There's Reason For Concern Over Geely Automobile Holdings Limited's (HKG:175) Massive 27% Price Jump

Geely Automobile Holdings Limited (HKG:175) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The annual gain comes to 125% following the latest surge, making investors sit up and take notice.

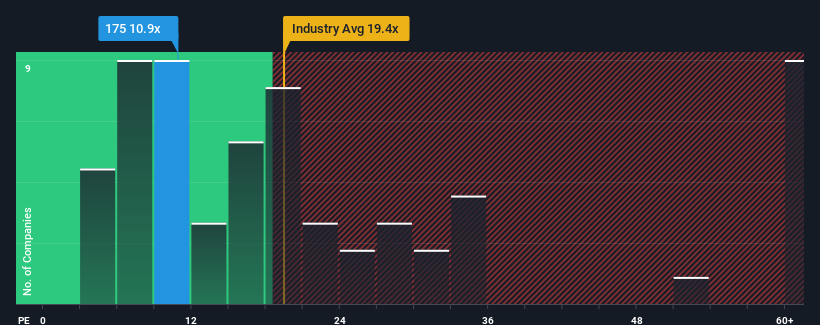

Although its price has surged higher, there still wouldn't be many who think Geely Automobile Holdings' price-to-earnings (or "P/E") ratio of 10.9x is worth a mention when the median P/E in Hong Kong is similar at about 10x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been advantageous for Geely Automobile Holdings as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Geely Automobile Holdings

Is There Some Growth For Geely Automobile Holdings?

Geely Automobile Holdings' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 198% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 196% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 1.5% per year as estimated by the analysts watching the company. That's not great when the rest of the market is expected to grow by 12% per annum.

With this information, we find it concerning that Geely Automobile Holdings is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Final Word

Geely Automobile Holdings' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Geely Automobile Holdings currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Geely Automobile Holdings (at least 1 which shouldn't be ignored), and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:175

Geely Automobile Holdings

An investment holding company, operates as an automobile manufacturer primarily in the People’s Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives