- Hong Kong

- /

- Auto Components

- /

- SEHK:179

Undiscovered Gems in Hong Kong Stocks to Explore October 2024

Reviewed by Simply Wall St

As global markets experience varied shifts, with Hong Kong's Hang Seng Index recently facing a decline amidst broader economic adjustments in China, investors are turning their attention to potential opportunities within the small-cap sector. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering undiscovered gems that may offer resilience and promise in the evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Time Interconnect Technology | 151.14% | 24.74% | 19.78% | ★★★★☆☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Zhejiang Shibao (SEHK:1057)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Shibao Company Limited, along with its subsidiaries, is engaged in the research, design, development, production, and sale of automotive steering systems and accessories in the People’s Republic of China with a market capitalization of HK$9.06 billion.

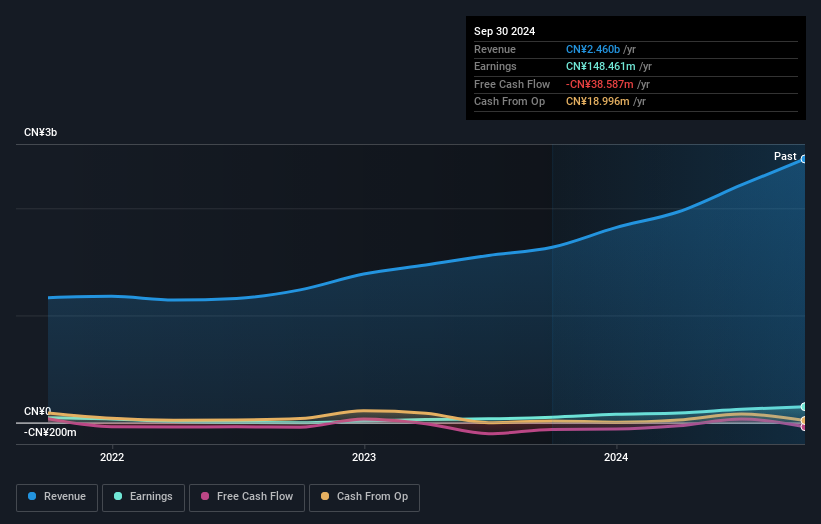

Operations: The company's revenue primarily comes from the manufacture of automobile parts and accessories, totaling CN¥2.14 billion.

Zhejiang Shibao, a niche player in the auto components sector, has shown impressive financial strides. Over the past year, earnings surged by 257%, significantly outpacing the industry's -19.9% performance. Its debt-to-equity ratio improved remarkably from 12.9% to just 0.6% in five years, reflecting strong fiscal management. The company reported half-year sales of CNY 1.09 billion and net income of CNY 66.89 million as of June 2024, showcasing robust growth compared to last year’s figures of CNY 690 million and CNY 19.84 million respectively—indicative of its potential for future value creation despite recent share price volatility.

- Get an in-depth perspective on Zhejiang Shibao's performance by reading our health report here.

Review our historical performance report to gain insights into Zhejiang Shibao's's past performance.

Xin Point Holdings (SEHK:1571)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xin Point Holdings Limited is an investment holding company that manufactures and sells automotive and electronic components across China, North America, Europe, and other international markets with a market capitalization of HK$3.95 billion.

Operations: Xin Point Holdings generates revenue primarily from the manufacture and sale of automotive and electronic components, amounting to CN¥3.23 billion. The company's financial performance is impacted by its cost structure, which influences profitability metrics such as net profit margin.

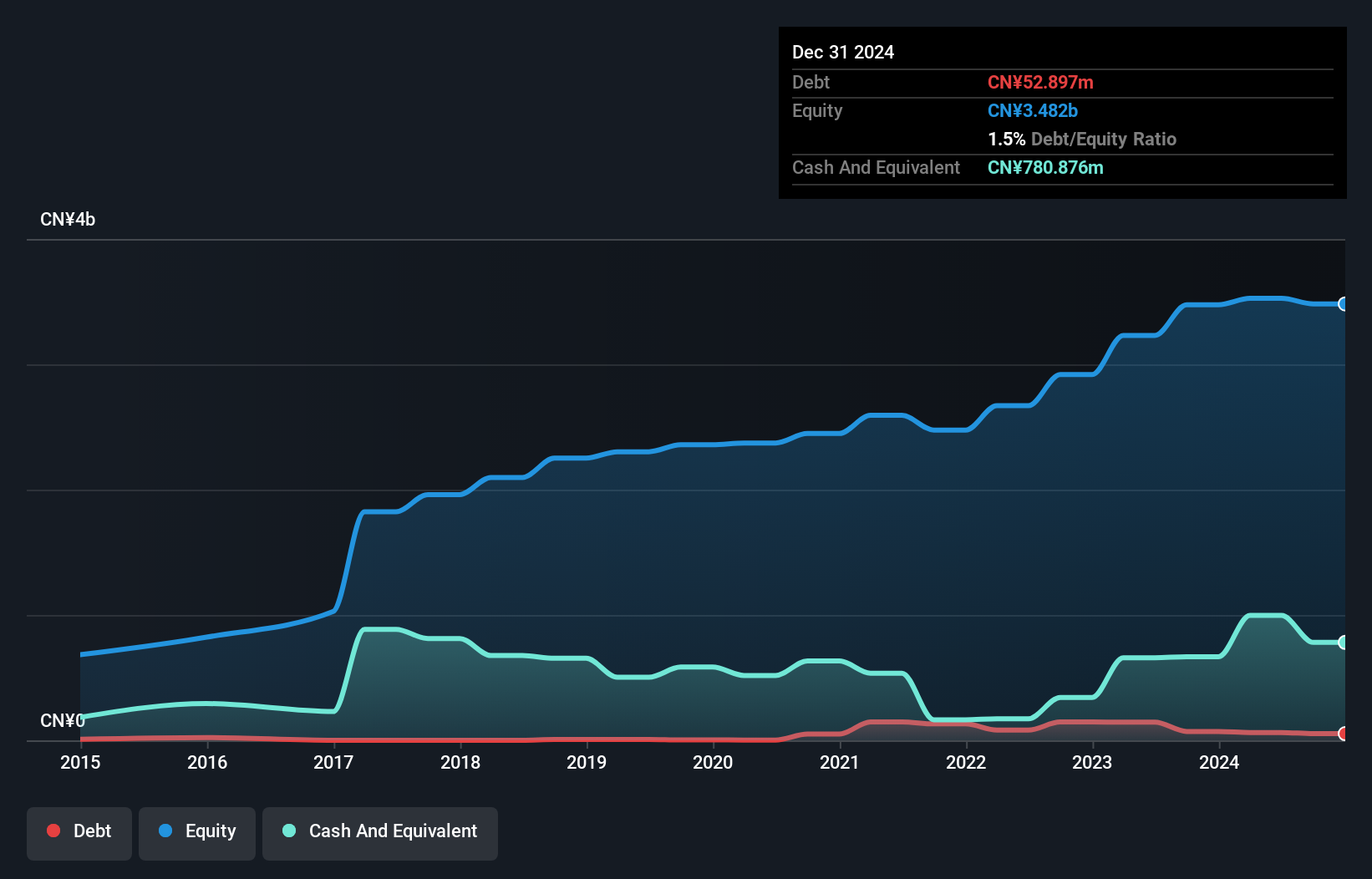

Xin Point Holdings, a small player in the auto components sector, has shown notable financial resilience. With earnings growth of 27% over the past year, it outpaced its industry peers who faced a 20% downturn. The company reported sales of CNY 1.65 billion for the first half of 2024, up from CNY 1.52 billion last year, alongside net income rising to CNY 322 million from CNY 264 million. Trading at a significant discount to its estimated fair value and maintaining more cash than total debt suggests potential undervaluation and financial stability in turbulent times.

- Delve into the full analysis health report here for a deeper understanding of Xin Point Holdings.

Evaluate Xin Point Holdings' historical performance by accessing our past performance report.

Johnson Electric Holdings (SEHK:179)

Simply Wall St Value Rating: ★★★★★★

Overview: Johnson Electric Holdings Limited is an investment holding company that specializes in the manufacture and sale of motion systems globally, with a market capitalization of approximately HK$10.25 billion.

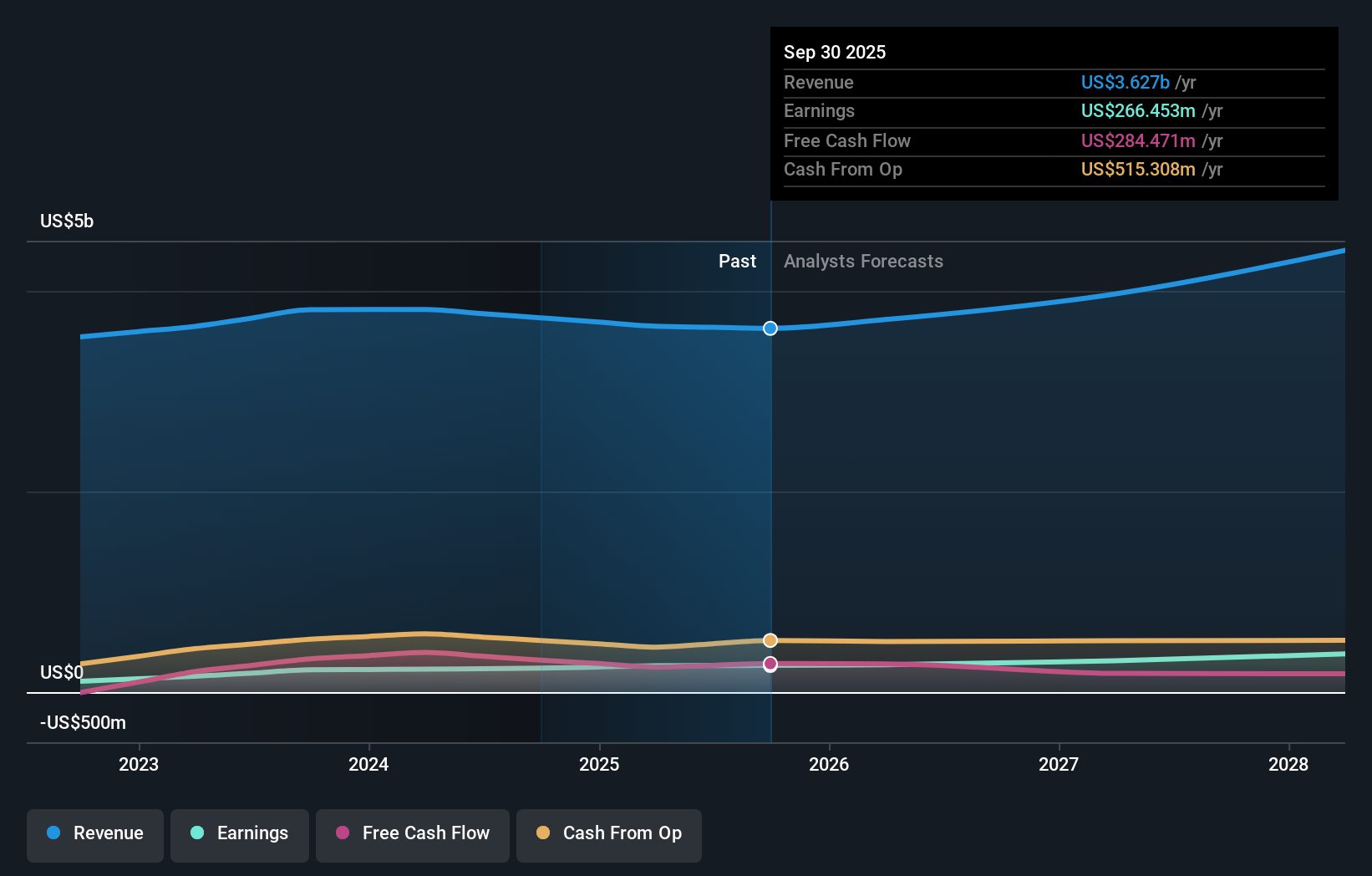

Operations: Johnson Electric generates revenue primarily from its Auto Parts & Accessories segment, amounting to $3.81 billion. The company's financial performance is influenced by the cost structure and efficiencies within this segment, impacting its profitability metrics.

Johnson Electric Holdings, a notable player in the auto components sector, has seen its earnings surge by 45% over the past year, outpacing the industry average of -20%. The company is trading at an impressive 88.9% below its estimated fair value, suggesting potential undervaluation. Over five years, Johnson Electric's debt-to-equity ratio improved from 26.8 to 21.6, indicating prudent financial management. With EBIT covering interest payments by a robust 24 times and possessing more cash than total debt, Johnson Electric seems well-positioned financially despite forecasts of a modest annual earnings decline of around 1% over the next three years.

Next Steps

- Gain an insight into the universe of 166 SEHK Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:179

Johnson Electric Holdings

An investment holding company, engages in the manufacture and sale of motion systems worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives