- Greece

- /

- Basic Materials

- /

- ATSE:TITC

With EPS Growth And More, Titan Cement International (ATH:TITC) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Titan Cement International (ATH:TITC). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Titan Cement International with the means to add long-term value to shareholders.

Check out our latest analysis for Titan Cement International

Titan Cement International's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Recognition must be given to the that Titan Cement International has grown EPS by 45% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

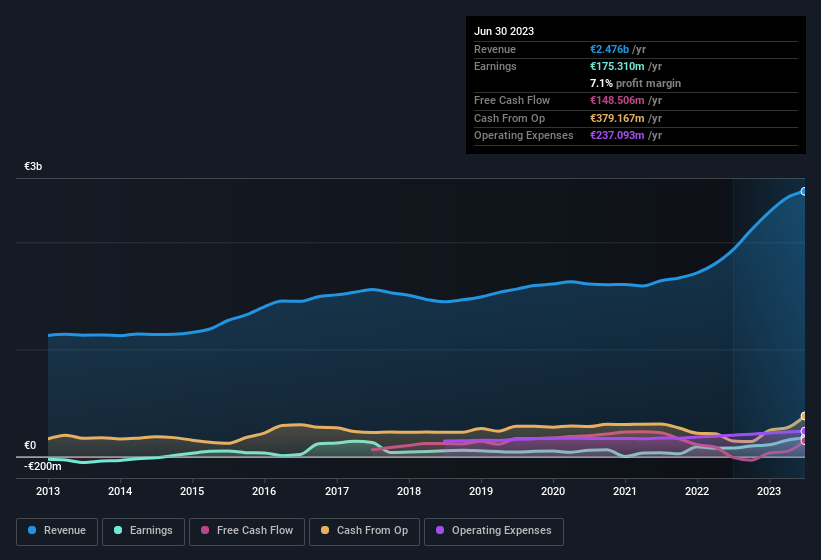

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Titan Cement International is growing revenues, and EBIT margins improved by 5.1 percentage points to 11%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Titan Cement International.

Are Titan Cement International Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First things first, there weren't any reports of insiders selling shares in Titan Cement International in the last 12 months. But the really good news is that Executive Director Alexandra Papalexopoulou-Benopoulou spent €507k buying stock, at an average price of around €12.19. Purchases like this can offer an insight into the faith of the company's management - and it seems to be all positive.

Along with the insider buying, another encouraging sign for Titan Cement International is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth €299m. Coming in at 22% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Looking very optimistic for investors.

Is Titan Cement International Worth Keeping An Eye On?

Titan Cement International's earnings have taken off in quite an impressive fashion. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Titan Cement International belongs near the top of your watchlist. Still, you should learn about the 2 warning signs we've spotted with Titan Cement International.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Titan Cement International, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Titan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:TITC

Titan

Engages in the production, trade, and distribution of construction materials in Greece, the Balkans, Egypt, Türkiye, the United States, and Brazil.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success