- Hong Kong

- /

- Auto Components

- /

- SEHK:360

More Unpleasant Surprises Could Be In Store For New Focus Auto Tech Holdings Limited's (HKG:360) Shares After Tumbling 41%

To the annoyance of some shareholders, New Focus Auto Tech Holdings Limited (HKG:360) shares are down a considerable 41% in the last month, which continues a horrid run for the company. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 24%.

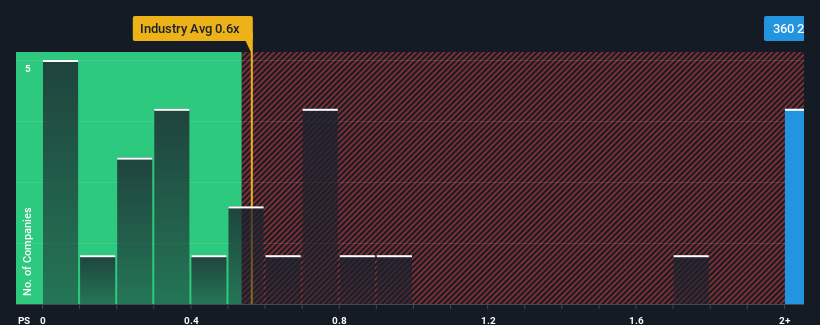

Although its price has dipped substantially, given around half the companies in Hong Kong's Auto Components industry have price-to-sales ratios (or "P/S") below 0.6x, you may still consider New Focus Auto Tech Holdings as a stock to avoid entirely with its 2.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for New Focus Auto Tech Holdings

What Does New Focus Auto Tech Holdings' P/S Mean For Shareholders?

For instance, New Focus Auto Tech Holdings' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for New Focus Auto Tech Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For New Focus Auto Tech Holdings?

The only time you'd be truly comfortable seeing a P/S as steep as New Focus Auto Tech Holdings' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 6.1% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 38% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 24% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that New Focus Auto Tech Holdings' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On New Focus Auto Tech Holdings' P/S

A significant share price dive has done very little to deflate New Focus Auto Tech Holdings' very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that New Focus Auto Tech Holdings currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - New Focus Auto Tech Holdings has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if New Focus Auto Tech Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:360

New Focus Auto Tech Holdings

An investment holding company, engages in the manufacturing and sales of electronic and power-related automotive parts and accessories in the People’s Republic of China, the United States, Europe, and the Asia Pacific.

Excellent balance sheet with weak fundamentals.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026