- Hong Kong

- /

- Auto Components

- /

- SEHK:6162

Does China Tianrui Automotive Interiors (HKG:6162) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies China Tianrui Automotive Interiors Co., LTD (HKG:6162) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

What Is China Tianrui Automotive Interiors's Net Debt?

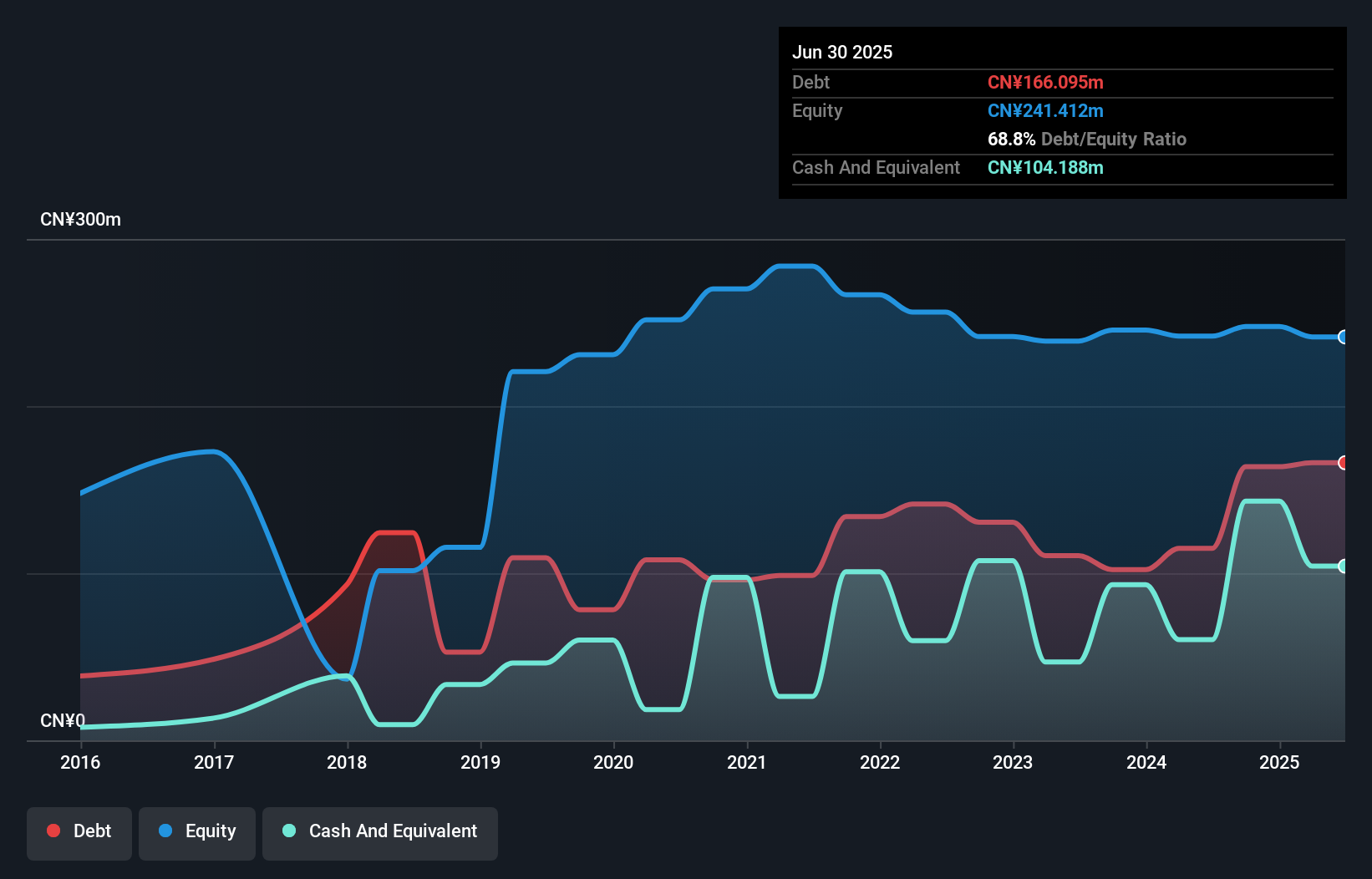

The image below, which you can click on for greater detail, shows that at June 2025 China Tianrui Automotive Interiors had debt of CN¥166.1m, up from CN¥114.9m in one year. However, because it has a cash reserve of CN¥104.2m, its net debt is less, at about CN¥61.9m.

How Strong Is China Tianrui Automotive Interiors' Balance Sheet?

According to the last reported balance sheet, China Tianrui Automotive Interiors had liabilities of CN¥318.2m due within 12 months, and liabilities of CN¥35.4m due beyond 12 months. On the other hand, it had cash of CN¥104.2m and CN¥222.7m worth of receivables due within a year. So it has liabilities totalling CN¥26.8m more than its cash and near-term receivables, combined.

Given China Tianrui Automotive Interiors has a market capitalization of CN¥457.4m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

View our latest analysis for China Tianrui Automotive Interiors

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While China Tianrui Automotive Interiors has a quite reasonable net debt to EBITDA multiple of 1.8, its interest cover seems weak, at 1.0. The main reason for this is that it has such high depreciation and amortisation. While companies often boast that these charges are non-cash, most such businesses will therefore require ongoing investment (that is not expensed.) Either way there's no doubt the stock is using meaningful leverage. Sadly, China Tianrui Automotive Interiors's EBIT actually dropped 9.9% in the last year. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. There's no doubt that we learn most about debt from the balance sheet. But it is China Tianrui Automotive Interiors's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last two years, China Tianrui Automotive Interiors generated free cash flow amounting to a very robust 88% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

Based on what we've seen China Tianrui Automotive Interiors is not finding it easy, given its interest cover, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to convert EBIT to free cash flow is pretty flash. When we consider all the elements mentioned above, it seems to us that China Tianrui Automotive Interiors is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for China Tianrui Automotive Interiors (1 is concerning) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6162

China Tianrui Automotive Interiors

An investment holding company, engages in the research and development, manufacture, and sale of automotive interior and exterior decorative components and parts in the People’s Republic of China.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026