- Greece

- /

- Basic Materials

- /

- ATSE:MERKO

Mermeren Kombinat AD (ATH:MERKO) Stocks Pounded By 25% But Not Lagging Market On Growth Or Pricing

Mermeren Kombinat AD (ATH:MERKO) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 31% in that time.

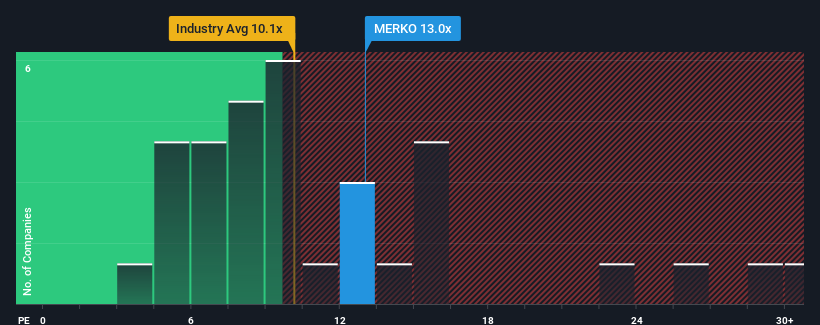

Even after such a large drop in price, there still wouldn't be many who think Mermeren Kombinat AD's price-to-earnings (or "P/E") ratio of 13x is worth a mention when the median P/E in Greece is similar at about 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been quite advantageous for Mermeren Kombinat AD as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Mermeren Kombinat AD

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Mermeren Kombinat AD's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 31% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 31% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

It turns out the market is also predicted to shrink 13% in the next 12 months, mirroring the company's downward momentum based on recent medium-term annualised earnings results.

In light of this, it's understandable that Mermeren Kombinat AD's P/E sits in line with the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E long-term, which could set up shareholders for future disappointment regardless. There is potential for the P/E to fall to lower levels if the company doesn't improve its profitability, which would be difficult to do with the current market outlook.

The Key Takeaway

Following Mermeren Kombinat AD's share price tumble, its P/E is now hanging on to the median market P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Mermeren Kombinat AD revealed its three-year contraction in earnings is contributing to its P/E, given the market is set to shrink at a similar rate. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Although, we are concerned whether the company can maintain its medium-term level of performance under these tough market conditions. For now though, it's hard to see the share price moving strongly in either direction under these circumstances.

Having said that, be aware Mermeren Kombinat AD is showing 3 warning signs in our investment analysis, and 2 of those can't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:MERKO

Mermeren Kombinat AD

Engages in mining, processing, and distribution of marble and decorative stones under the SIVEC brand name in North Macedonia, China, Greece, Balkan region, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives