- Greece

- /

- Specialty Stores

- /

- ATSE:EVR

Investors ignore increasing losses at I.Kloukinas-I.Lappas (ATH:KLM) as stock jumps 12% this past week

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. For example, the I.Kloukinas-I.Lappas S.A. (ATH:KLM) share price has soared 193% in the last three years. Most would be happy with that. Also pleasing for shareholders was the 49% gain in the last three months.

Since the stock has added €7.6m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for I.Kloukinas-I.Lappas

Given that I.Kloukinas-I.Lappas didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years I.Kloukinas-I.Lappas saw its revenue shrink by 0.9% per year. So the share price gain of 43% per year is quite surprising. It's a good reminder that expectations about the future, not the past history, always impact share prices.

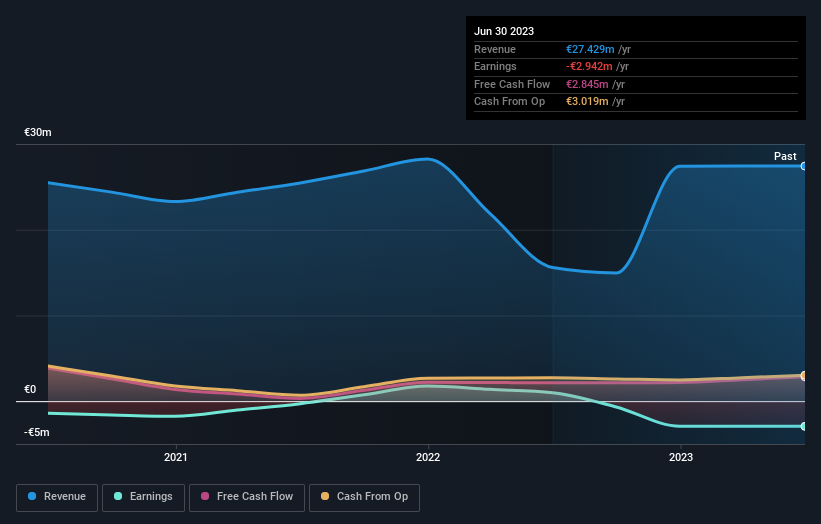

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between I.Kloukinas-I.Lappas' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. I.Kloukinas-I.Lappas' TSR of 215% for the 3 years exceeded its share price return, because it has paid dividends.

A Different Perspective

It's good to see that I.Kloukinas-I.Lappas has rewarded shareholders with a total shareholder return of 84% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 24% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that I.Kloukinas-I.Lappas is showing 3 warning signs in our investment analysis , and 2 of those don't sit too well with us...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Greek exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Evropi Holdings Societe Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:EVR

Evropi Holdings Societe Anonyme

Engages in construction businesses in Greece.

Flawless balance sheet low.

Market Insights

Community Narratives