- Hong Kong

- /

- Auto Components

- /

- SEHK:179

There's Reason For Concern Over Johnson Electric Holdings Limited's (HKG:179) Massive 32% Price Jump

Despite an already strong run, Johnson Electric Holdings Limited (HKG:179) shares have been powering on, with a gain of 32% in the last thirty days. The last month tops off a massive increase of 133% in the last year.

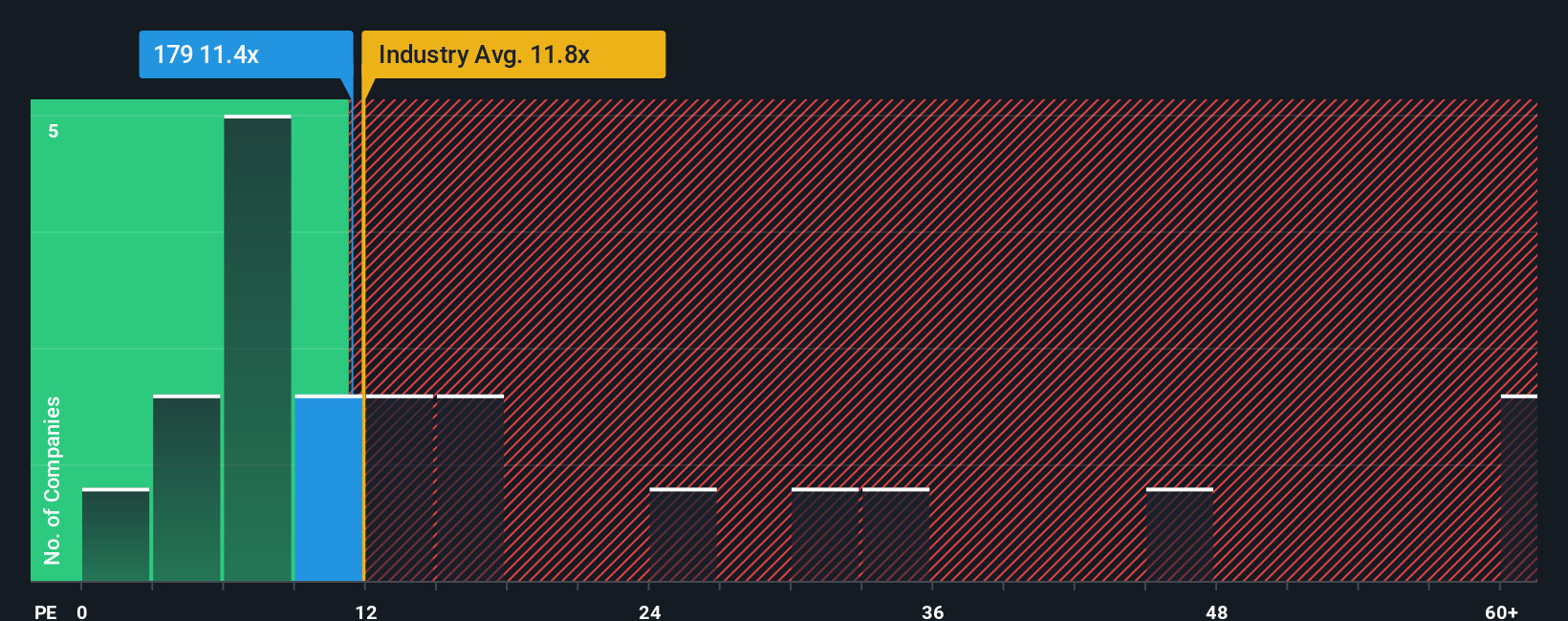

Although its price has surged higher, it's still not a stretch to say that Johnson Electric Holdings' price-to-earnings (or "P/E") ratio of 11.4x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Johnson Electric Holdings as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Johnson Electric Holdings

Is There Some Growth For Johnson Electric Holdings?

The only time you'd be comfortable seeing a P/E like Johnson Electric Holdings' is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 15% last year. The latest three year period has also seen an excellent 74% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 2.7% each year during the coming three years according to the dual analysts following the company. Meanwhile, the rest of the market is forecast to expand by 15% per year, which is noticeably more attractive.

With this information, we find it interesting that Johnson Electric Holdings is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Johnson Electric Holdings' P/E?

Johnson Electric Holdings' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Johnson Electric Holdings currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Johnson Electric Holdings with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:179

Johnson Electric Holdings

An investment holding company, manufactures and sells motion systems the Americas, the Asia-Pacific, Europe, the Middle East, Africa, and the People’s Republic of China.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.