- Hong Kong

- /

- Auto Components

- /

- SEHK:1269

Health Check: How Prudently Does China First Capital Group (HKG:1269) Use Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that China First Capital Group Limited (HKG:1269) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for China First Capital Group

What Is China First Capital Group's Debt?

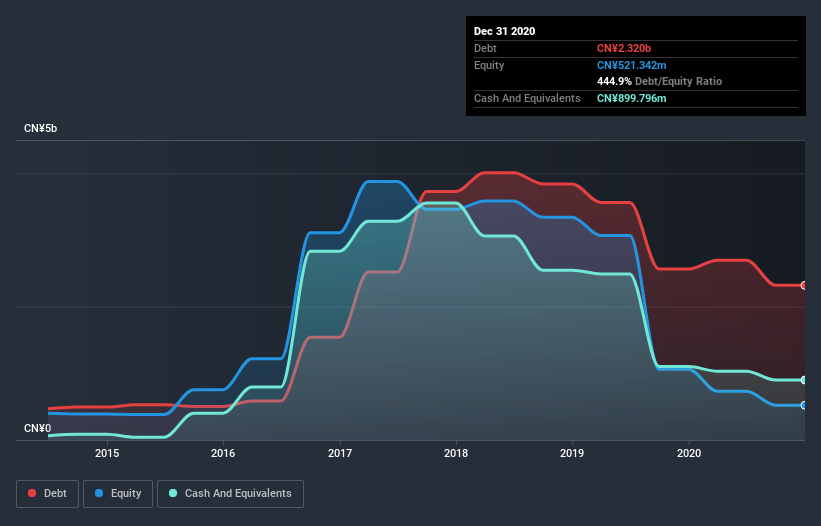

The image below, which you can click on for greater detail, shows that China First Capital Group had debt of CN¥2.32b at the end of December 2020, a reduction from CN¥2.56b over a year. However, because it has a cash reserve of CN¥899.8m, its net debt is less, at about CN¥1.42b.

How Healthy Is China First Capital Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that China First Capital Group had liabilities of CN¥3.20b due within 12 months and liabilities of CN¥729.8m due beyond that. Offsetting these obligations, it had cash of CN¥899.8m as well as receivables valued at CN¥1.25b due within 12 months. So its liabilities total CN¥1.79b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the CN¥343.2m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, China First Capital Group would probably need a major re-capitalization if its creditors were to demand repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since China First Capital Group will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year China First Capital Group had a loss before interest and tax, and actually shrunk its revenue by 5.2%, to CN¥1.4b. We would much prefer see growth.

Caveat Emptor

Over the last twelve months China First Capital Group produced an earnings before interest and tax (EBIT) loss. Indeed, it lost CN¥7.1m at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. But we think that is unlikely since it is low on liquid assets, and made a loss of CN¥374m in the last year. So we think this stock is quite risky. We'd prefer to pass. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that China First Capital Group is showing 3 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading China First Capital Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1269

China First Capital Group

An investment holding company, engages financial services business, education management and consultation business, and automotive part business in the People’s Republic of China, Hong Kong, Singapore, and Italy.

Low and slightly overvalued.

Market Insights

Community Narratives