It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Gr. Sarantis (ATH:SAR), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Quickly Is Gr. Sarantis Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Gr. Sarantis managed to grow EPS by 16% per year, over three years. That's a good rate of growth, if it can be sustained.

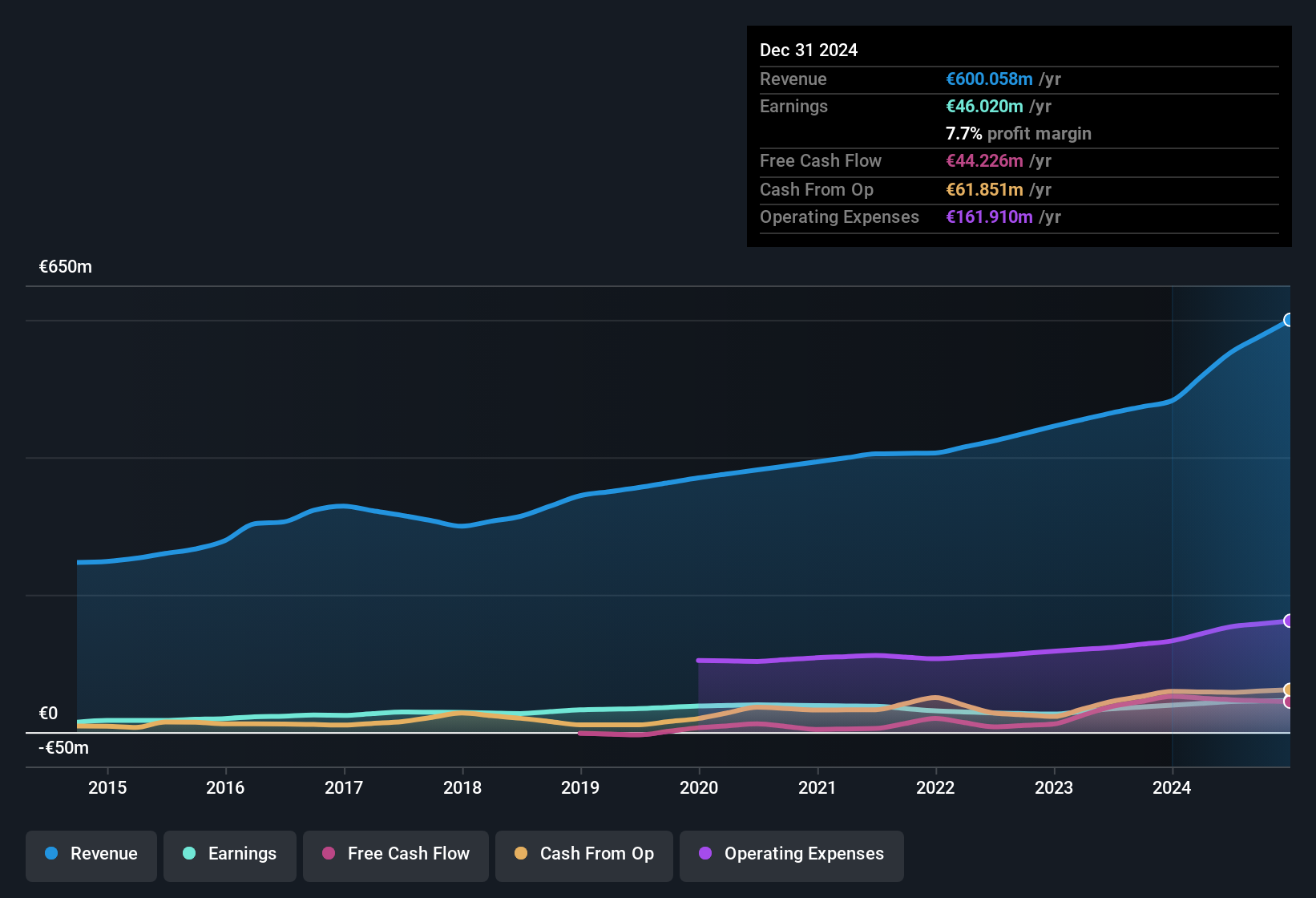

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Gr. Sarantis remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 24% to €600m. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Check out our latest analysis for Gr. Sarantis

Fortunately, we've got access to analyst forecasts of Gr. Sarantis' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Gr. Sarantis Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Although we did see some insider selling (worth €5.3k) this was overshadowed by a mountain of buying, totalling €1.5m in just one year. This adds to the interest in Gr. Sarantis because it suggests that those who understand the company best, are optimistic. We also note that it was the Executive Chairman, Kyriakos Sarantis, who made the biggest single acquisition, paying €544k for shares at about €10.88 each.

The good news, alongside the insider buying, for Gr. Sarantis bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a significant chunk of shares, currently valued at €50m, they have plenty of motivation to push the business to succeed. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

Does Gr. Sarantis Deserve A Spot On Your Watchlist?

One positive for Gr. Sarantis is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for your watchlist - and arguably a research priority. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Gr. Sarantis. You might benefit from giving it a glance today.

The good news is that Gr. Sarantis is not the only stock with insider buying. Here's a list of small cap, undervalued companies in GR with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:SAR

Gr. Sarantis

Produces and trades in cosmetics, household products, and pharmaceutical items in Greece, Portugal, Poland, Romania, Bulgaria, Serbia, Bosnia-Herzegovina, North Macedonia, Slovenia, Czech-Slovakia, Hungary, and Ukraine.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success