Global markets have been buoyed by a recent surge, with major U.S. indices reaching record highs following the election, driven by optimism for economic growth and tax reforms. In this context, penny stocks—often representing smaller or newer companies—continue to capture investor interest due to their potential for substantial returns when backed by strong financial health. Despite being considered a niche area of investment today, these stocks can still offer promising opportunities for those seeking hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.25 | MYR349.03M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR136.84M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$526.87M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.46 | MYR2.46B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$139.45M | ★★★★☆☆ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.06 | THB1.72B | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR2.93 | MYR2.04B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.87 | £384.89M | ★★★★☆☆ |

Click here to see the full list of 5,746 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Ev Dynamics (Holdings) (SEHK:476)

Simply Wall St Financial Health Rating: ★★★★☆☆

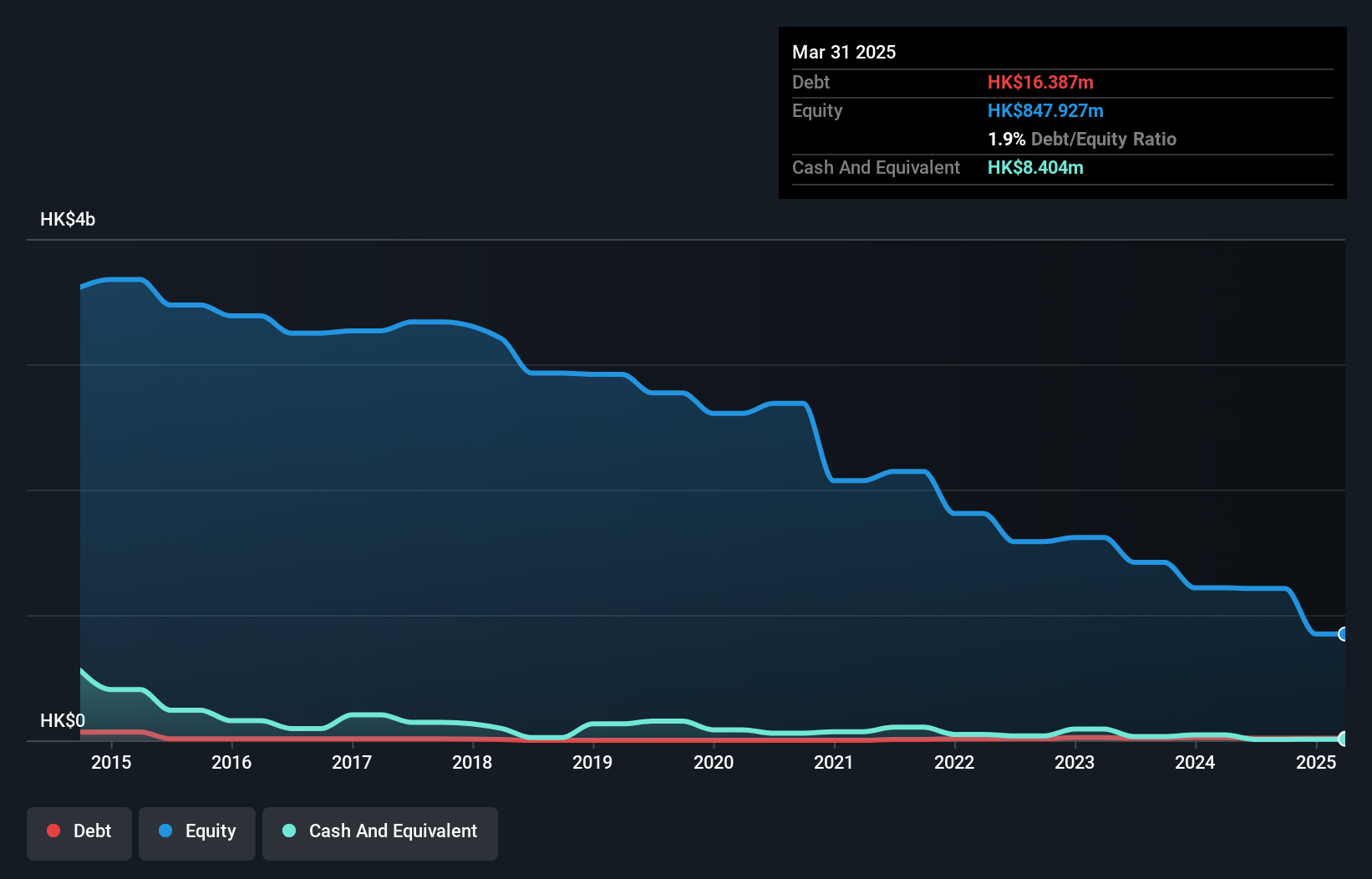

Overview: Ev Dynamics (Holdings) Limited is an investment holding company that manufactures and sells electric vehicles in Mexico, with a market cap of HK$87.99 million.

Operations: The company generates revenue primarily from the development of electric vehicles, amounting to HK$42.24 million.

Market Cap: HK$87.99M

Ev Dynamics (Holdings) Limited, with a market cap of HK$87.99 million, focuses on electric vehicle development in Mexico, generating revenue of HK$42.24 million. Despite being unprofitable and experiencing shareholder dilution over the past year, the company benefits from a strong cash position exceeding its total debt and maintains a cash runway for over three years due to positive free cash flow growth. Recent strategic moves include forming EVD.MCB with MCB Ventures to expand operations in Asia and Africa and completing an equity offering of HKD 6.83 million to support these initiatives amidst leadership changes.

- Unlock comprehensive insights into our analysis of Ev Dynamics (Holdings) stock in this financial health report.

- Examine Ev Dynamics (Holdings)'s past performance report to understand how it has performed in prior years.

Oceanus Group (SGX:579)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oceanus Group Limited is an investment holding company that sells processed marine products, sugar, beverages, and other commodities across Singapore, Hong Kong, Macau, Thailand, and the People's Republic of China with a market capitalization of SGD153.99 million.

Operations: The company generates revenue primarily through its Distribution segment, which accounts for SGD343.36 million, and its Services segment, contributing SGD5.56 million.

Market Cap: SGD153.99M

Oceanus Group Limited, with a market cap of SGD153.99 million, primarily generates revenue through its Distribution segment, totaling SGD343.36 million. Despite being unprofitable and experiencing increased losses over the past five years at a rate of 40.5% annually, the company has a cash runway exceeding three years if it maintains current free cash flow levels. Short-term assets surpass both short-term and long-term liabilities, providing some financial stability despite high net debt to equity ratio at 133.2%. Recent earnings show sales growth to SGD127.61 million for H1 2024 but resulted in a net loss of SGD1.08 million compared to previous profits.

- Take a closer look at Oceanus Group's potential here in our financial health report.

- Review our historical performance report to gain insights into Oceanus Group's track record.

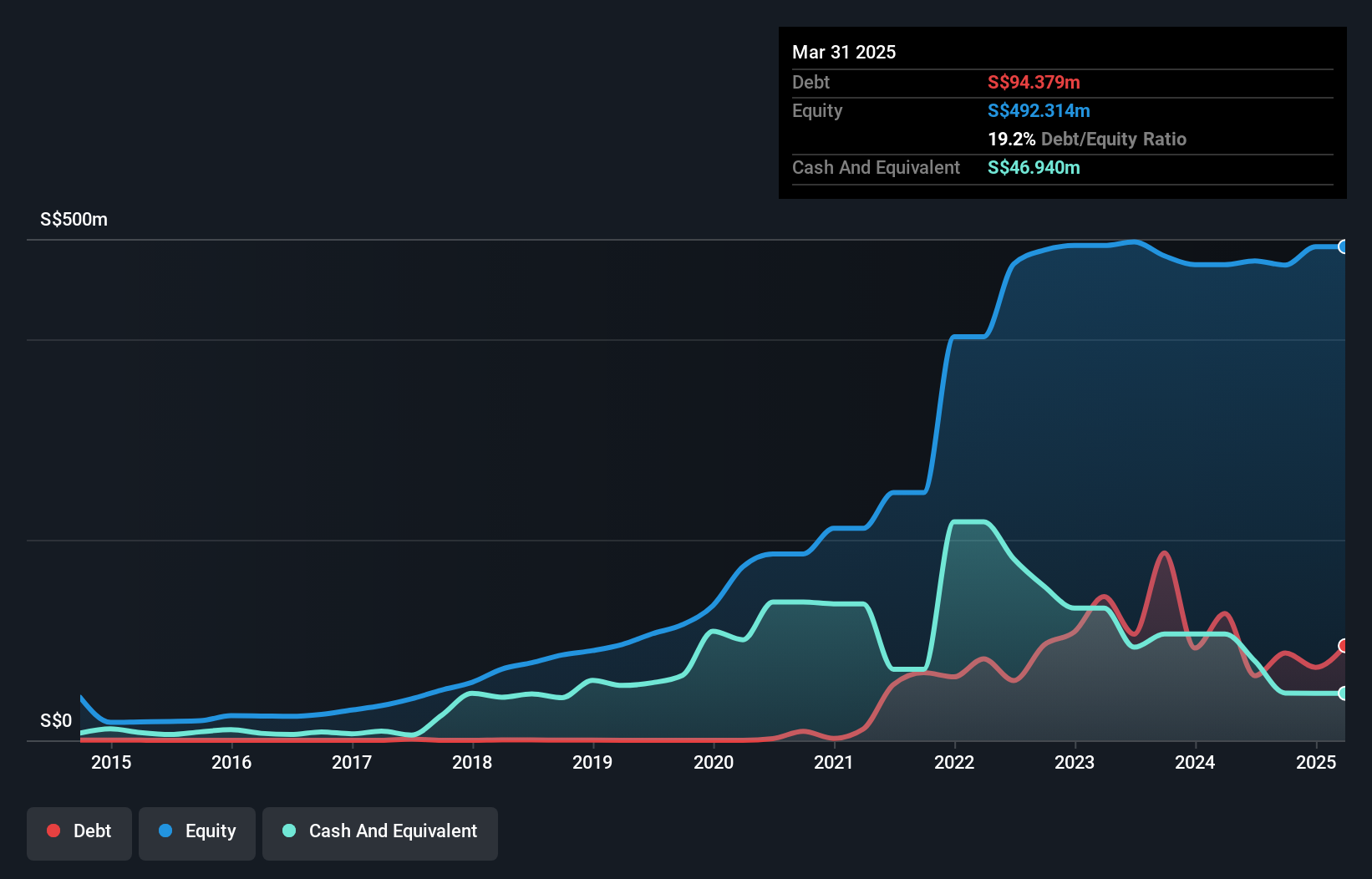

AEM Holdings (SGX:AWX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AEM Holdings Ltd., with a market cap of SGD406.93 million, offers application-specific intelligent system tests and handling solutions for semiconductor and electronics companies.

Operations: The company's revenue is primarily derived from Test Cell Solutions (SGD198.79 million), Contract Manufacturing (SGD182.46 million), and Instrumentation (SGD6.92 million).

Market Cap: SGD406.93M

AEM Holdings Ltd., with a market cap of SGD406.93 million, derives significant revenue from Test Cell Solutions and Contract Manufacturing. Despite a recent decline in sales to SGD173.58 million for H1 2024, the company maintains strong financial stability, with short-term assets of SGD474.8 million exceeding both short-term and long-term liabilities. AEM's debt is well-covered by operating cash flow at 69.2%, and it holds more cash than total debt, indicating prudent financial management despite current unprofitability and negative return on equity (-4.19%). The company forecasts H2 2024 revenue between SGD160-180 million, suggesting potential recovery efforts underway.

- Click here to discover the nuances of AEM Holdings with our detailed analytical financial health report.

- Learn about AEM Holdings' future growth trajectory here.

Next Steps

- Jump into our full catalog of 5,746 Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ev Dynamics (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:476

Ev Dynamics (Holdings)

An investment holding company, manufactures and sells electric vehicles in Mexico.

Slight with imperfect balance sheet.

Market Insights

Community Narratives