- Hong Kong

- /

- Auto Components

- /

- SEHK:305

Investors Who Bought Wuling Motors Holdings (HKG:305) Shares A Year Ago Are Now Up 604%

It's been a soft week for Wuling Motors Holdings Limited (HKG:305) shares, which are down 13%. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. Indeed, the share price is up a whopping 604% in that time. So we wouldn't blame sellers for taking some profits. While winners often keep winning, it can pay to be cautious after a strong rise.

We love happy stories like this one. The company should be really proud of that performance!

See our latest analysis for Wuling Motors Holdings

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Wuling Motors Holdings saw its earnings per share (EPS) drop below zero. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. It may be that the company has done well on other metrics.

We are skeptical of the suggestion that the 0.2% dividend yield would entice buyers to the stock. Wuling Motors Holdings' revenue actually dropped 7.7% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

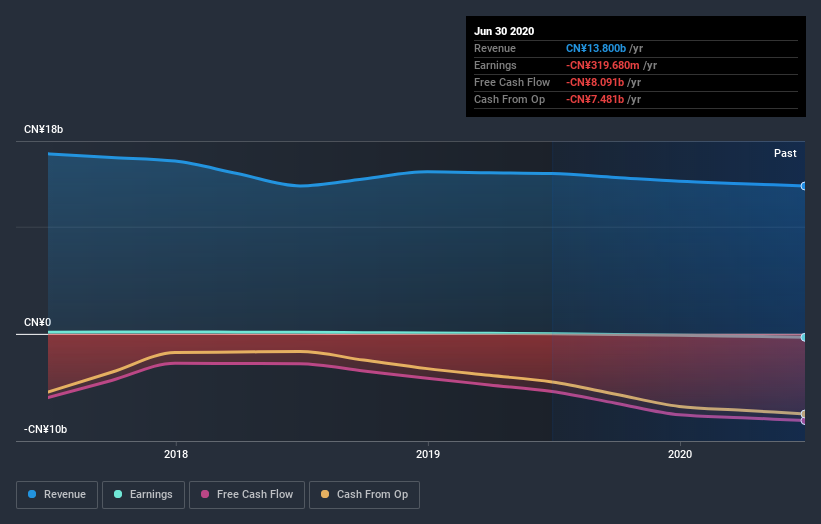

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Wuling Motors Holdings' earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Wuling Motors Holdings, it has a TSR of 608% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Wuling Motors Holdings shareholders have received a total shareholder return of 608% over one year. And that does include the dividend. That's better than the annualised return of 30% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Wuling Motors Holdings better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Wuling Motors Holdings (including 3 which shouldn't be ignored) .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Wuling Motors Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wuling Motors Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:305

Wuling Motors Holdings

An investment holding company, engages in trading and manufacturing of automotive components, engines, and specialized vehicles in the People's Republic of China and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives