- Hong Kong

- /

- Auto Components

- /

- SEHK:179

Johnson Electric Holdings Limited (HKG:179) Stock Rockets 44% As Investors Are Less Pessimistic Than Expected

The Johnson Electric Holdings Limited (HKG:179) share price has done very well over the last month, posting an excellent gain of 44%. The last 30 days bring the annual gain to a very sharp 76%.

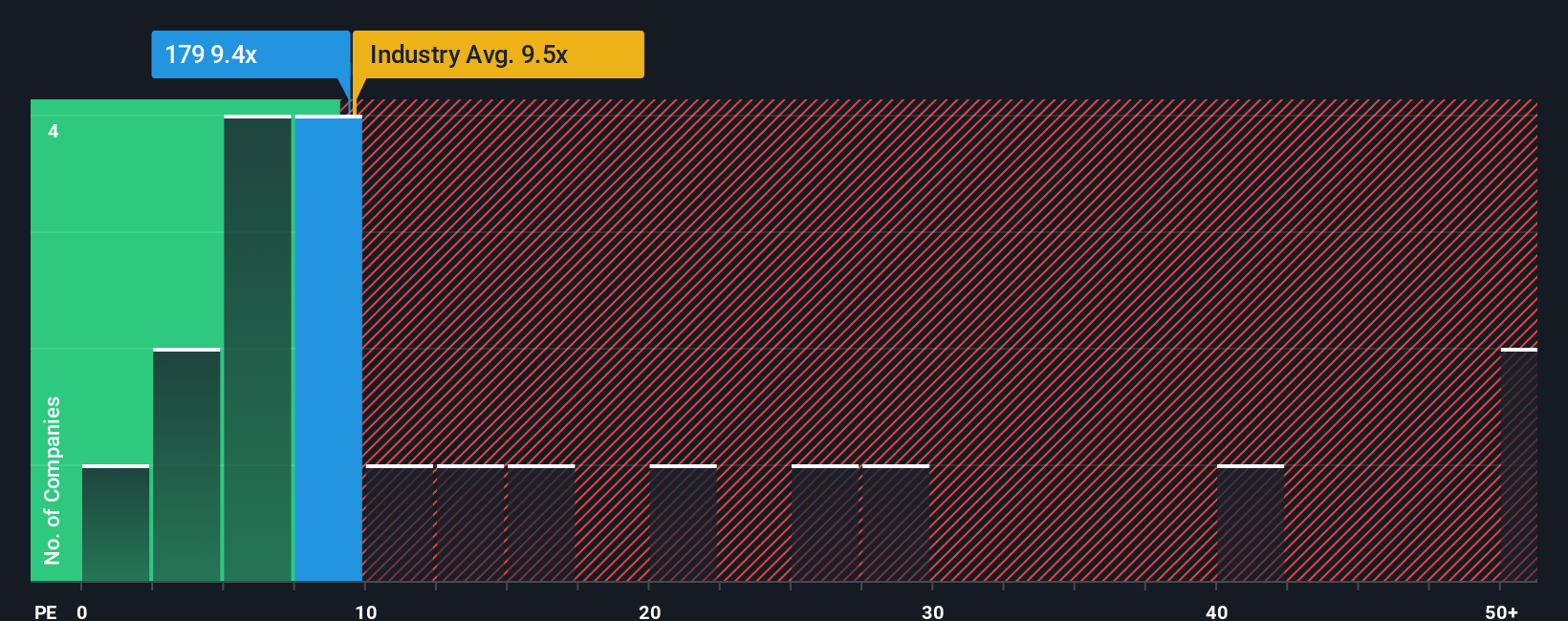

Although its price has surged higher, it's still not a stretch to say that Johnson Electric Holdings' price-to-earnings (or "P/E") ratio of 9.4x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 11x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Johnson Electric Holdings certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Johnson Electric Holdings

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Johnson Electric Holdings' to be considered reasonable.

Retrospectively, the last year delivered a decent 15% gain to the company's bottom line. The latest three year period has also seen an excellent 74% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 0.3% per year as estimated by the dual analysts watching the company. Meanwhile, the broader market is forecast to expand by 14% per annum, which paints a poor picture.

With this information, we find it concerning that Johnson Electric Holdings is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On Johnson Electric Holdings' P/E

Johnson Electric Holdings' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Johnson Electric Holdings currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Johnson Electric Holdings (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than Johnson Electric Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:179

Johnson Electric Holdings

An investment holding company, manufactures and sells motion systems the Americas, the Asia-Pacific, Europe, the Middle East, Africa, and the People’s Republic of China.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.