Stock Analysis

- Hong Kong

- /

- Real Estate

- /

- SEHK:1821

SEHK Growth Leaders With High Insider Ownership July 2024

Reviewed by Simply Wall St

Amid a backdrop of mixed global economic signals, the Hong Kong market has shown resilience with the Hang Seng Index marking a modest gain in a holiday-shortened week. In such an environment, growth companies with high insider ownership in Hong Kong can be particularly compelling as these firms often benefit from aligned interests between shareholders and management, fostering robust long-term strategies even in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Fenbi (SEHK:2469) | 32.8% | 43% |

| Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

| Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 73.4% |

| DPC Dash (SEHK:1405) | 38.2% | 90.2% |

| Beijing Airdoc Technology (SEHK:2251) | 28.7% | 83.9% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

Let's dive into some prime choices out of from the screener.

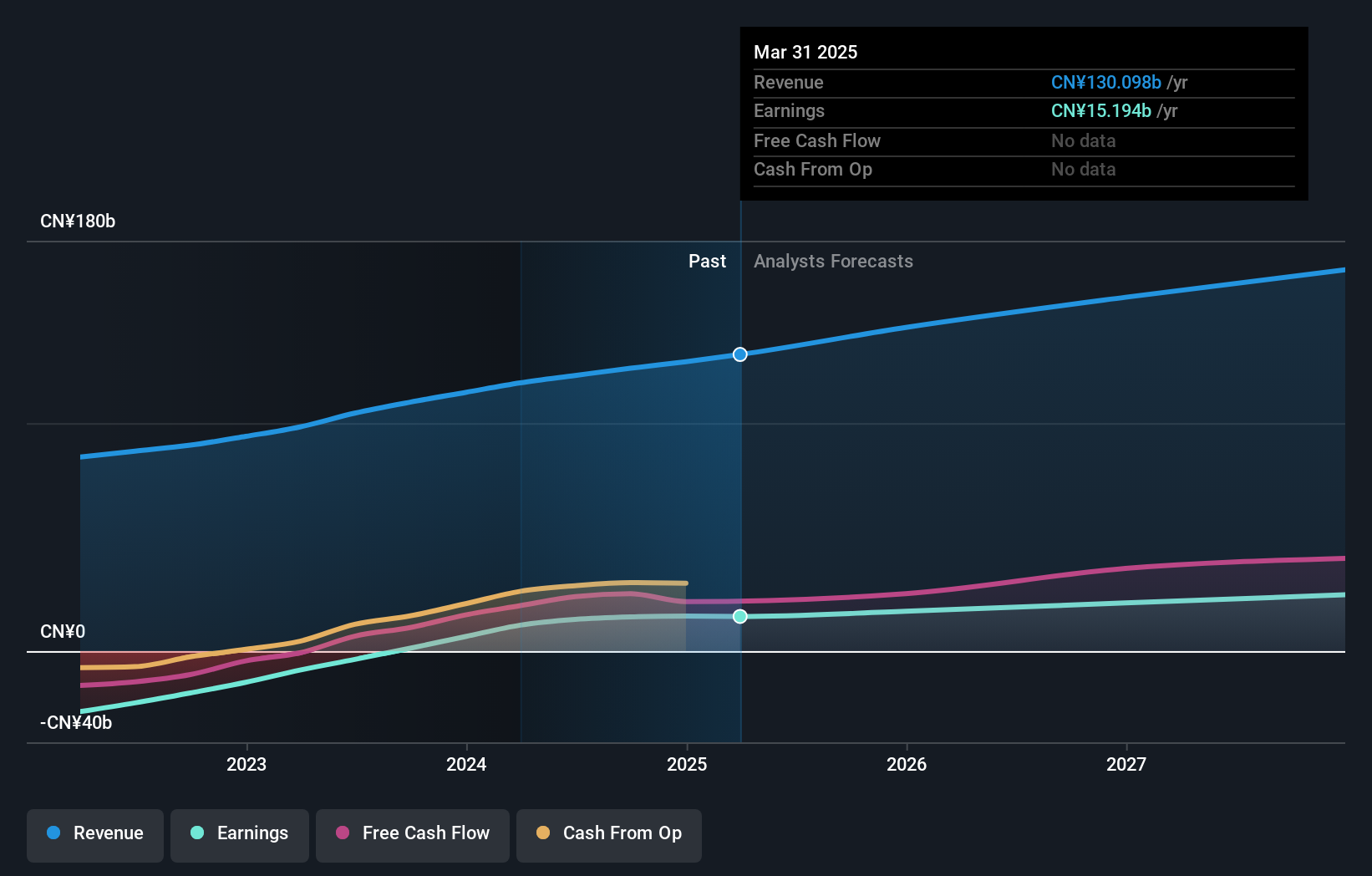

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kuaishou Technology operates as an investment holding company in the People’s Republic of China, offering services such as live streaming and online marketing, with a market capitalization of approximately HK$207.67 billion.

Operations: The company generates revenue primarily through domestic operations, which amounted to CN¥114.72 billion, and a smaller portion from overseas activities totaling CN¥2.94 billion.

Insider Ownership: 19.2%

Earnings Growth Forecast: 22.5% p.a.

Kuaishou Technology, a notable growth company in Hong Kong with significant insider ownership, has recently demonstrated robust advancements in AI technology, enhancing its commercial ecosystem. At the 2024 World Artificial Intelligence Conference, the company unveiled upgrades to its AI models such as Kling and Kolors, boosting user engagement and commercial applications. Financially, Kuaishou reported a substantial turnaround with Q1 earnings of CNY 4.12 billion in 2024 from a loss the previous year and is executing a share buyback program worth HK$16 billion valid until 2027. Despite trading below analyst price targets and perceived fair value, expectations for revenue growth are optimistic relative to the market.

- Unlock comprehensive insights into our analysis of Kuaishou Technology stock in this growth report.

- In light of our recent valuation report, it seems possible that Kuaishou Technology is trading behind its estimated value.

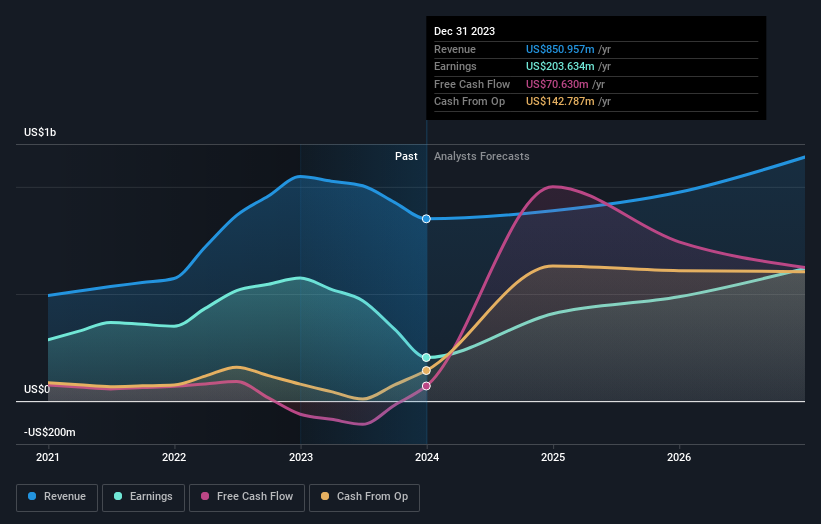

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally with a market capitalization of approximately HK$755.62 billion.

Operations: The company's revenue is primarily derived from its automobile and battery segments across various regions including China, Hong Kong, Macau, and Taiwan.

Insider Ownership: 30.1%

Earnings Growth Forecast: 15.3% p.a.

BYD, a growth-oriented company in Hong Kong with high insider ownership, has shown impressive performance with strong sales and production increases year-over-year as of June 2024. Despite trading at 47% below estimated fair value, BYD's revenue is expected to grow faster than the Hong Kong market average. Earnings are also projected to expand annually by 15.29%. The company recently enhanced its product line with the launch of BYD SHARK in Mexico, marking its first global product introduction outside China and underscoring its innovation capabilities and expansion strategy. However, it should be noted that earnings growth is not considered significantly high compared to industry benchmarks.

- Navigate through the intricacies of BYD with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that BYD's current price could be inflated.

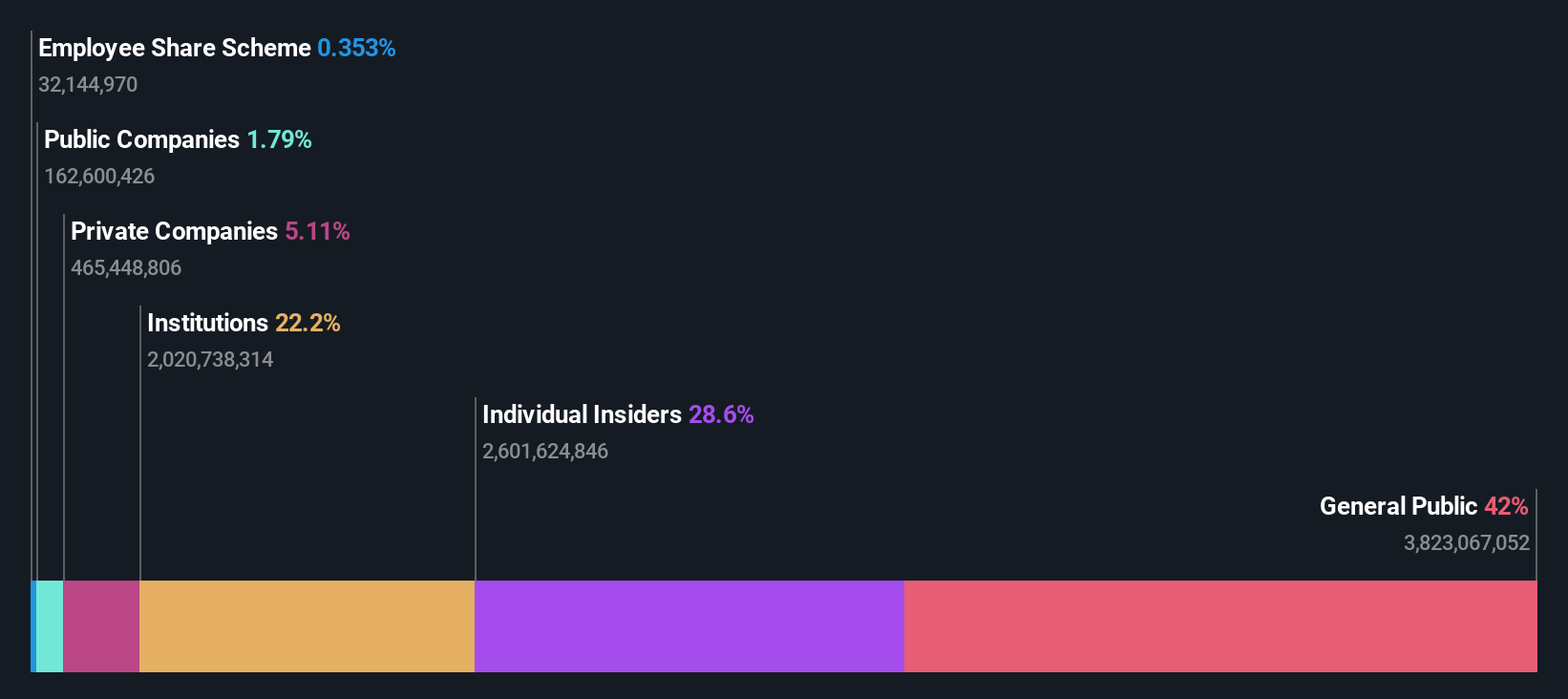

ESR Group (SEHK:1821)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, and Europe with a market capitalization of approximately HK$50.56 billion.

Operations: The company generates revenue primarily through fund management at HK$774.64 million and new economy development at HK$105.48 million.

Insider Ownership: 13.1%

Earnings Growth Forecast: 26.5% p.a.

ESR Group, a key entity in Hong Kong's growth sector with substantial insider ownership, is navigating a complex landscape. Despite trading 36.6% below its fair value and facing challenges like low forecasted Return on Equity at 7.3%, ESR's earnings are expected to surge by 26.5% annually, outpacing the local market's growth. Recent strategic moves include potential privatization discussions led by significant shareholders and consortiums, reflecting a dynamic shift in its operational focus and ownership structure amidst fluctuating market conditions.

- Take a closer look at ESR Group's potential here in our earnings growth report.

- Our expertly prepared valuation report ESR Group implies its share price may be too high.

Key Takeaways

- Click this link to deep-dive into the 54 companies within our Fast Growing SEHK Companies With High Insider Ownership screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if ESR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1821

ESR Group

Engages in the logistics real estate development, leasing, and management activities in Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe, and internationally.

Reasonable growth potential low.