- Hong Kong

- /

- Auto Components

- /

- SEHK:3931

Investors Appear Satisfied With CALB Group Co., Ltd.'s (HKG:3931) Prospects

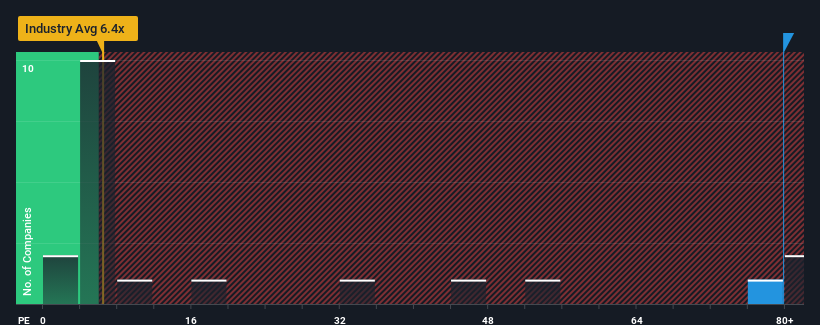

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider CALB Group Co., Ltd. (HKG:3931) as a stock to avoid entirely with its 79.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

CALB Group could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for CALB Group

Is There Enough Growth For CALB Group?

The only time you'd be truly comfortable seeing a P/E as steep as CALB Group's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 62% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 2,057% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 104% per year during the coming three years according to the six analysts following the company. With the market only predicted to deliver 15% per year, the company is positioned for a stronger earnings result.

With this information, we can see why CALB Group is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that CALB Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with CALB Group (including 1 which is a bit unpleasant).

If these risks are making you reconsider your opinion on CALB Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3931

CALB Group

A new energy technology company, engages in the design, research, development, production, and sale of electric vehicle (EV) batteries and energy storage system (ESS) products in Mainland China, Europe, Asia, the United States, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives