- Greece

- /

- Basic Materials

- /

- ATSE:MERKO

Market is not liking Mermeren Kombinat AD's (ATH:MERKO) earnings decline as stock retreats 11% this week

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But even in a market-beating portfolio, some stocks will lag the market. The Mermeren Kombinat AD (ATH:MERKO) stock price is down 24% over five years, but the total shareholder return is -6.4% once you include the dividend. That's better than the market which declined 32% over the same time. Even worse, it's down 13% in about a month, which isn't fun at all. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

If the past week is anything to go by, investor sentiment for Mermeren Kombinat AD isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Mermeren Kombinat AD

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

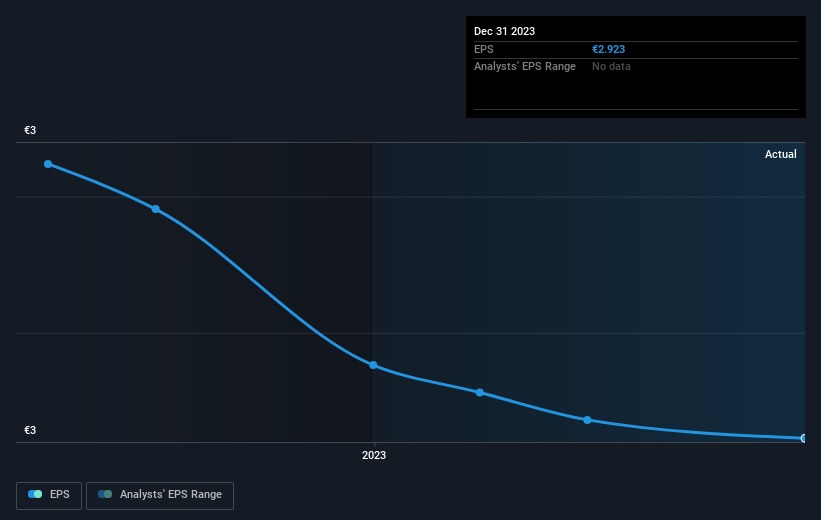

During the five years over which the share price declined, Mermeren Kombinat AD's earnings per share (EPS) dropped by 9.7% each year. This fall in the EPS is worse than the 5% compound annual share price fall. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Mermeren Kombinat AD's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Mermeren Kombinat AD's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Mermeren Kombinat AD's TSR, which was a 6.4% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

It's good to see that Mermeren Kombinat AD has rewarded shareholders with a total shareholder return of 26% in the last twelve months. Notably the five-year annualised TSR loss of 1.3% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Mermeren Kombinat AD is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Greek exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ATSE:MERKO

Mermeren Kombinat AD

Engages in mining, processing, and distribution of marble and decorative stones under the SIVEC brand name in North Macedonia, China, Greece, Balkan region, and internationally.

Flawless balance sheet with solid track record.