Is Yadea’s Launch of High-Speed Charging and Sodium-Ion Tech Reshaping Its Investment Case (SEHK:1585)?

Reviewed by Sasha Jovanovic

- At EICMA 2025, Yadea Group Holdings unveiled its latest high-performance electric motorcycles and an integrated charging ecosystem, debuting innovations such as the Velax series with ultra-fast charging, next-generation sodium-ion batteries, and a range of intelligent mobility solutions.

- A key highlight is Yadea’s focus on making rapid charging and sodium battery technology widely accessible, underlining its ambitions to accelerate sustainable electric mobility on a global scale.

- As Yadea unveils proprietary sodium-ion battery systems and fast-charging products, we'll explore the impact on its long-term investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Yadea Group Holdings' Investment Narrative?

For shareholders to be on board with Yadea Group Holdings, it often comes down to believing in the company's ability to keep innovating and scaling its electric mobility offerings both in China and international markets. The recent EICMA 2025 launches, particularly the Velax high-performance motorcycle and proprietary sodium-ion battery ecosystem, could reshape short-term investor expectations and even shift near-term catalysts. Where before, the focus was on expanding market presence and improving financial recovery after a tough prior year, fresh product breakthroughs and a clear play for global tech leadership may drive excitement around margin stabilization and create new growth opportunities in high-value segments. At the same time, while rapid innovation brings attention, it could also introduce operational complexity, execution risk, and pressure on costs, areas that demand close monitoring, especially in light of recent auditor changes and evolving competitive pressures. Depending on how these new technologies gain traction, the overall risk-reward profile for Yadea could look increasingly different from even just a few months ago.

By contrast, concerns remain around whether rapid scaling and innovation will translate to consistent profitability.

Exploring Other Perspectives

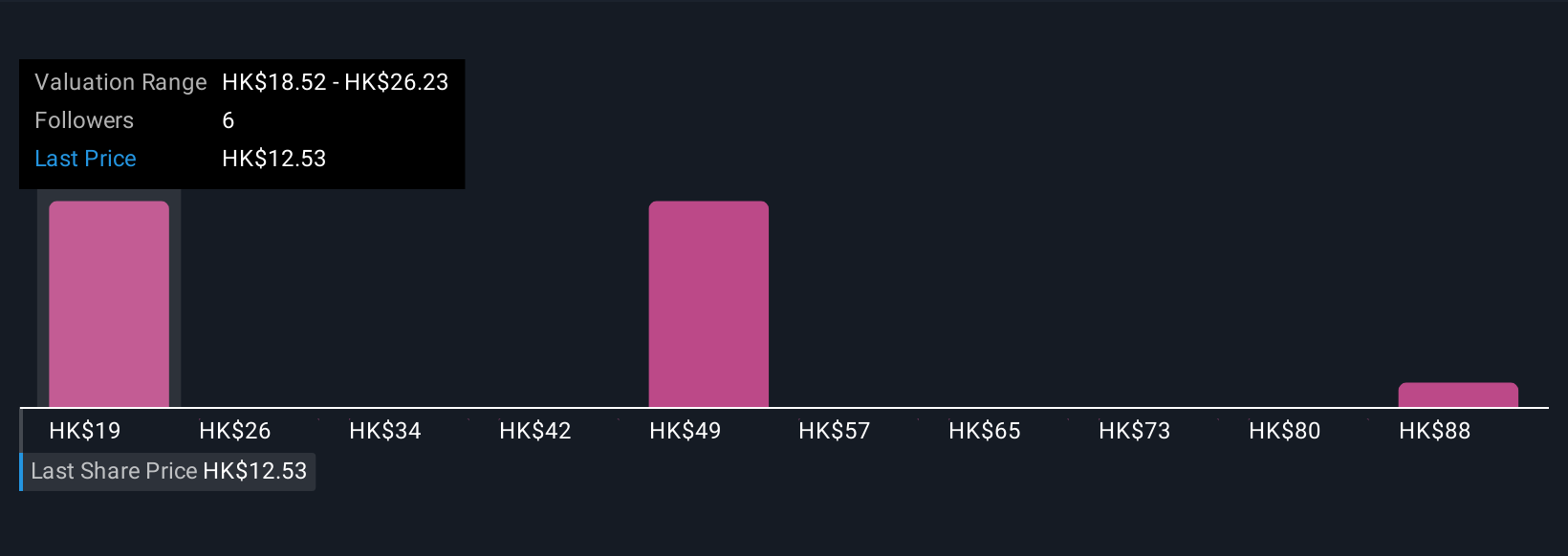

Explore 3 other fair value estimates on Yadea Group Holdings - why the stock might be worth over 7x more than the current price!

Build Your Own Yadea Group Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yadea Group Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Yadea Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yadea Group Holdings' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1585

Yadea Group Holdings

An investment holding company, engages in the development, manufacture, and sale of electric two-wheeled vehicles and related accessories under the Yadea brand in the People’s Republic of China.

High growth potential and good value.

Market Insights

Community Narratives