Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the TOMO Holdings Limited (HKG:8463) share price slid 37% over twelve months. That's well bellow the market return of -7.2%. We wouldn't rush to judgement on TOMO Holdings because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 11% in the last three months. Of course, this share price action may well have been influenced by the 5.9% decline in the broader market, throughout the period.

View our latest analysis for TOMO Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

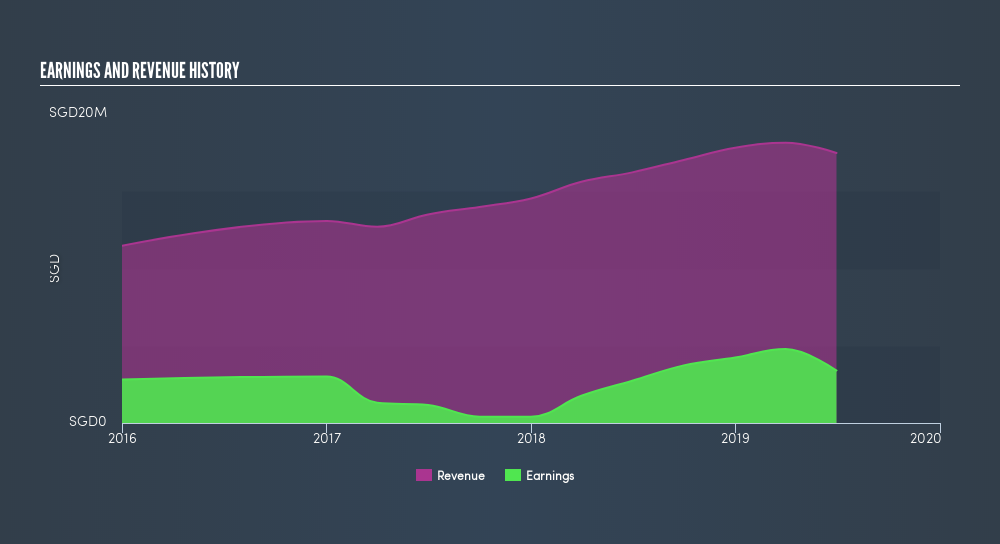

Even though the TOMO Holdings share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past. It's surprising to see the share price fall so much, despite the improved EPS. So it's easy to justify a look at some other metrics.

TOMO Holdings managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

This free interactive report on TOMO Holdings's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

TOMO Holdings shareholders are down 37% for the year, even worse than the market loss of 7.2%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 11% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Is TOMO Holdings cheap compared to other companies? These 3 valuation measures might help you decide.

We will like TOMO Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:6928

TOMO Holdings

An investment holding company, engages in the design, manufacture, supply, and installation of leather upholstery for passenger vehicles (PV) in Singapore.

Flawless balance sheet slight.

Market Insights

Community Narratives