- Hong Kong

- /

- Auto Components

- /

- SEHK:2025

Ruifeng Power Group Company Limited's (HKG:2025) Stock's Been Going Strong: Could Weak Financials Mean The Market Will Correct Its Share Price?

Most readers would already be aware that Ruifeng Power Group's (HKG:2025) stock increased significantly by 95% over the past three months. However, in this article, we decided to focus on its weak fundamentals, as long-term financial performance of a business is what ultimately dictates market outcomes. Particularly, we will be paying attention to Ruifeng Power Group's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Ruifeng Power Group is:

2.3% = CN¥23m ÷ CN¥995m (Based on the trailing twelve months to June 2025).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each HK$1 of shareholders' capital it has, the company made HK$0.02 in profit.

Check out our latest analysis for Ruifeng Power Group

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Ruifeng Power Group's Earnings Growth And 2.3% ROE

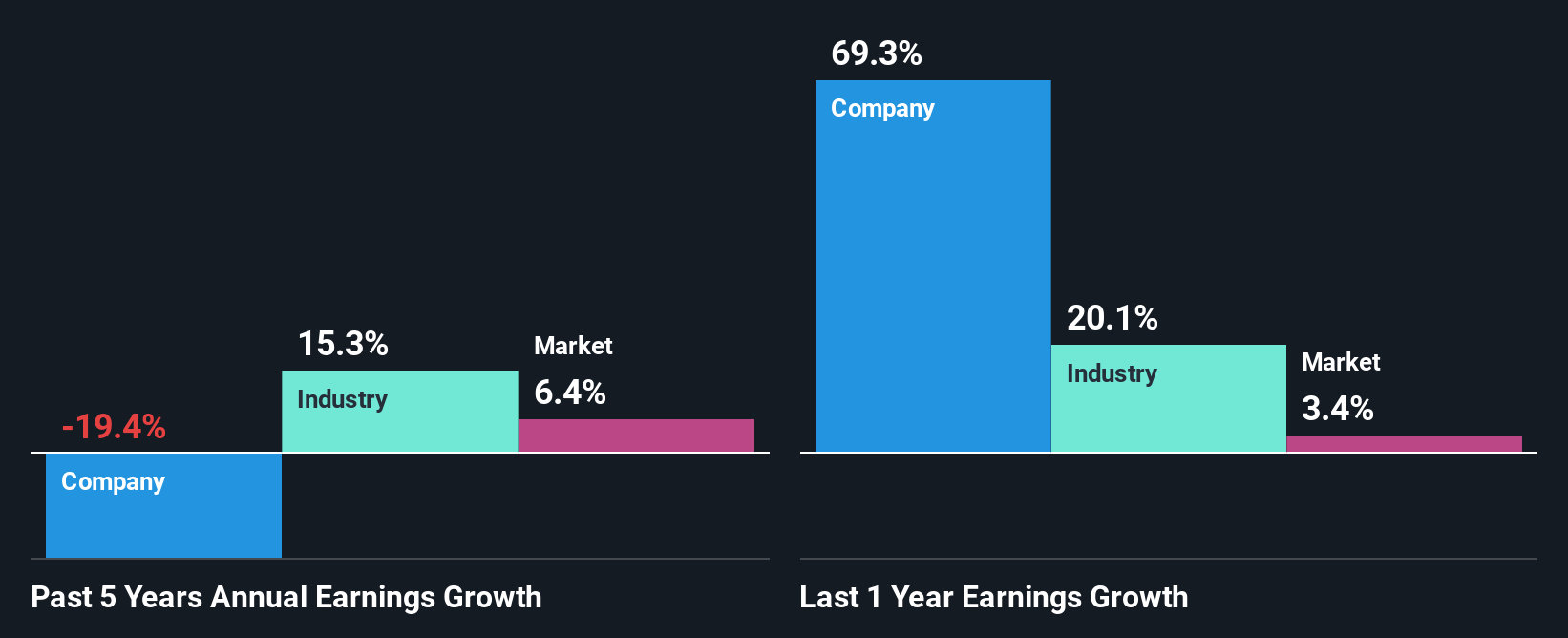

As you can see, Ruifeng Power Group's ROE looks pretty weak. Not just that, even compared to the industry average of 5.7%, the company's ROE is entirely unremarkable. Therefore, it might not be wrong to say that the five year net income decline of 19% seen by Ruifeng Power Group was possibly a result of it having a lower ROE. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

However, when we compared Ruifeng Power Group's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 15% in the same period. This is quite worrisome.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Ruifeng Power Group's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Ruifeng Power Group Making Efficient Use Of Its Profits?

Ruifeng Power Group has a high three-year median payout ratio of 70% (that is, it is retaining 30% of its profits). This suggests that the company is paying most of its profits as dividends to its shareholders. This goes some way in explaining why its earnings have been shrinking. With only a little being reinvested into the business, earnings growth would obviously be low or non-existent. Our risks dashboard should have the 2 risks we have identified for Ruifeng Power Group.

In addition, Ruifeng Power Group has been paying dividends over a period of seven years suggesting that keeping up dividend payments is preferred by the management even though earnings have been in decline.

Conclusion

Overall, we would be extremely cautious before making any decision on Ruifeng Power Group. Because the company is not reinvesting much into the business, and given the low ROE, it's not surprising to see the lack or absence of growth in its earnings. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. So it may be worth checking this free detailed graph of Ruifeng Power Group's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2025

Ruifeng Power Group

An investment holding company, engages in the design, development, manufacture, and sale of cylinder blocks and heads in the People's Republic of China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success