- Hong Kong

- /

- Auto Components

- /

- SEHK:1809

Uncovering Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets experience a rebound with major U.S. stock indexes climbing higher, driven by easing core inflation and strong banking sector earnings, small-cap stocks have also shown resilience. The S&P MidCap 400 and Russell 2000 indices posted notable gains, highlighting the potential opportunities within this segment of the market. In such an environment, identifying promising small-cap stocks often involves seeking companies with solid fundamentals that can thrive amid broader economic shifts and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.18% | 50.86% | 65.05% | ★★★★★☆ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.47% | 61.65% | 67.97% | ★★★★★☆ |

| Kerevitas Gida Sanayi ve Ticaret | 48.40% | 45.75% | 37.51% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Hoist Finance (OM:HOFI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hoist Finance AB (publ) is a credit market company that specializes in loan acquisition and management operations across Europe, with a market cap of SEK8.54 billion.

Operations: Hoist Finance generates revenue primarily from unsecured loans, contributing SEK3.04 billion, and secured loans, adding SEK935 million. The company's net profit margin is a key indicator of its financial performance.

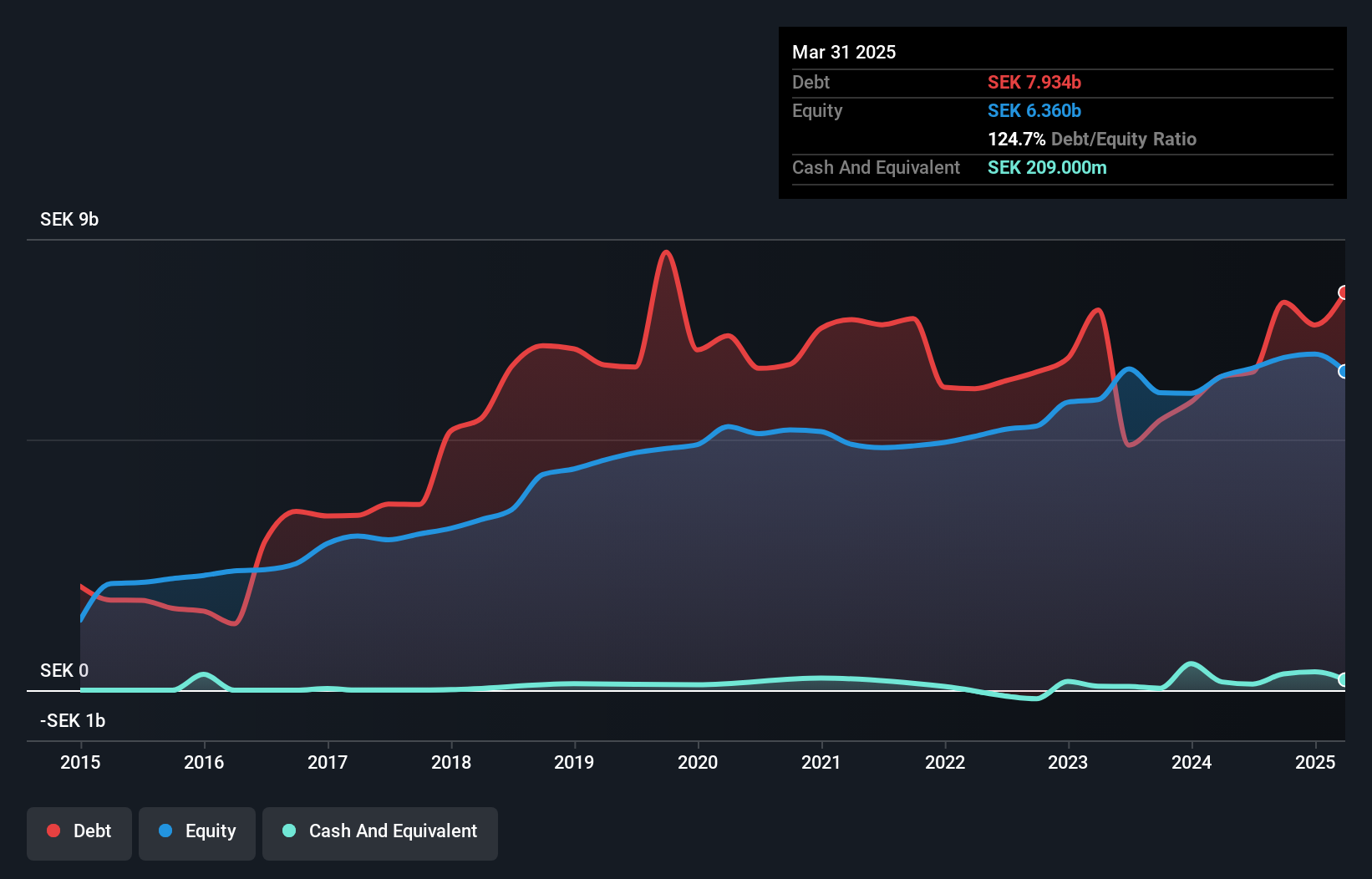

Hoist Finance, a notable player in the financial sector, has shown impressive earnings growth of 107% over the past year, outpacing the Consumer Finance industry’s 6%. Despite its high net debt to equity ratio of 112%, which has decreased from 181% over five years, it remains a concern. The company's price-to-earnings ratio stands at an attractive 10x compared to Sweden's market average of 23x. Recent fixed-income offerings and bond issuances totaling SEK 1.45 billion highlight its strategic financial maneuvers. Positive free cash flow further underscores Hoist’s robust operational efficiency amidst these developments.

Prinx Chengshan Holdings (SEHK:1809)

Simply Wall St Value Rating: ★★★★★☆

Overview: Prinx Chengshan Holdings Limited is an investment holding company that engages in the research, development, design, manufacturing, and sale of tires and related products across Mainland China, Asia, the United States, Africa, the Middle East, and internationally with a market cap of approximately HK$4.90 billion.

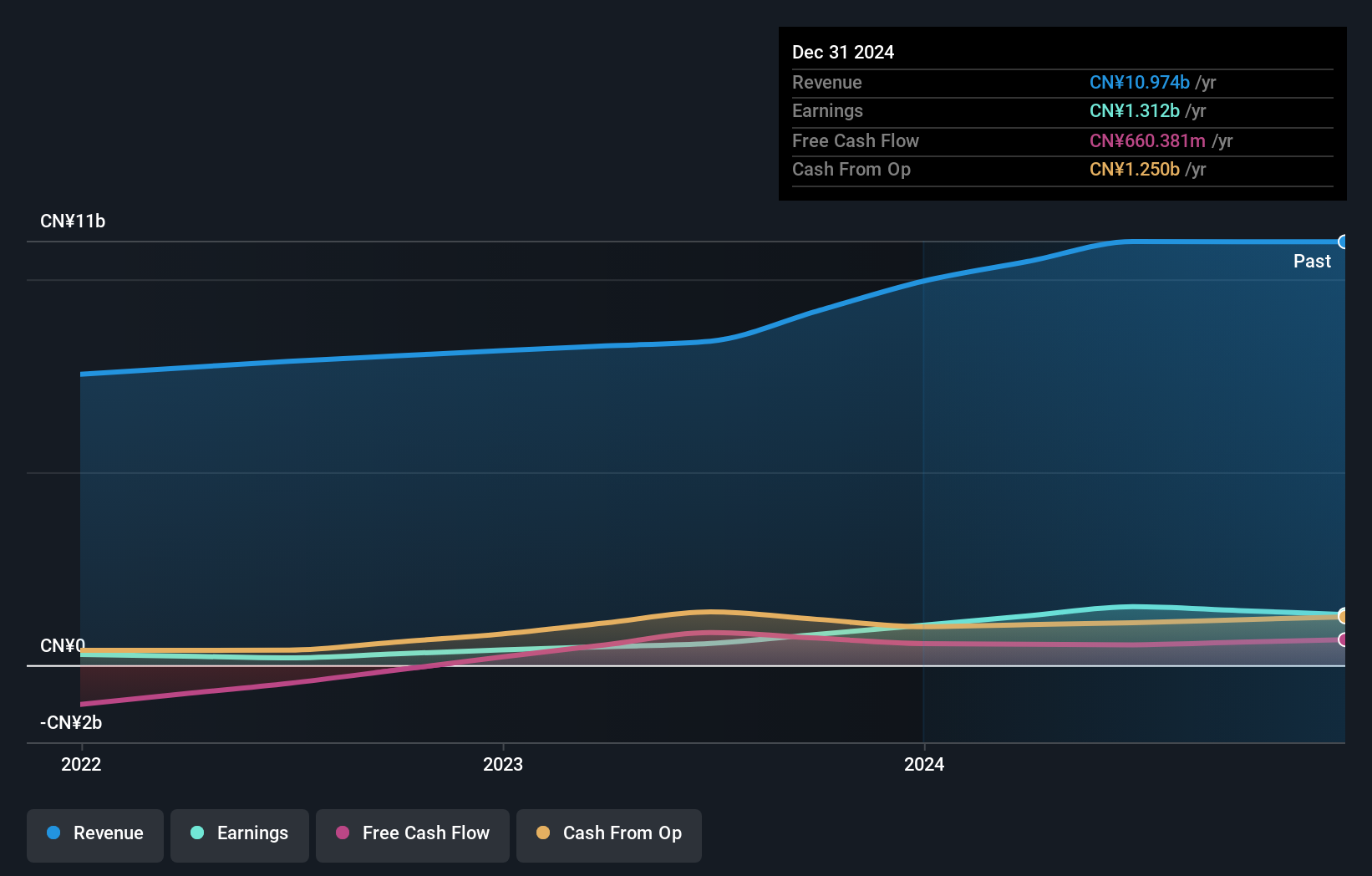

Operations: Prinx Chengshan generates revenue primarily from the manufacturing and selling of tire products, amounting to CN¥10.98 billion. The company's financial performance is characterized by its focus on this core revenue stream.

Prinx Chengshan Holdings, a nimble player in the tire manufacturing sector, has shown impressive financial resilience. With its earnings surging 169.9% over the past year, it outperformed the broader Auto Components industry which saw a -19.9% shift. The company's net debt to equity ratio stands at 7.2%, indicating satisfactory leverage levels while interest payments are well covered by EBIT at 29 times over, highlighting robust operational efficiency. Trading with a price-to-earnings ratio of just 3x against Hong Kong's market average of 9.9x suggests it offers good value compared to peers and industry norms.

- Get an in-depth perspective on Prinx Chengshan Holdings' performance by reading our health report here.

Assess Prinx Chengshan Holdings' past performance with our detailed historical performance reports.

Wuxi ETEK MicroelectronicsLtd (SHSE:688601)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuxi ETEK Micro-Electronics Co., Ltd. specializes in the manufacturing of analog integrated circuits (IC) and has a market capitalization of approximately CN¥5.43 billion.

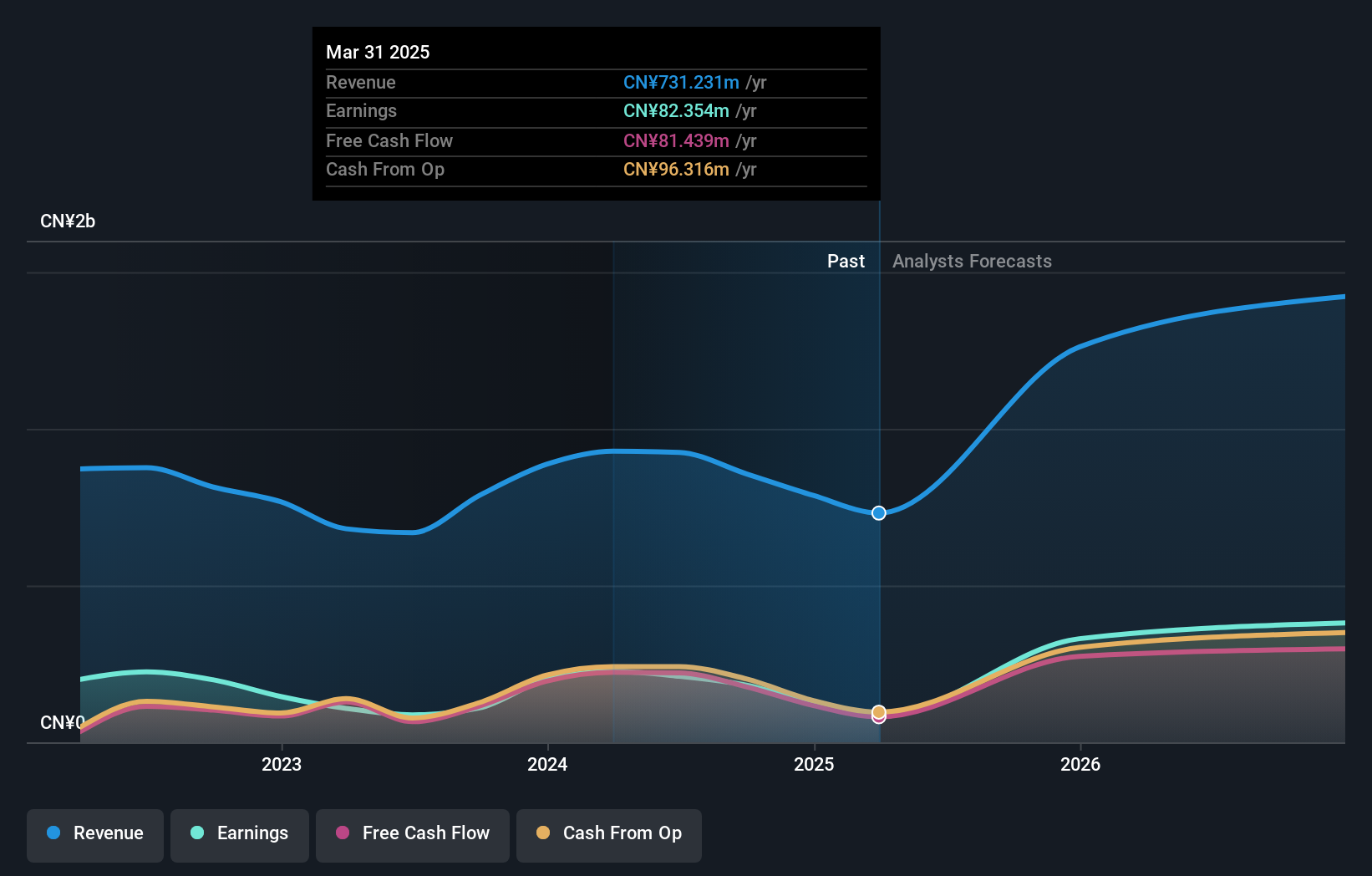

Operations: Wuxi ETEK generates revenue primarily from its integrated circuit segment, amounting to CN¥854.86 million. The company's market capitalization is approximately CN¥5.43 billion.

Wuxi ETEK Microelectronics, a noteworthy player in the semiconductor space, has demonstrated robust earnings growth of 66% over the past year, significantly outpacing the industry's 12%. The company seems to manage its finances prudently, with more cash than total debt and a manageable debt-to-equity ratio that increased from 0.3% to 0.9% over five years. Trading at a price-to-earnings ratio of 29.8x, it offers good value compared to peers in China’s market average of 34.3x. Recent buybacks saw the company repurchase shares worth CNY 40.19 million, signaling confidence in its future prospects despite recent revenue and net income dips.

Make It Happen

- Click through to start exploring the rest of the 4641 Undiscovered Gems With Strong Fundamentals now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1809

Prinx Chengshan Holdings

An investment holding company, researches and develops, designs, manufactures, and sells tires and related products.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives