Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We really hate to see fellow investors lose their hard-earned money. Imagine if you held Euroxx Securities S.A. (ATH:EX) for half a decade as the share price tanked 71%. And it's not just long term holders hurting, because the stock is down 51% in the last year. Shareholders have had an even rougher run lately, with the share price down 36% in the last 90 days.

View 4 warning signs we detected for Euroxx Securities

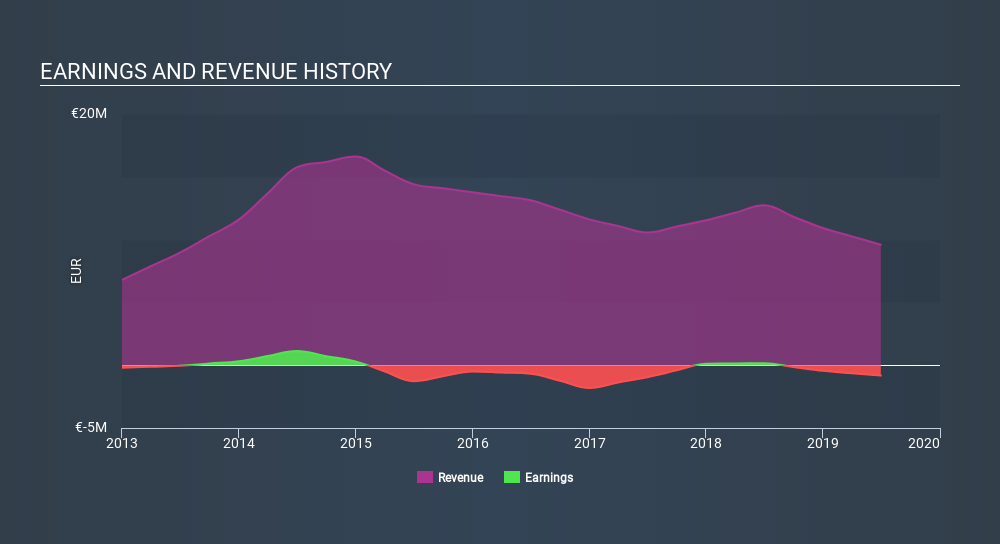

Given that Euroxx Securities didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Euroxx Securities reduced its trailing twelve month revenue by 9.3% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 22% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Fundamentally, investors are buying a company's future earnings, but the stability of the business can influence the price they're willing to pay. For example, we've discovered 4 warning signs for Euroxx Securities (of which 1 is major) which any shareholder or potential investor should be aware of.

A Different Perspective

Investors in Euroxx Securities had a tough year, with a total loss of 51%, against a market gain of about 50%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 22% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ATSE:EX

Euroxx Securities

A brokerage firm, provides a range of products and services to the investors in Greece and internationally.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives