- Greece

- /

- Metals and Mining

- /

- ATSE:PROFK

Pipe Works L. Girakian Profil S.A.'s (ATH:PROFK) P/S Is On The Mark

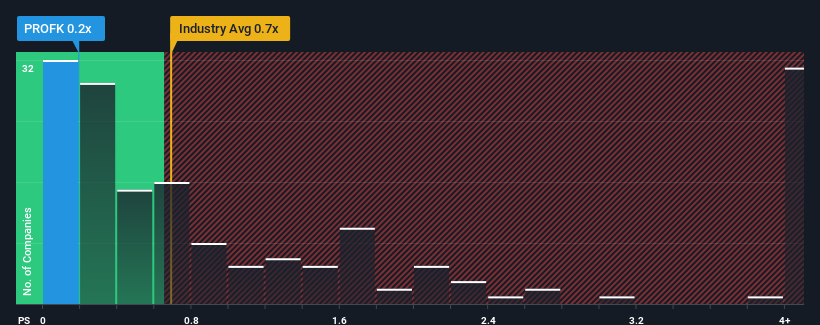

With a median price-to-sales (or "P/S") ratio of close to 0.2x in the Metals and Mining industry in Greece, you could be forgiven for feeling indifferent about Pipe Works L. Girakian Profil S.A.'s (ATH:PROFK) P/S ratio, which comes in at about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Pipe Works L. Girakian Profil

What Does Pipe Works L. Girakian Profil's Recent Performance Look Like?

For instance, Pipe Works L. Girakian Profil's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Pipe Works L. Girakian Profil, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Pipe Works L. Girakian Profil's Revenue Growth Trending?

In order to justify its P/S ratio, Pipe Works L. Girakian Profil would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 7.6% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 1.4% shows it's about the same on an annualised basis.

With this in consideration, it's clear to see why Pipe Works L. Girakian Profil's P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we've seen, Pipe Works L. Girakian Profil's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Pipe Works L. Girakian Profil, and understanding should be part of your investment process.

If you're unsure about the strength of Pipe Works L. Girakian Profil's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:PROFK

Pipe Works L. Girakian Profil

Manufactures and sells various types of steel pipes in Greece.

Adequate balance sheet with low risk.

Market Insights

Community Narratives