Does BYD’s Latest Global Expansion Signal an Opportunity After 22% Price Surge in 2025?

Reviewed by Bailey Pemberton

Trying to figure out what to do with BYD stock right now? You’re not alone. Whether you’re sitting on some sizeable gains or thinking about making your first move, the recent swings in BYD’s share price have likely caught your attention. Over the last five years, investors have seen the stock climb a whopping 90.7%, with a powerful 21.8% return just year-to-date. But, as you may have noticed, these results come amid some choppier waters lately, including a slight dip of 1.6% over the past month.

Much of this turbulence reflects shifting investor moods around the electric vehicle market, with BYD playing a pivotal position within it. Notably, the industry is abuzz following recent government initiatives to tighten environmental policies in Asia and Europe, as policymakers aim to further accelerate EV adoption. While this creates fresh opportunity, it also invites new competition and regulatory uncertainties. Meanwhile, BYD has managed to stay in the headlines for rapidly expanding its international sales footprint, with new partnerships announced in emerging markets and increased visibility at major auto expos.

All these developments paint a dynamic, but sometimes puzzling, picture for anyone trying to gauge whether BYD is undervalued or overpriced. For what it’s worth, BYD receives a valuation score of 3 out of 6, meaning it’s flagged as undervalued in three of the key checks that analysts often use. But traditional valuation tests only tell part of the story. Up next, we’ll break down exactly how BYD stacks up across different valuation approaches, and then dig into whether there might be an even smarter way to put its true worth into perspective.

Why BYD is lagging behind its peers

Approach 1: BYD Discounted Cash Flow (DCF) Analysis

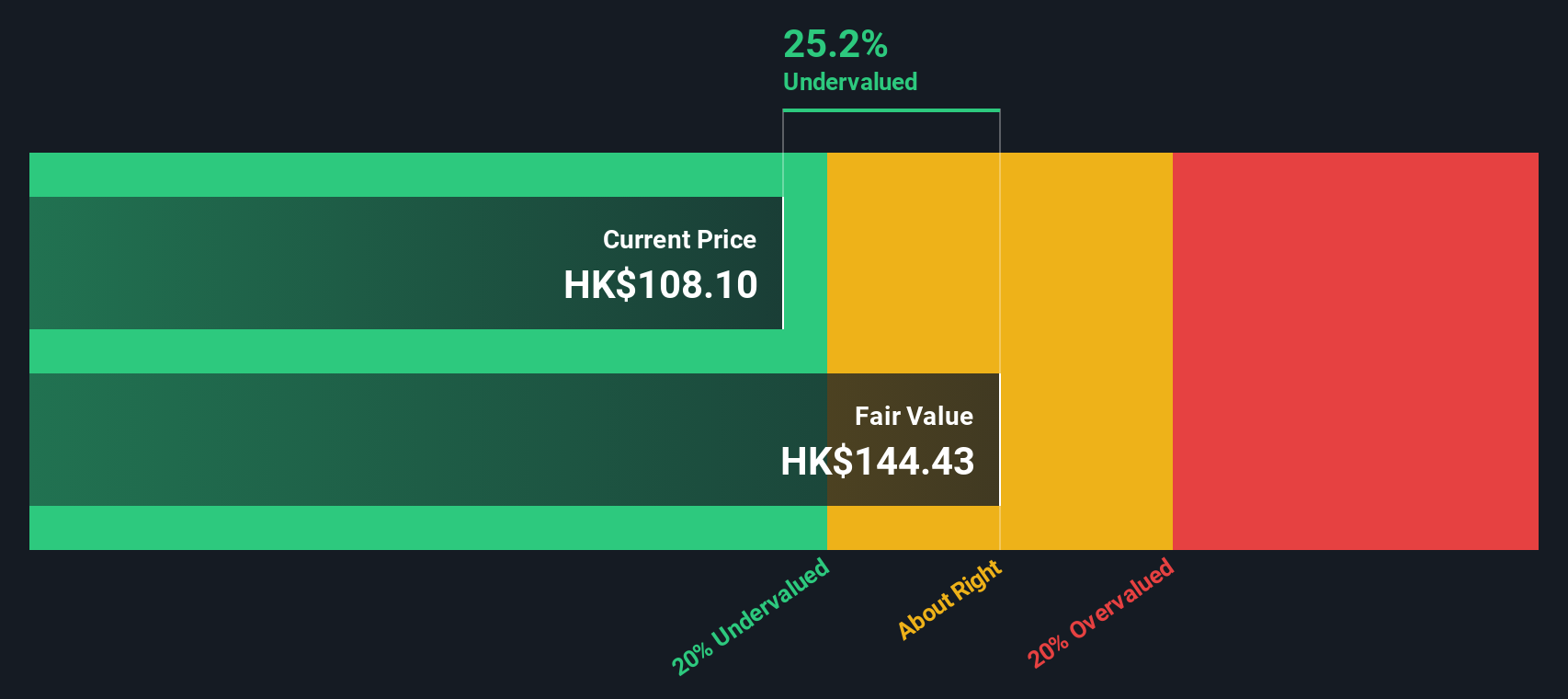

The Discounted Cash Flow (DCF) model values a company by estimating all its future free cash flows and discounting them back to today’s value. This technique helps investors determine the intrinsic worth of a business, rather than relying only on market price trends.

For BYD, the latest twelve-month free cash flow was negative at around CN¥124 million. However, analysts forecast dramatic improvement, with free cash flow expected to reach an estimated CN¥78.8 billion by 2027 and projected to rise to approximately CN¥121.7 billion by 2035, according to extended estimates. These projections rely on a two-stage free cash flow to equity model, which considers both near-term analyst forecasts and longer-term growth assumptions.

Using this methodology, the intrinsic value for BYD stock is calculated at CN¥123.22 per share. Compared to the current market price, this suggests the stock is trading at a 15% discount, indicating it is undervalued based on this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BYD is undervalued by 15.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: BYD Price vs Earnings (PE Ratio)

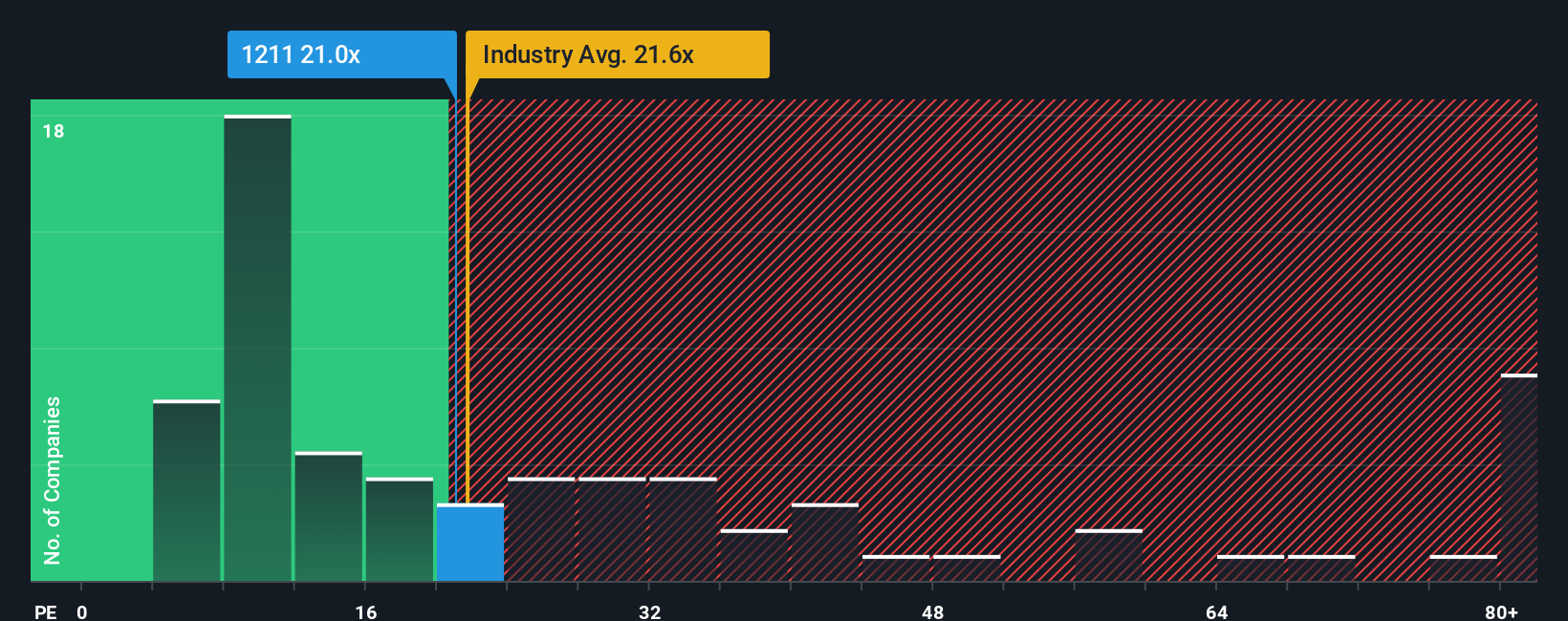

The Price-to-Earnings (PE) ratio is one of the most widely used valuation tools for profitable companies because it relates a company's share price to its per-share earnings. It provides investors with a quick way to assess how much they are paying for a dollar of current profits, which is especially relevant for established businesses like BYD with consistent earnings.

Growth prospects and perceived risk play a big role in what is considered a “normal” PE ratio. Businesses with higher expected future growth or lower risk typically command higher PE multiples, as investors are willing to pay for anticipated expansion and stability. Conversely, companies with slower growth or greater uncertainty generally trade at lower PE ratios.

BYD currently trades on a PE ratio of 20.8x. To put this in context, its PE is higher than the listed peer group’s average of 9.8x and also sits above the Auto industry average of 18.9x. However, Simply Wall St calculates a “Fair Ratio” for BYD of 17.3x, which adjusts for details like BYD’s expected earnings growth, its market cap, profit margins, risk profile, and industry trends.

The Fair Ratio is a more precise benchmark than simply looking at the peer or industry average because it customizes the multiple to reflect the company’s unique characteristics, growth potential, and risk profile. This approach helps investors avoid misjudging a stock based only on broad sector metrics.

With BYD’s current PE of 20.8x somewhat above its calculated Fair Ratio of 17.3x, the stock appears slightly overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

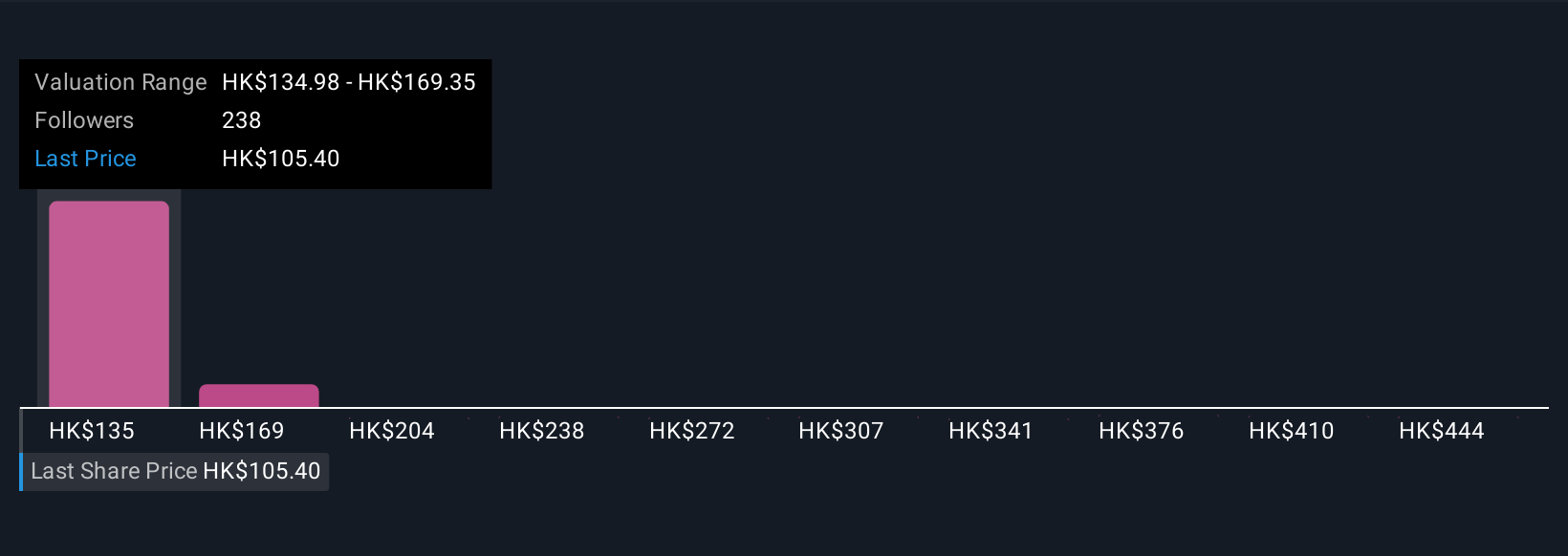

Upgrade Your Decision Making: Choose your BYD Narrative

Earlier we mentioned that there might be an even better way to understand BYD’s value, so let’s introduce you to Narratives. A Narrative is a simple, powerful tool that lets you shape a story about BYD by combining your perspectives on its future revenue, margins, and fair value. This approach goes beyond what traditional valuation models show. Narratives connect the actual events and outlooks for a company to financial forecasts, making investing much more personal and realistic.

On Simply Wall St’s Community page, used by millions of investors, you can easily access Narratives, create your own, or explore others’ views. These tools help you decide when to buy or sell BYD by directly comparing your calculated Fair Value to today’s market price. Since Narratives update automatically as news or earnings are released, your outlook always stays current.

For example, some investors see BYD’s future Fair Value much higher than the current price based on strong global expansion prospects, while others anticipate a lower value due to increased competition and margin pressure. Narratives let you weigh these possibilities and make smarter, more transparent investment decisions that fit your convictions.

Do you think there's more to the story for BYD? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives