- Greece

- /

- Electronic Equipment and Components

- /

- ATSE:INTET

What Intertech S.A. Inter. Technologies' (ATH:INTET) P/E Is Not Telling You

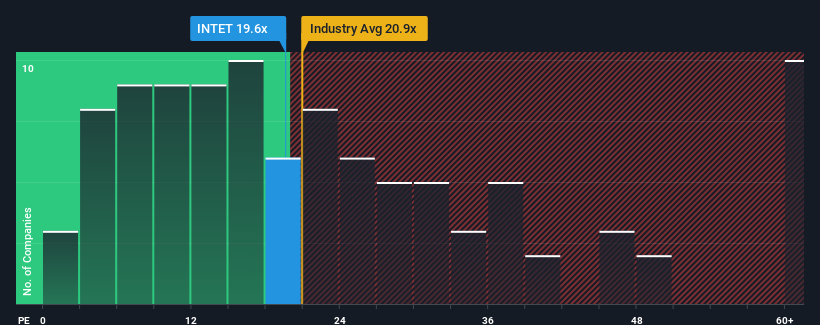

When close to half the companies in Greece have price-to-earnings ratios (or "P/E's") below 10x, you may consider Intertech S.A. Inter. Technologies (ATH:INTET) as a stock to avoid entirely with its 19.6x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

We'd have to say that with no tangible growth over the last year, Intertech Inter. Technologies' earnings have been unimpressive. It might be that many are expecting an improvement to the uninspiring earnings performance over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Intertech Inter. Technologies

How Is Intertech Inter. Technologies' Growth Trending?

Intertech Inter. Technologies' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. So it seems apparent to us that the company has struggled to grow earnings meaningfully over that time.

This is in contrast to the rest of the market, which is expected to grow by 6.9% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Intertech Inter. Technologies is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Intertech Inter. Technologies' P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Intertech Inter. Technologies currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Intertech Inter. Technologies is showing 2 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ATSE:INTET

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

BSX after Penumbra ?

Procter & Gamble - A Fundamental and Historical Valuation

Investing in the future with RGYAS as fair value hits 228.23

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!