There's Reason For Concern Over Great Wall Motor Company Limited's (HKG:2333) Massive 25% Price Jump

Great Wall Motor Company Limited (HKG:2333) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 72%.

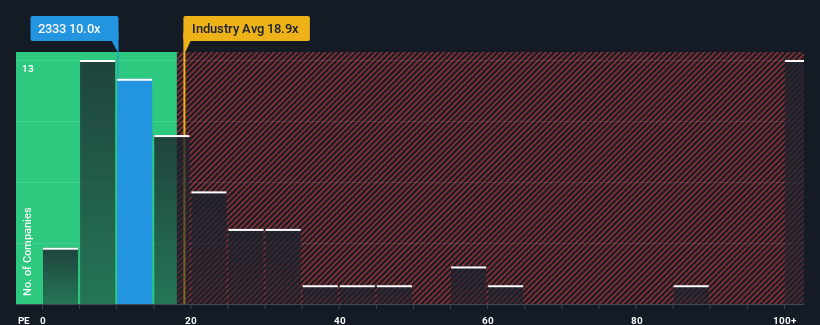

Even after such a large jump in price, it's still not a stretch to say that Great Wall Motor's price-to-earnings (or "P/E") ratio of 10x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 11x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, Great Wall Motor has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Great Wall Motor

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Great Wall Motor would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 144%. Pleasingly, EPS has also lifted 71% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 2.8% per annum over the next three years. Meanwhile, the broader market is forecast to expand by 11% per annum, which paints a poor picture.

In light of this, it's somewhat alarming that Great Wall Motor's P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

What We Can Learn From Great Wall Motor's P/E?

Great Wall Motor appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Great Wall Motor's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Great Wall Motor with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Great Wall Motor, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2333

Great Wall Motor

Engages in the manufacture and sale of automobiles, and automotive parts and components in the People's Republic of China, Europe, ASEAN countries, Latin America, the Middle East, Australia, South Africa, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives