Some Shareholders Feeling Restless Over Guangzhou Automobile Group Co., Ltd.'s (HKG:2238) P/S Ratio

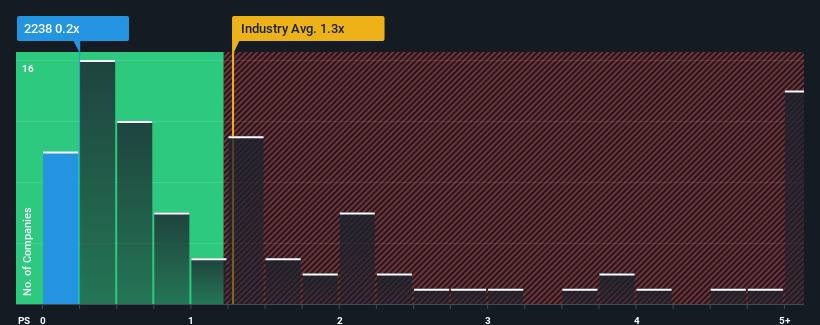

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Auto industry in Hong Kong, you could be forgiven for feeling indifferent about Guangzhou Automobile Group Co., Ltd.'s (HKG:2238) P/S ratio of 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Guangzhou Automobile Group

How Guangzhou Automobile Group Has Been Performing

Guangzhou Automobile Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guangzhou Automobile Group.How Is Guangzhou Automobile Group's Revenue Growth Trending?

In order to justify its P/S ratio, Guangzhou Automobile Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 28% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 8.1% per year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 18% each year growth forecast for the broader industry.

With this in mind, we find it intriguing that Guangzhou Automobile Group's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Guangzhou Automobile Group's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given that Guangzhou Automobile Group's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Guangzhou Automobile Group with six simple checks on some of these key factors.

If you're unsure about the strength of Guangzhou Automobile Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2238

Guangzhou Automobile Group

Research, develops, manufactures, and sells vehicles and motorcycles, and parts and components in Mainland China and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026