Should You Be Adding Flexopack Société Anonyme Commercial and Industrial Plastics (ATH:FLEXO) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Flexopack Société Anonyme Commercial and Industrial Plastics (ATH:FLEXO). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Flexopack Société Anonyme Commercial and Industrial Plastics

How Quickly Is Flexopack Société Anonyme Commercial and Industrial Plastics Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, Flexopack Société Anonyme Commercial and Industrial Plastics has grown EPS by 14% per year. That's a good rate of growth, if it can be sustained.

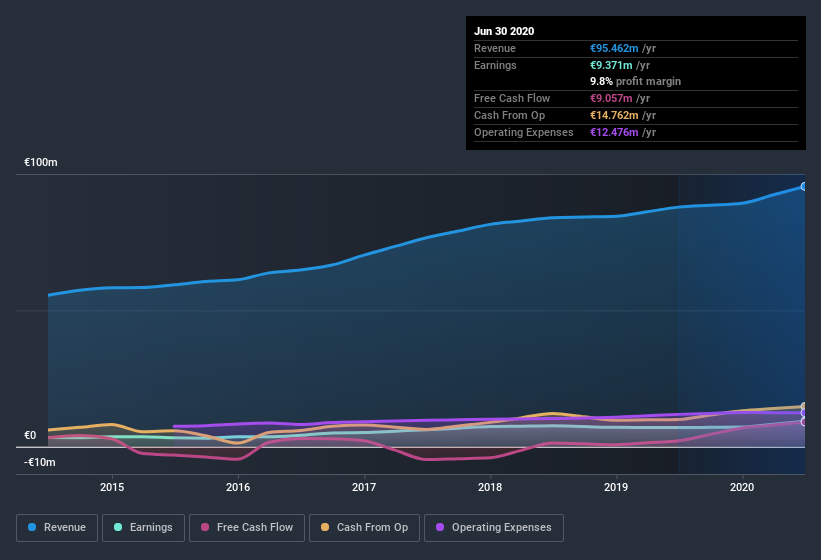

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Flexopack Société Anonyme Commercial and Industrial Plastics shareholders can take confidence from the fact that EBIT margins are up from 11% to 13%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Since Flexopack Société Anonyme Commercial and Industrial Plastics is no giant, with a market capitalization of €101m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Flexopack Société Anonyme Commercial and Industrial Plastics Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that Flexopack Société Anonyme Commercial and Industrial Plastics insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 65%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. In terms of absolute value, insiders have €66m invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is Flexopack Société Anonyme Commercial and Industrial Plastics Worth Keeping An Eye On?

As I already mentioned, Flexopack Société Anonyme Commercial and Industrial Plastics is a growing business, which is what I like to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. You still need to take note of risks, for example - Flexopack Société Anonyme Commercial and Industrial Plastics has 1 warning sign we think you should be aware of.

Although Flexopack Société Anonyme Commercial and Industrial Plastics certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Flexopack Société Anonyme Commercial and Industrial Plastics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ATSE:FLEXO

Flexopack Société Anonyme Commercial and Industrial Plastics

Manufactures and sells flexible plastic packaging materials for the food industry in Greece, other European countries, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives