Investors Interested In Karelia Tobacco Company Inc.'s (ATH:KARE) Earnings

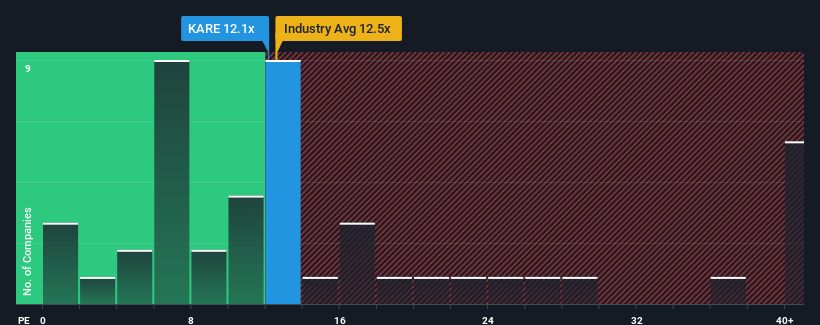

It's not a stretch to say that Karelia Tobacco Company Inc.'s (ATH:KARE) price-to-earnings (or "P/E") ratio of 12.1x right now seems quite "middle-of-the-road" compared to the market in Greece, where the median P/E ratio is around 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

As an illustration, earnings have deteriorated at Karelia Tobacco over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Karelia Tobacco

Does Growth Match The P/E?

In order to justify its P/E ratio, Karelia Tobacco would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 23%. Regardless, EPS has managed to lift by a handy 24% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Comparing that to the market, which is predicted to deliver 9.4% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

In light of this, it's understandable that Karelia Tobacco's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Karelia Tobacco revealed its three-year earnings trends are contributing to its P/E, given they look similar to current market expectations. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Karelia Tobacco with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Karelia Tobacco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:KARE

Karelia Tobacco

Engages in the production and sale of tobacco products in European Union, Africa, Asia, Greece, and Other European countries.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives