Assessing ICBC’s Fair Value After Recent 25% Share Price Surge in 2025

Reviewed by Bailey Pemberton

If you have been watching Industrial and Commercial Bank of China lately, you are not alone. Plenty of investors are eyeing this financial giant while weighing whether it is time to buy, hold, or take profits. After all, the stock has climbed an impressive 25.2% year-to-date, and a cool 35.9% over the past twelve months. Zoom out even further and the numbers get even more interesting: shares have nearly doubled over five years, returning 99.4%, with a three-year surge of 109.4%. That kind of consistency grabs attention, especially given the volatility often seen in banking stocks.

Much of this momentum has developed after policy adjustments in China aimed at supporting major financial institutions, boosting investor sentiment. The market seems to be factoring in both the stability the bank provides and its prominent role in some nationwide initiatives. These moves, alongside broader optimism in China’s economic outlook, appear to have shifted risk perceptions in the market’s favor. This is one reason recent upward pressure has been seen on the stock price, including a 4.5% bounce in the last seven days.

All of this makes the question of value even more fascinating. According to a common set of valuation checks, Industrial and Commercial Bank of China is currently undervalued on five out of six counts, earning a value score of 5. But what do these valuation methods actually tell us, and do they capture the full story? We will break down the major valuation approaches for the company, and at the end, explore whether there might be an even more insightful way to look at its worth.

Why Industrial and Commercial Bank of China is lagging behind its peers

Approach 1: Industrial and Commercial Bank of China Excess Returns Analysis

The Excess Returns model evaluates a company’s ability to generate returns above its cost of equity. This valuation method is especially useful for financial institutions like Industrial and Commercial Bank of China, as it measures how much value is being generated for shareholders through return on invested capital versus what it actually costs to raise that capital.

For Industrial and Commercial Bank of China, the numbers tell a clear story. The current Book Value stands at HK$10.52 per share, with a Stable Earnings Per Share estimated at HK$1.04. These earnings projections are informed by a consensus of 14 analysts focused on future returns. The Cost of Equity, or the baseline the bank must exceed to create value, is HK$1.00 per share. The calculated Excess Return is HK$0.04 per share. The bank’s Average Return on Equity sits at 8.83 percent, and it is projected to grow its Stable Book Value to HK$11.73 per share, supported by estimates from 10 different analysts.

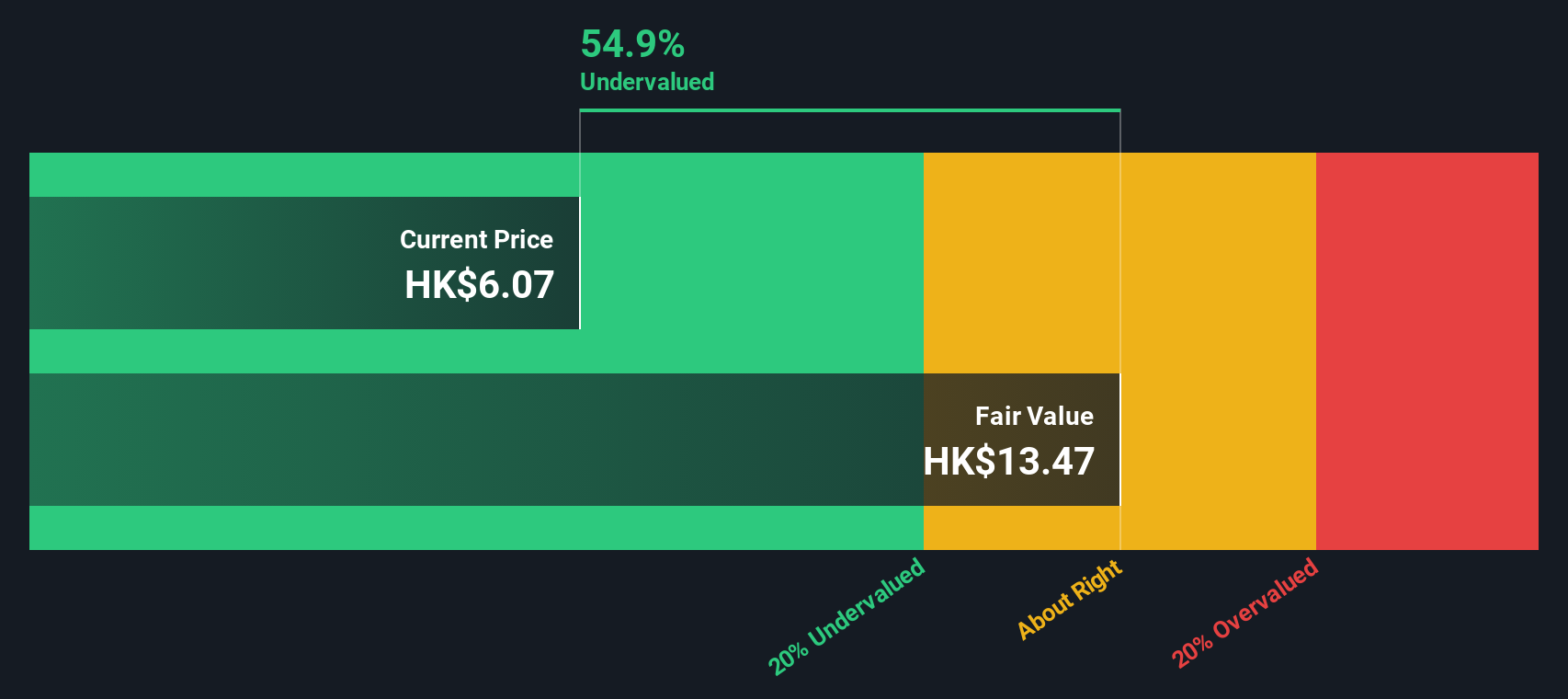

Based on this analysis, the Excess Returns model suggests the intrinsic value for Industrial and Commercial Bank of China is substantially higher than the current market price. This indicates the stock is about 54.9 percent undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests Industrial and Commercial Bank of China is undervalued by 54.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Industrial and Commercial Bank of China Price vs Earnings

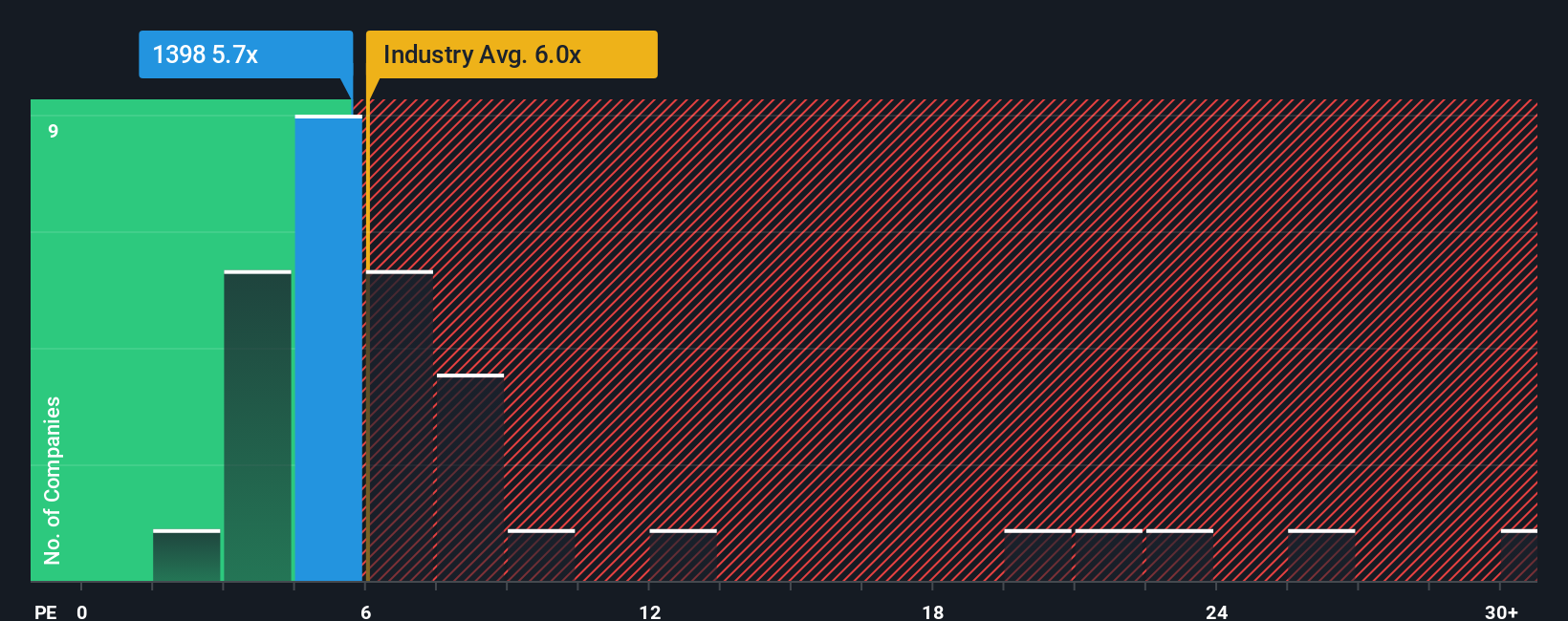

For profitable companies like Industrial and Commercial Bank of China, the price-to-earnings (PE) ratio remains one of the most widely used ways to assess whether a stock is trading at a reasonable valuation. The PE multiple helps investors determine how much the market is willing to pay for each HK$1 of earnings. Generally, faster-growing or less risky companies tend to command higher PE ratios, while slower-growing or riskier businesses trade at lower ones. Comparing this ratio to relevant benchmarks is key.

Currently, Industrial and Commercial Bank of China trades at a PE ratio of 5.69x. When measured against the industry average of 6.00x and a peer group average of 6.69x, the company’s shares look modestly cheaper than both sectors. However, using simple averages can be misleading, since they do not account for specifics such as the company’s underlying growth rate, profit margins, size, and risk profile.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Industrial and Commercial Bank of China is 6.81x. Unlike basic peer or industry comparisons, this measure includes factors such as forecast growth, company size, profitability, and specific risks to suggest a multiple that the stock should command given today’s data. Comparing the current PE ratio of 5.69x with the Fair Ratio of 6.81x, the gap of more than 1x implies that Industrial and Commercial Bank of China is trading noticeably below what would be considered fair value, even after adjusting for its unique situation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Industrial and Commercial Bank of China Narrative

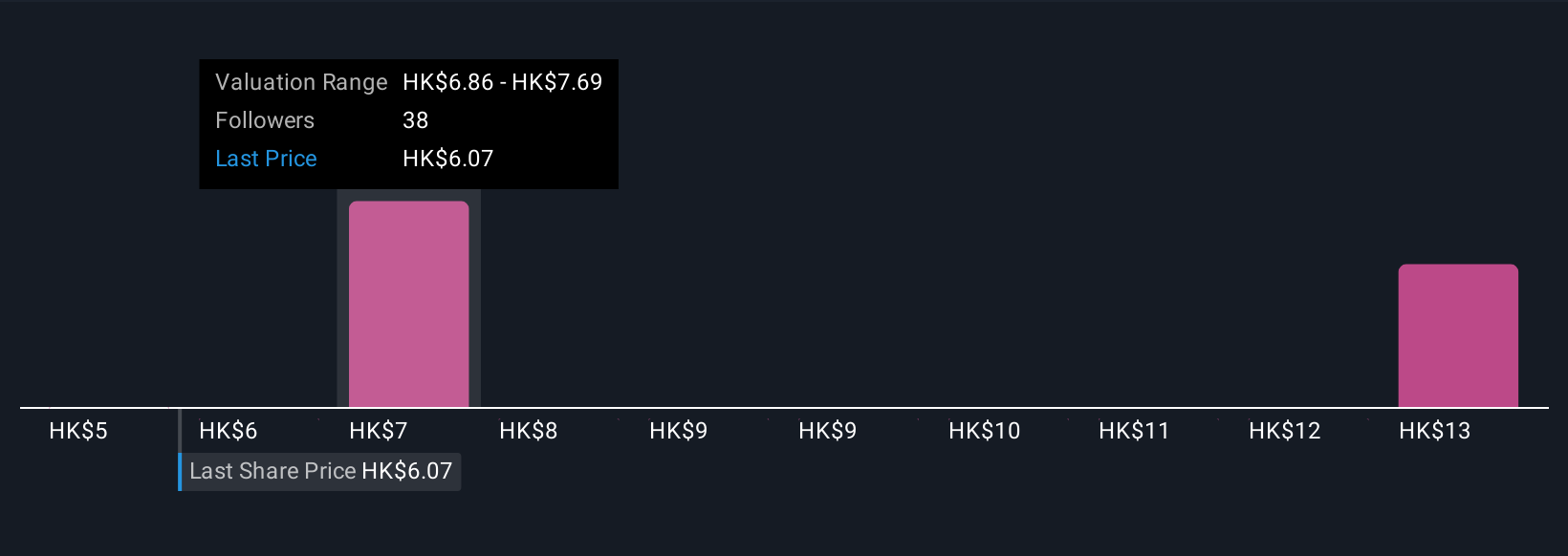

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story about a company, where you bring together your perspective and the numbers, including your assumptions for fair value, future revenue, earnings, and profit margins. Narratives connect the background and outlook of a company directly to a financial forecast, helping you translate the company's evolving story into a clear estimate of what its shares are worth today.

On Simply Wall St’s platform, Narratives are immediately accessible on each company’s Community page and are used daily by millions of investors. They help bridge the gap between qualitative insights and quantitative models, letting you see how shifts in a company’s prospects or market conditions can influence Fair Value. When news breaks or earnings are released, Narratives update with the latest information, empowering you to make buy or sell decisions based on meaningful context, by comparing Fair Value to the current Price, not just following the crowd.

For example, some investors in Industrial and Commercial Bank of China are highly optimistic, seeing upside to HK$8.29 based on future digital-driven growth, while others are more cautious and estimate fair value closer to HK$5.09, factoring in competitive pressures and margin risks. Your Narrative helps you decide which story you believe.

Do you think there's more to the story for Industrial and Commercial Bank of China? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1398

Industrial and Commercial Bank of China

Provides banking products and services in the People's Republic of China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives