- Hong Kong

- /

- Auto Components

- /

- SEHK:6830

Returns On Capital At Huazhong In-Vehicle Holdings (HKG:6830) Paint A Concerning Picture

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. However, after briefly looking over the numbers, we don't think Huazhong In-Vehicle Holdings (HKG:6830) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Huazhong In-Vehicle Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.012 = CN¥20m ÷ (CN¥3.3b - CN¥1.6b) (Based on the trailing twelve months to June 2022).

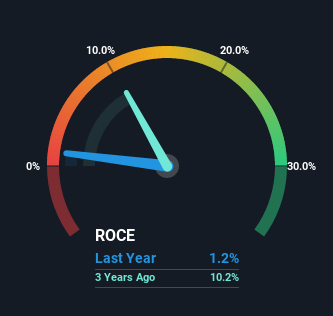

So, Huazhong In-Vehicle Holdings has an ROCE of 1.2%. In absolute terms, that's a low return and it also under-performs the Auto Components industry average of 4.2%.

View our latest analysis for Huazhong In-Vehicle Holdings

Historical performance is a great place to start when researching a stock so above you can see the gauge for Huazhong In-Vehicle Holdings' ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Huazhong In-Vehicle Holdings, check out these free graphs here.

The Trend Of ROCE

When we looked at the ROCE trend at Huazhong In-Vehicle Holdings, we didn't gain much confidence. Over the last five years, returns on capital have decreased to 1.2% from 17% five years ago. Given the business is employing more capital while revenue has slipped, this is a bit concerning. If this were to continue, you might be looking at a company that is trying to reinvest for growth but is actually losing market share since sales haven't increased.

On a side note, Huazhong In-Vehicle Holdings' current liabilities are still rather high at 50% of total assets. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Bottom Line On Huazhong In-Vehicle Holdings' ROCE

We're a bit apprehensive about Huazhong In-Vehicle Holdings because despite more capital being deployed in the business, returns on that capital and sales have both fallen. Since the stock has skyrocketed 192% over the last five years, it looks like investors have high expectations of the stock. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

If you want to know some of the risks facing Huazhong In-Vehicle Holdings we've found 3 warning signs (1 is concerning!) that you should be aware of before investing here.

While Huazhong In-Vehicle Holdings may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Huazhong In-Vehicle Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6830

Huazhong In-Vehicle Holdings

An investment holding company, manufactures, supplies, and sells automobile body parts in Mainland China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026