- Greece

- /

- Metals and Mining

- /

- ATSE:IKTIN

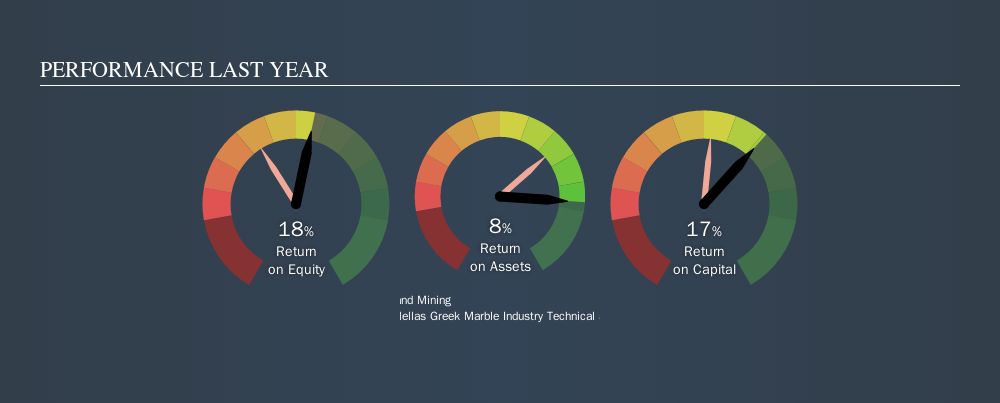

Is Iktinos Hellas S.A. Greek Marble Industry Technical and Touristic Company’s (ATH:IKTIN) 17% ROCE Any Good?

Today we'll evaluate Iktinos Hellas S.A. Greek Marble Industry Technical and Touristic Company (ATH:IKTIN) to determine whether it could have potential as an investment idea. Specifically, we'll consider its Return On Capital Employed (ROCE), since that will give us an insight into how efficiently the business can generate profits from the capital it requires.

Firstly, we'll go over how we calculate ROCE. Next, we'll compare it to others in its industry. Last but not least, we'll look at what impact its current liabilities have on its ROCE.

What is Return On Capital Employed (ROCE)?

ROCE measures the amount of pre-tax profits a company can generate from the capital employed in its business. Generally speaking a higher ROCE is better. Ultimately, it is a useful but imperfect metric. Renowned investment researcher Michael Mauboussin has suggested that a high ROCE can indicate that 'one dollar invested in the company generates value of more than one dollar'.

How Do You Calculate Return On Capital Employed?

Analysts use this formula to calculate return on capital employed:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

Or for Iktinos Hellas Greek Marble Industry Technical and Touristic:

0.17 = €13m ÷ (€124m - €45m) (Based on the trailing twelve months to June 2019.)

So, Iktinos Hellas Greek Marble Industry Technical and Touristic has an ROCE of 17%.

Check out our latest analysis for Iktinos Hellas Greek Marble Industry Technical and Touristic

Is Iktinos Hellas Greek Marble Industry Technical and Touristic's ROCE Good?

One way to assess ROCE is to compare similar companies. In our analysis, Iktinos Hellas Greek Marble Industry Technical and Touristic's ROCE is meaningfully higher than the 9.2% average in the Metals and Mining industry. I think that's good to see, since it implies the company is better than other companies at making the most of its capital. Independently of how Iktinos Hellas Greek Marble Industry Technical and Touristic compares to its industry, its ROCE in absolute terms appears decent, and the company may be worthy of closer investigation.

In our analysis, Iktinos Hellas Greek Marble Industry Technical and Touristic's ROCE appears to be 17%, compared to 3 years ago, when its ROCE was 13%. This makes us wonder if the company is improving. Take a look at the image below to see how Iktinos Hellas Greek Marble Industry Technical and Touristic's past growth compares to the average in its industry.

When considering ROCE, bear in mind that it reflects the past and does not necessarily predict the future. ROCE can be deceptive for cyclical businesses, as returns can look incredible in boom times, and terribly low in downturns. ROCE is, after all, simply a snap shot of a single year. Remember that most companies like Iktinos Hellas Greek Marble Industry Technical and Touristic are cyclical businesses. Future performance is what matters, and you can see analyst predictions in our free report on analyst forecasts for the company.

Iktinos Hellas Greek Marble Industry Technical and Touristic's Current Liabilities And Their Impact On Its ROCE

Liabilities, such as supplier bills and bank overdrafts, are referred to as current liabilities if they need to be paid within 12 months. Due to the way the ROCE equation works, having large bills due in the near term can make it look as though a company has less capital employed, and thus a higher ROCE than usual. To check the impact of this, we calculate if a company has high current liabilities relative to its total assets.

Iktinos Hellas Greek Marble Industry Technical and Touristic has total liabilities of €45m and total assets of €124m. Therefore its current liabilities are equivalent to approximately 37% of its total assets. Iktinos Hellas Greek Marble Industry Technical and Touristic has a middling amount of current liabilities, increasing its ROCE somewhat.

Our Take On Iktinos Hellas Greek Marble Industry Technical and Touristic's ROCE

With a decent ROCE, the company could be interesting, but remember that the level of current liabilities make the ROCE look better. Iktinos Hellas Greek Marble Industry Technical and Touristic shapes up well under this analysis, but it is far from the only business delivering excellent numbers . You might also want to check this free collection of companies delivering excellent earnings growth.

I will like Iktinos Hellas Greek Marble Industry Technical and Touristic better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ATSE:IKTIN

Iktinos Hellas Greek Marble Industry Technical and Touristic

Engages in the quarrying, processing, and trading in marbles and granites in Greece, the Euro Area, and internationally.

Moderate and slightly overvalued.