Yadea Group Holdings (HKG:1585) Is Paying Out Less In Dividends Than Last Year

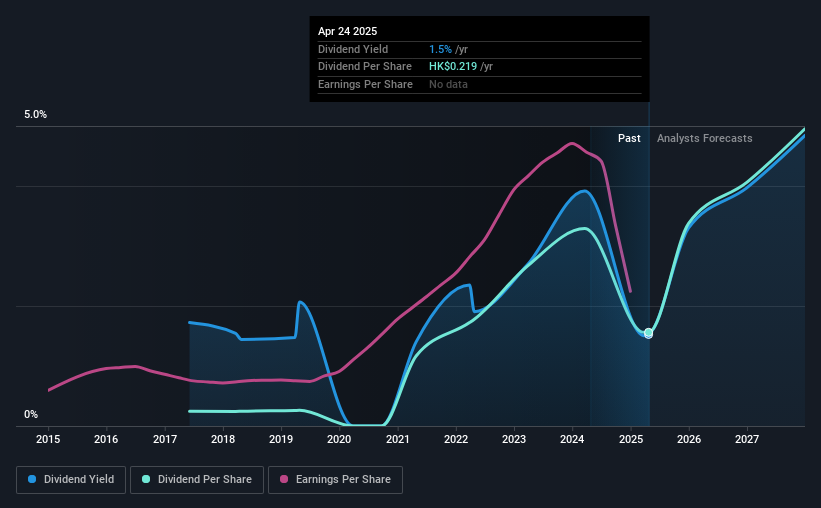

Yadea Group Holdings Ltd.'s (HKG:1585) dividend is being reduced from last year's payment covering the same period to CN¥0.45 on the 16th of July. This means that the annual payment is 1.5% of the current stock price, which is lower than what the rest of the industry is paying.

Yadea Group Holdings' Payment Could Potentially Have Solid Earnings Coverage

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. The last dividend was quite easily covered by Yadea Group Holdings' earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

Looking forward, earnings per share is forecast to rise exponentially over the next year. Assuming the dividend continues along recent trends, we think the payout ratio will be 44%, which makes us pretty comfortable with the sustainability of the dividend.

View our latest analysis for Yadea Group Holdings

Yadea Group Holdings' Dividend Has Lacked Consistency

Yadea Group Holdings has been paying dividends for a while, but the track record isn't stellar. This makes us cautious about the consistency of the dividend over a full economic cycle. Since 2017, the dividend has gone from CN¥0.0321 total annually to CN¥0.205. This works out to be a compound annual growth rate (CAGR) of approximately 26% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. We are encouraged to see that Yadea Group Holdings has grown earnings per share at 20% per year over the past five years. The company is paying out a lot of its cash as a dividend, but it looks okay based on the payout ratio.

We Really Like Yadea Group Holdings' Dividend

In general, we don't like to see the dividend being cut, especially when the company has such high potential like Yadea Group Holdings does. By reducing the dividend, pressure will be taken off the balance sheet, which could help the dividend to be consistent in the future. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for Yadea Group Holdings that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1585

Yadea Group Holdings

An investment holding company, engages in the development, manufacture, and sale of electric two-wheeled vehicles and related accessories under the Yadea brand in the People’s Republic of China.

High growth potential and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026