Is Karelia Tobacco Company Inc.’s (ATH:KARE) 16% Return On Capital Employed Good News?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Today we'll evaluate Karelia Tobacco Company Inc. (ATH:KARE) to determine whether it could have potential as an investment idea. Specifically, we'll consider its Return On Capital Employed (ROCE), since that will give us an insight into how efficiently the business can generate profits from the capital it requires.

First, we'll go over how we calculate ROCE. Second, we'll look at its ROCE compared to similar companies. And finally, we'll look at how its current liabilities are impacting its ROCE.

What is Return On Capital Employed (ROCE)?

ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Generally speaking a higher ROCE is better. In brief, it is a useful tool, but it is not without drawbacks. Renowned investment researcher Michael Mauboussin has suggested that a high ROCE can indicate that 'one dollar invested in the company generates value of more than one dollar'.

How Do You Calculate Return On Capital Employed?

Analysts use this formula to calculate return on capital employed:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

Or for Karelia Tobacco:

0.16 = €79m ÷ (€586m - €103m) (Based on the trailing twelve months to December 2018.)

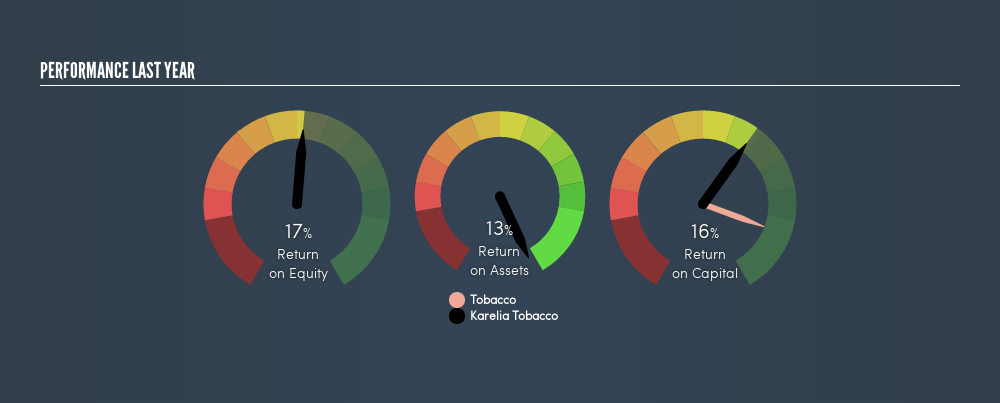

So, Karelia Tobacco has an ROCE of 16%.

See our latest analysis for Karelia Tobacco

Is Karelia Tobacco's ROCE Good?

When making comparisons between similar businesses, investors may find ROCE useful. It appears that Karelia Tobacco's ROCE is fairly close to the Tobacco industry average of 16%. Separate from Karelia Tobacco's performance relative to its industry, its ROCE in absolute terms looks satisfactory, and it may be worth researching in more depth.

Karelia Tobacco's current ROCE of 16% is lower than 3 years ago, when the company reported a 25% ROCE. Therefore we wonder if the company is facing new headwinds.

When considering this metric, keep in mind that it is backwards looking, and not necessarily predictive. ROCE can be deceptive for cyclical businesses, as returns can look incredible in boom times, and terribly low in downturns. ROCE is, after all, simply a snap shot of a single year. How cyclical is Karelia Tobacco? You can see for yourself by looking at this free graph of past earnings, revenue and cash flow.

Karelia Tobacco's Current Liabilities And Their Impact On Its ROCE

Current liabilities are short term bills and invoices that need to be paid in 12 months or less. Due to the way the ROCE equation works, having large bills due in the near term can make it look as though a company has less capital employed, and thus a higher ROCE than usual. To counter this, investors can check if a company has high current liabilities relative to total assets.

Karelia Tobacco has total assets of €586m and current liabilities of €103m. As a result, its current liabilities are equal to approximately 18% of its total assets. Low current liabilities are not boosting the ROCE too much.

The Bottom Line On Karelia Tobacco's ROCE

This is good to see, and with a sound ROCE, Karelia Tobacco could be worth a closer look. There might be better investments than Karelia Tobacco out there, but you will have to work hard to find them . These promising businesses with rapidly growing earnings might be right up your alley.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ATSE:KARE

Karelia Tobacco

Engages in the production and sale of tobacco products in European Union, Africa, Asia, Greece, and Other European countries.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives