BYD (SEHK:1211) Valuation: Is the Market Overlooking Long-Term Growth Potential?

Reviewed by Simply Wall St

See our latest analysis for BYD.

Zooming out, BYD’s 20.8% share price gain year to date stands out even amid recent volatility, although momentum has cooled a bit since the spring rally. Over the past year, the stock notched a 7.8% total shareholder return, and its longer term performance still demonstrates significant growth, with three and five year total returns of 94% and 109%, respectively. Recent headlines about EV competition and regulatory changes may be adding some bumps in the short run, but the bigger picture suggests BYD remains a formidable player with long term appeal.

If you’re curious which other automakers have interesting trends shaping their outlook, it’s a great moment to explore See the full list for free.

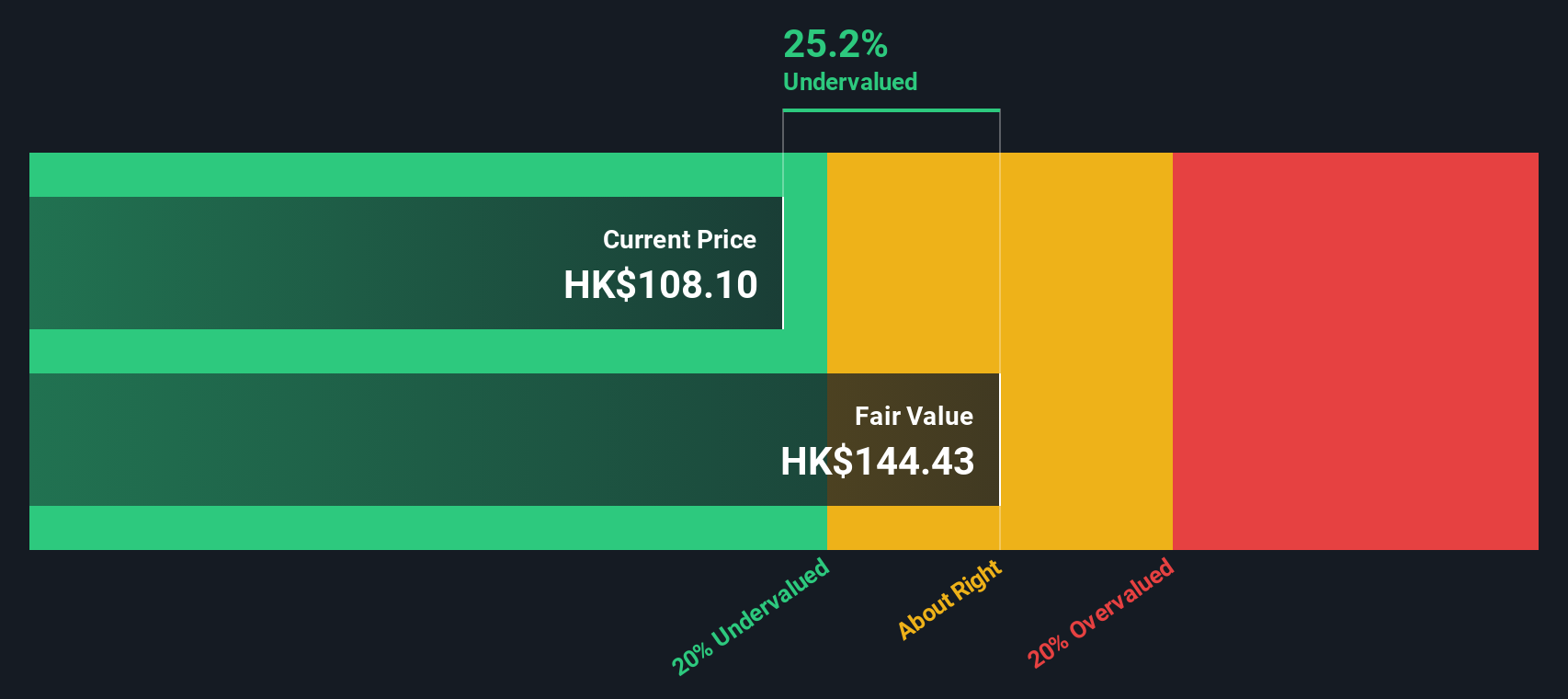

The big question now is whether BYD’s current valuation leaves room for upside, or if recent gains mean the market is already factoring in all the company’s expected growth. Is there still a buying opportunity here?

Price-to-Earnings of 20.7x: Is it Justified?

BYD currently trades at a price-to-earnings (P/E) ratio of 20.7x, which places the stock just below the Asian Auto industry average of 21.4x. At the last close of HK$104, the valuation sits at a point where the market seems to be pricing in healthy expectations, but not excessive optimism.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of earnings. This offers insight into the market’s confidence in a company’s future growth. For a fast-growing electric vehicle leader like BYD, this metric is particularly relevant as it reflects how earnings expansion may already be baked into the share price.

While BYD's P/E ratio suggests the company is priced in line with its industry on this metric, it is crucial to look beyond the headline figure. Compared to its peer group, BYD's multiple is more than double the peer average of 9.6x, which points to elevated expectations or a premium for market leadership. However, it is above what our models view as a fair Price-to-Earnings Ratio of 17.3x, a benchmark level the market could eventually move towards.

Explore the SWS fair ratio for BYD

Result: Price-to-Earnings of 20.7x (OVERVALUED)

However, slowing revenue growth or unexpected shifts in EV industry regulations could present challenges to BYD’s current momentum and investor expectations.

Find out about the key risks to this BYD narrative.

Another View: What Does the SWS DCF Model Suggest?

Taking a different approach with the SWS DCF model, the numbers tell a contrasting story. On this basis, BYD is trading around 15% below our estimate of fair value. This suggests the market may actually be undervaluing the company's future cash flows, despite what its earnings ratio indicates. Could this be a hidden opportunity for long-term investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BYD for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BYD Narrative

If you see things differently or would rather dig into the data your own way, you can easily build and test your own perspective in just a few minutes, Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding BYD.

Looking for More Investment Ideas?

Step beyond BYD and give yourself an edge in the market. If you want to spot the next breakout stock or build a stronger portfolio, check out these fresh opportunities below.

- Grow your wealth by tapping into these 17 dividend stocks with yields > 3% to secure reliable passive income from companies delivering attractive yields over 3%.

- Unlock the potential of these 872 undervalued stocks based on cash flows that could be trading at bargain prices and may offer notable upside based on solid financials.

- Join the tech revolution by targeting these 27 AI penny stocks and invest in pioneers pushing AI innovation, automation, and future-ready business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives