Byte Computer S.A. (ATH:BYTE) Passed Our Checks, And It's About To Pay A €0.10 Dividend

Byte Computer S.A. (ATH:BYTE) stock is about to trade ex-dividend in 3 days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. In other words, investors can purchase Byte Computer's shares before the 12th of May in order to be eligible for the dividend, which will be paid on the 18th of May.

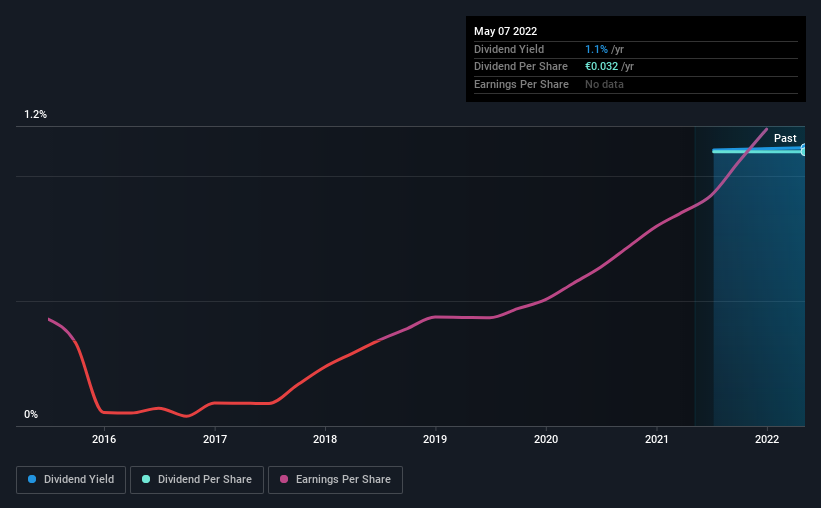

The upcoming dividend for Byte Computer is €0.10 per share, increased from last year's total dividends per share of €0.032. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Byte Computer

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Byte Computer has a low and conservative payout ratio of just 16% of its income after tax. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Over the last year, it paid out dividends equivalent to 1,419% of what it generated in free cash flow, a disturbingly high percentage. Our definition of free cash flow excludes cash generated from asset sales, so since Byte Computer is paying out such a high percentage of its cash flow, it might be worth seeing if it sold assets or had similar events that might have led to such a high dividend payment.

While Byte Computer's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Were this to happen repeatedly, this would be a risk to Byte Computer's ability to maintain its dividend.

Click here to see how much of its profit Byte Computer paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. It's encouraging to see Byte Computer has grown its earnings rapidly, up 74% a year for the past five years. Earnings have been growing quickly, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Unfortunately Byte Computer has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

Final Takeaway

Should investors buy Byte Computer for the upcoming dividend? We like that Byte Computer has been successfully growing its earnings per share at a nice rate and reinvesting most of its profits in the business. However, we note the high cashflow payout ratio with some concern. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

In light of that, while Byte Computer has an appealing dividend, it's worth knowing the risks involved with this stock. We've identified 3 warning signs with Byte Computer (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Byte Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:BYTE

Byte Computer

Byte Computer S.A. provides integrated IT and communication solutions in Greece and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

The silent giant behind virtually every advanced chip powering AI, smartphones, and modern infrastructure.

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

Looking to be second time lucky with a game-changing new product

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026