- Greece

- /

- Electronic Equipment and Components

- /

- ATSE:INTET

Would Intertech Inter. Technologies (ATH:INTET) Be Better Off With Less Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Intertech S.A. Inter. Technologies (ATH:INTET) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Our analysis indicates that INTET is potentially undervalued!

What Is Intertech Inter. Technologies's Debt?

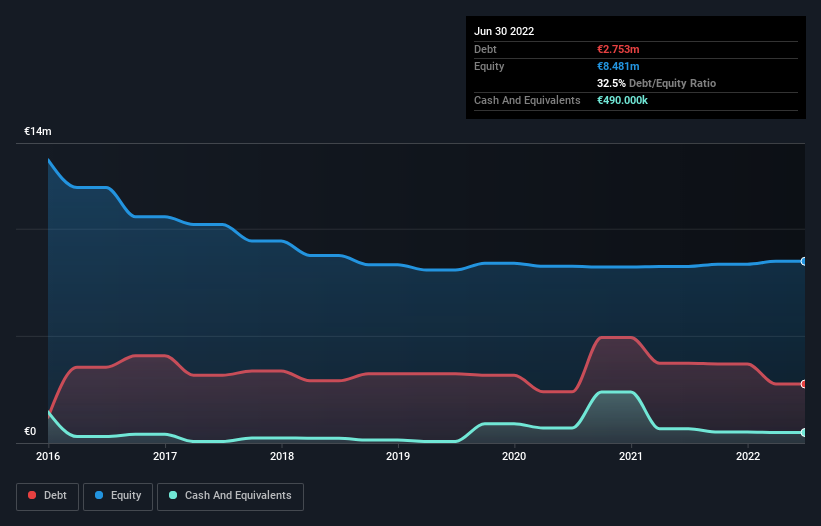

The image below, which you can click on for greater detail, shows that Intertech Inter. Technologies had debt of €2.75m at the end of June 2022, a reduction from €3.72m over a year. On the flip side, it has €490.0k in cash leading to net debt of about €2.26m.

How Strong Is Intertech Inter. Technologies' Balance Sheet?

According to the last reported balance sheet, Intertech Inter. Technologies had liabilities of €4.90m due within 12 months, and liabilities of €2.03m due beyond 12 months. Offsetting this, it had €490.0k in cash and €4.83m in receivables that were due within 12 months. So it has liabilities totalling €1.62m more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Intertech Inter. Technologies has a market capitalization of €7.90m, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Intertech Inter. Technologies will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Intertech Inter. Technologies made a loss at the EBIT level, and saw its revenue drop to €19m, which is a fall of 7.8%. That's not what we would hope to see.

Caveat Emptor

Over the last twelve months Intertech Inter. Technologies produced an earnings before interest and tax (EBIT) loss. Indeed, it lost €76k at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. Surprisingly, we note that it actually reported positive free cash flow of €1.1m and a profit of €154k. So one might argue that there's still a chance it can get things on the right track. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Intertech Inter. Technologies has 2 warning signs we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:INTET

Flawless balance sheet and good value.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Hims & Hers Health aims for three dimensional revenue expansion

Endeavour Group's Future PE Expected to Climb to 15.51%

A Quality Compounder Marked Down on Overblown Fears

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale