.08% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Mulsanne Group Holding | 186.88% | -12.02% | -43.54% | ★★★★☆☆ |

| Laopu Gold | 8.43% | 26.56% | 36.28% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Xiamen Yan Palace Bird's Nest Industry (SEHK:1497)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Yan Palace Bird's Nest Industry Co., Ltd. is a company that focuses on the research, development, production, and marketing of edible bird’s nest products within the People’s Republic of China, with a market capitalization of HK$6.68 billion.

Operations: The company primarily generates revenue through direct sales to online customers, offline customers, and e-commerce platforms, supplemented by distribution channels both online and offline. It has experienced a steady increase in revenue from CN¥724.22 million in 2018 to CN¥1964.24 million in recent years, with a significant portion of costs attributed to cost of goods sold (COGS), which was CN¥969.32 million as of the latest report.

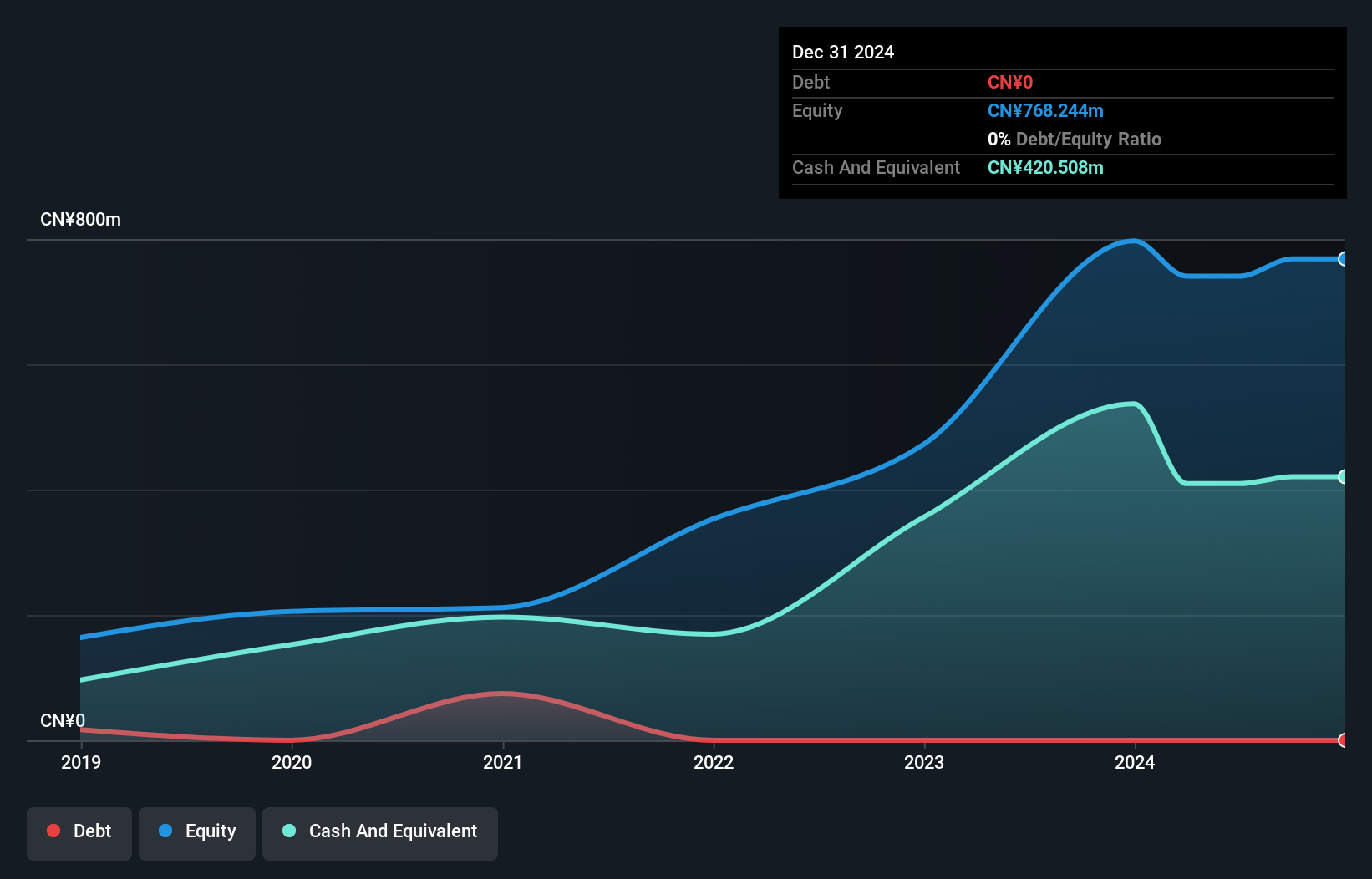

Xiamen Yan Palace Bird's Nest Industry, despite a challenging first half of 2024, projects a revenue increase between 10% to 15% year-over-year, reaching up to RMB 1.09 billion. However, net profit is anticipated to drop by about 40% to 50%, settling between RMB 50 million and RMB 60 million for the same period. The company remains debt-free and has showcased earnings growth of approximately 5% last year, outpacing the industry average. This performance is underpinned by robust online sales growth and operational adjustments reflected in recent corporate governance updates.

- Take a closer look at Xiamen Yan Palace Bird's Nest Industry's potential here in our health report.

Learn about Xiamen Yan Palace Bird's Nest Industry's historical performance.

Bank of Tianjin (SEHK:1578)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank of Tianjin Co., Ltd. offers various banking and financial services mainly in the People’s Republic of China, with a market capitalization of HK$10.68 billion.

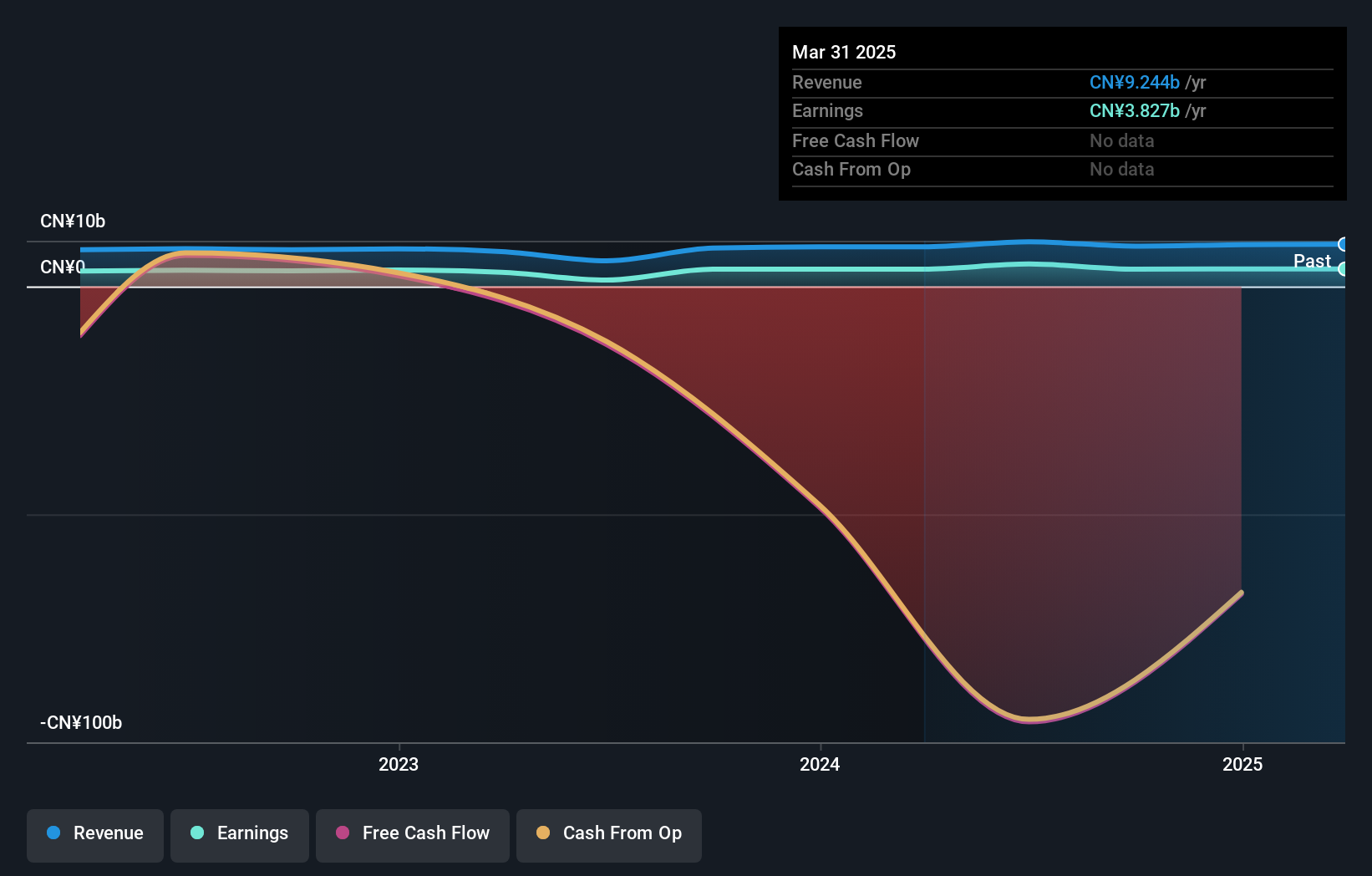

Operations: Bank of Tianjin operates primarily in the financial sector, generating revenue through diverse banking services. The company consistently achieves a high gross profit margin of 100%, indicating that its revenue is effectively managed without the cost of goods sold. Over recent years, it has maintained a net income margin around 47% to 49%, reflecting efficient operational management and profitability.

Bank of Tianjin, with its total assets reaching CN¥871.1B and total equity of CN¥66.5B, presents a compelling case as an overlooked gem in Hong Kong's financial sector. The bank has demonstrated robust financial health with a bad loans ratio at a mere 1.7%, well below the industry standard, and an impressive earnings growth of 22.5% over the past year—surpassing the industry average significantly. This performance is underpinned by a prudent bad loan allowance covering 168% of total loans, ensuring stability amidst market fluctuations.

Tenfu (Cayman) Holdings (SEHK:6868)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tenfu (Cayman) Holdings Company Limited, together with its subsidiaries, specializes in the production and sale of traditional Chinese tea products, boasting a market capitalization of HK$4.87 billion.

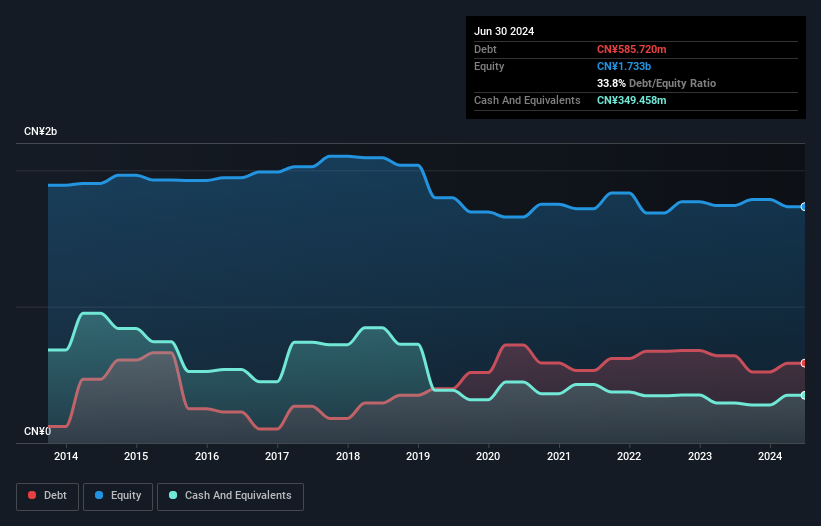

Operations: The company generates its primary revenue from the sale of tea leaves, contributing CN¥1.25 billion, supplemented by tea snacks and tea ware, which add CN¥244.52 million and CN¥175.24 million respectively. It operates with a gross profit margin that has shown variations but was recorded at 54.23% as of the latest data point in 2023, reflecting the costs associated with goods sold and operational expenses tied to sales and marketing efforts among other administrative activities.

Tenfu (Cayman) Holdings, a notable player in Hong Kong's market, trades at 65.9% below its estimated fair value, signaling potential undervaluation. Despite a 3.3% earnings growth lagging behind the industry's 4.1%, its financial health remains robust with a satisfactory net debt to equity ratio of 13.6%. The company recently initiated a share repurchase program, enhancing shareholder value while maintaining strong interest coverage at 14.6 times EBIT and positive free cash flow.

- Click here to discover the nuances of Tenfu (Cayman) Holdings with our detailed analytical health report.

Understand Tenfu (Cayman) Holdings' track record by examining our Past report.

Seize The Opportunity

- Click here to access our complete index of 178 SEHK Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1497

Xiamen Yan Palace Bird's Nest Industry

Engages in the research, development, production, and marketing of edible bird’s nest (EBN) products in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.