Here's Why We Think Yadea Group Holdings (HKG:1585) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Yadea Group Holdings (HKG:1585). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out the opportunities and risks within the HK Auto industry.

How Quickly Is Yadea Group Holdings Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. To the delight of shareholders, Yadea Group Holdings has achieved impressive annual EPS growth of 60%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

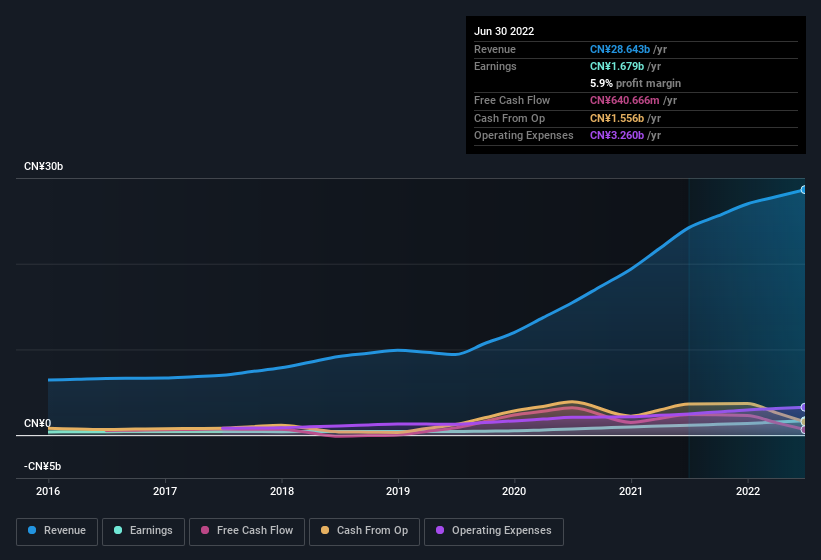

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Yadea Group Holdings achieved similar EBIT margins to last year, revenue grew by a solid 18% to CN¥29b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Yadea Group Holdings' future EPS 100% free.

Are Yadea Group Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One shining light for Yadea Group Holdings is the serious outlay one insider has made to buy shares, in the last year. In one big hit, Vice Chairwoman & CEO Jinghong Qian paid HK$26m, for shares at an average price of HK$11.07 per share. It doesn't get much better than that, in terms of large investments from insiders.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Yadea Group Holdings will reveal that insiders own a significant piece of the pie. Indeed, with a collective holding of 65%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. CN¥23b That level of investment from insiders is nothing to sneeze at.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Jinghong Qian, is paid less than the median for similar sized companies. For companies with market capitalisations between CN¥15b and CN¥46b, like Yadea Group Holdings, the median CEO pay is around CN¥5.2m.

The CEO of Yadea Group Holdings only received CN¥1.1m in total compensation for the year ending December 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Yadea Group Holdings To Your Watchlist?

Yadea Group Holdings' earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Yadea Group Holdings deserves timely attention. We don't want to rain on the parade too much, but we did also find 1 warning sign for Yadea Group Holdings that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Yadea Group Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1585

Yadea Group Holdings

An investment holding company, engages in the development, manufacture, and sale of electric two-wheeled vehicles and related accessories under the Yadea brand in the People’s Republic of China.

High growth potential and good value.

Market Insights

Community Narratives